Trickle before the Flood – Digitising Assets

News

|

Posted 24/10/2019

|

13475

State Street, one of the world's largest custody banks which holds more than $30 trillion, or more than 10% of the world's total financial assets, is preparing for the future of blockchain.

"We're seeing assets start to become digitized," says Jay Biancamano, State Street's head of digital assets and blockchain in capital markets. "Trickle, trickle, trickle—and then we believe there will be a flood."

“It's only a matter of time than before investors see the value and start adding blockchain-based "tokens" representing not only real estate but all variety of intellectual property, paintings, virtual items in video games, even wine, to their portfolios.”

"If you look at 30 years ago when assets moved from materialization to dematerialization—where we moved from coupon clippings and stock certificates to electronification—we believe the same thing is going to happen with digital assets," he says.

Although Bitcoin is the “king of crypto”, Biancamano explains that State Street is far more interested in a decentralised digital representation of traditional assets – i.e. stocks, bonds and gold.

"We're not focused really on cryptocurrencies—the Bitcoins, the Litecoins that are in vogue right now. We're really forward-facing, and we're thinking about what does the future hold for assets as a whole.”

Already, we have had many customers take advantage of Gold and Silver Standard’s digitised nature. One of the greatest advantages of buying Gold or Silver Standard is the ease of secure storage and transference. AUS and AGS are easily stored on an Ethereum wallet and can be bought and sold using CoinSpot out of business hours and when the precious metals markets are closed (like on weekends). However a digitised asset is only as good as the security of the asset being digitised and in that sense Gold & Silver Standard are unparalleled. All metal is already secured in Reserve Vault, a vault independent of any government or financial institution, in high reg and geopolitically safe Australia, audited by BDO and publicly transparent, and insured by the world’s leading insurer. All this is delivered by a 45 year old independent bullion dealer, not a start up. No other gold or silver token ticks all those boxes. With such possibilities its no wonder State Street are excited.

"I think there's a lot that's going to happen in the next year," Biancamano forecasts. "Like anything, it could happen very quickly."

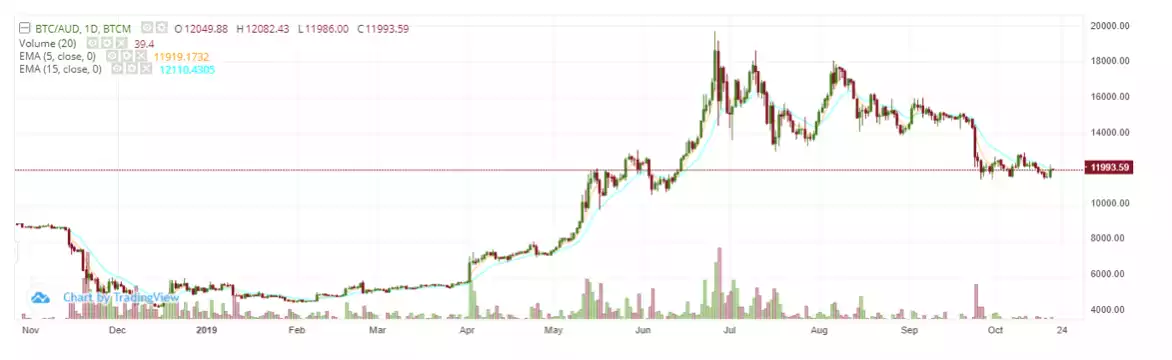

More broadly, cryptos started the week in the green finding 2-5% across the board after bouncing off the lower range of its current trading band. The asset class has been tracking sideways since declining sharply at the end of September. Bitcoins longer-term view shows the next support price at AUD 11,500.

In traditional crypto form, altcoins are tracking behind the day-to-day gains of Bitcoin. However, with every rally we experience with Bitcoin we find that the rising tide lifts all boats. We are certainly at a critical junction for the bitcoin price. If the price breaks below the trough of June, more losses may be found. Likewise, if the price is supported, bitcoin may be due to testing its yearly high.

One thing is sure is that crypto and blockchain technology continues to expand and we are amidst the industrial adoption phase. The future looks bright for the space.