The Student Loan Timebomb

News

|

Posted 16/06/2017

|

6220

An often counterintuitive notion in accounting for newcomers is that debt issued is counted as an ‘asset’ on your balance sheet, your total net wealth. I lend Jack $100 and put that $100 as an asset on my balance sheet on the assumption Jack will pay me back. In most cases of course that is correct. But what if Jack is in way over his head?

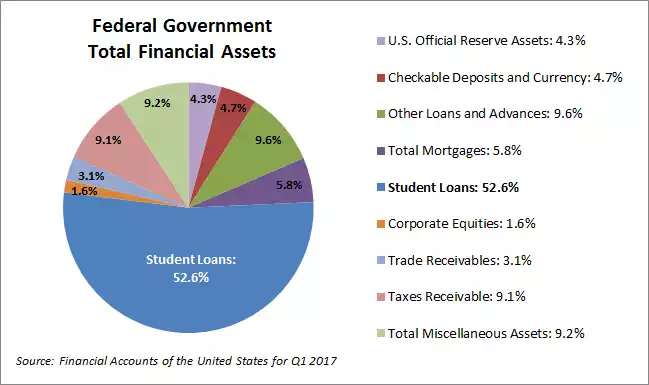

Whilst you may have read endless stories of the scary scale and questionable ‘security’ of all the student debt in the US, we hadn’t seen it set out so clearly as in a recent article on advisorperspectives.com. That article asked the simple question, “what line item is the largest asset in Uncle Sam's [US Federal Government] financial accounts?

A) U.S. Official Reserve Assets

B) Total Mortgages

C) Taxes Receivable

D) Student Loans”

The answer, with the source direct from the US Federal Reserve’s Financial Accounts, is as you may have guessed from the title of today’s news…student loans. Now that might be scary enough but we’d hazard to guess you might find the scale outright terrifying

Yep, over half, and not just that, but over 9 times bigger than the next biggest asset. But I hear you say, ‘yeah but that may not matter if the liabilities are modest’? The total of the US Federal Governments Financial Assets sits at $2.1 trillion. The total liabilities totalled $15.2 trillion as at the end of March this year….(that’s not a typo).

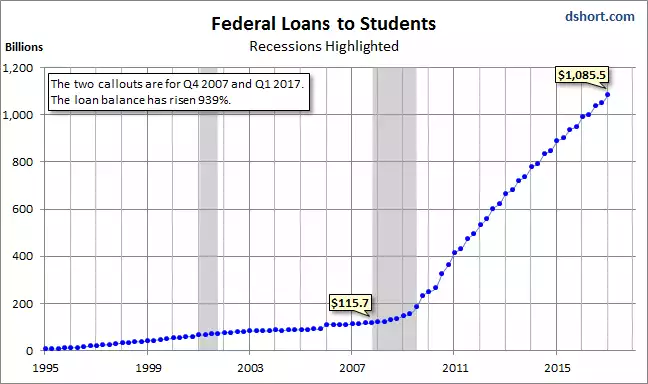

So how did Student Loans get to this incredible figure when before the GFC is represented only around 17%, not 53%? It increased by 939%..

And by the way, that $1.1 trillion is just what is owed to the Government, total student loans are $1.34 trillion according to official data from the Fed. To add salt to the wound, a recent study showed 31% of students were using their loans to fund Spring Break trips to the likes of Cancun…

If all these uni students were getting good paying jobs afterwards to pay it all down that may not be the end of the world, but as we repeatedly report after each NFP payrolls report, many are going into part time and/or low paying jobs.

This is but one of many examples (arguably auto ‘sub prime’ loans are far worse) of the broad scale explosion of adoption of debt across society. This is robbing future generations to fund our current lifestyles, or just survive. It always, always, has a day of reckoning.

Finally, if you think this couldn’t possibly happen in Australia…. From The Australian last year:

“Australian taxpayers’ exposure to university students’ loans will explode more than fivefold to $185.2 billion in 2025-26, accounting for 46.3 per cent of the nation’s public debt, according to an independent review of the Higher Education Loans Scheme.

The Parliamentary Budget Office report on the HELP scheme, commonly known as HECS, finds about 21.8 per cent of new loans taken out in that year — is unlikely to ever be repaid because the borrower either earns below the taxable income threshold or has moved overseas.

The annual cost of the HELP loans will rise from $1.7 billion in 2015-16 to $11.1 billion in 2025-26.

The report revealed the nominal value of the HELP loan portfolio, currently $42.3bn, was projected to reach $185.2bn in 2026.”