The Stagflation Trap before the US

News

|

Posted 11/08/2021

|

6157

Amid the market gyrations at present based on expectations of the Fed tapering its QE and tightening more broadly, we must look beyond what they are ‘saying’ and what they are ‘doing’. Last night saw the US Senate pass the $1.2 trillion (that’s $1,200,000,000,000….) infrastructure bill. Whilst certainly a hard fought milestone, as it goes back to the House of Reps, democratic speaker has promised it won’t be passed unless the Senate approve another $3.5 trillion spending package.

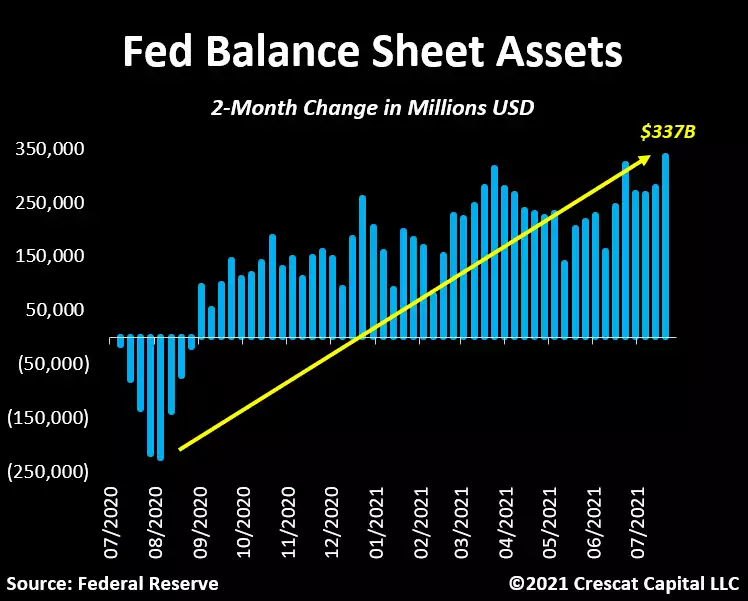

And as we’ve reported before, despite all this taper talk, in the last two months alone, the Fed’s balance sheet increased by $337 billion, the largest amount in over a year.

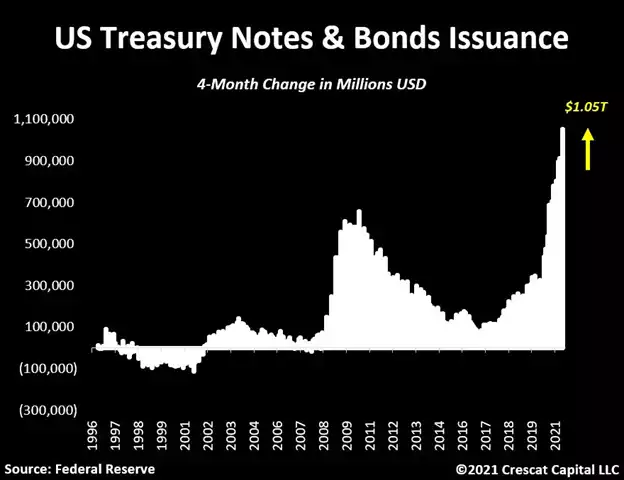

And don’t just blame the Fed, that $1.2 trillion package last night and the seemingly inevitable $3.5 trillion still to come, is after the US government ripped through all the $1.8 trillion Trump left in the TGA and issuing another $1.05 trillion worth of bonds and notes in just the last 4 months to pay for all of Bidens spending already. $1.05 trillion over that amount of time is the largest in all recorded history and depicted below for context:

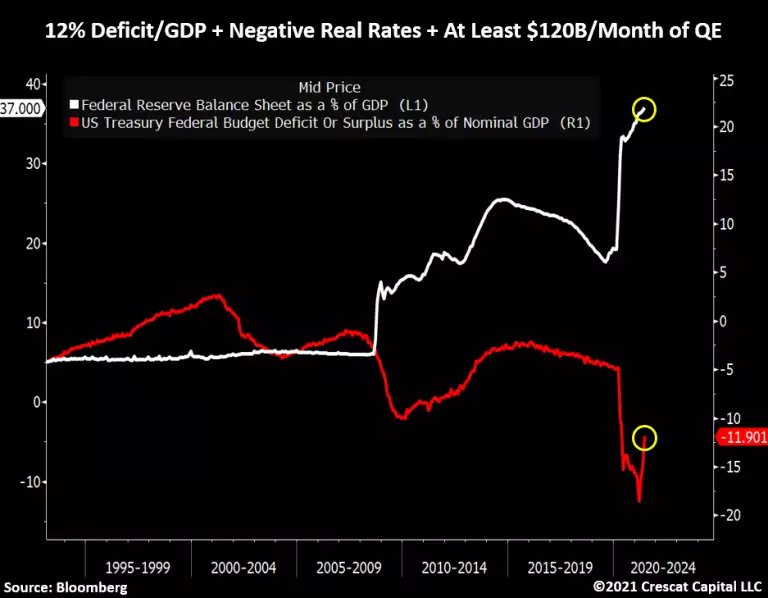

Combining the two looks even more scary. The chart below maps that march higher of cumulative QE sitting on the Fed’s balance sheet and the deeply red (deficit) government budget as a percentage of GDP. The post lockdown / base effects jump in GDP saw a reversion from nearly 20% to a still unsustainable 11.9%. However that will surely head south again as these new spending bills get passed and GDP inevitably slows. From the chart author “The macro imbalances today are extreme, and the ultimate inflationary consequences of years of reliance on ever greater monetary and fiscal stimulus as the primary policy tools to solve economic problems are inescapable.”

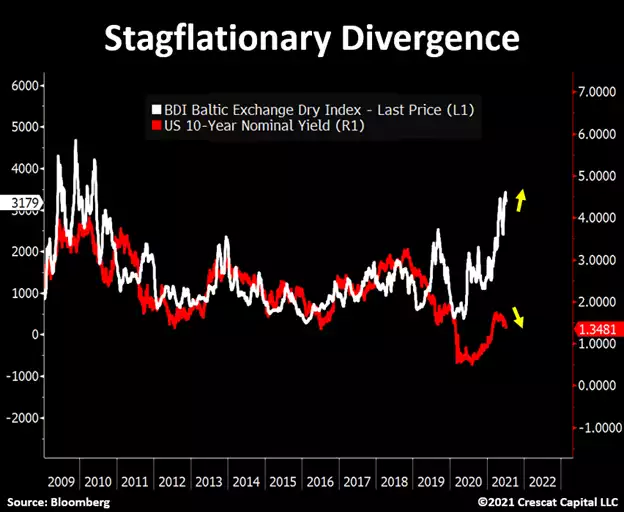

The market vacillations at present reflect the spectrum of views trying to figure out how on earth this all plays out. A strong NFP jobs print on Friday night was seen as proof of economic recovery and more inflationary pressure to come. Surely wage growth will start as over 13 million Americans still on a variety of COVID unemployment benefits are outnumbered by job openings. And yet counter to that is a host of indicators that the US economy is weakening, and that weakness accelerating now that Delta starts to impact the US. Of course, if you get both rising inflation and a weak economy, you are looking down the barrel of the dreaded stagflation outcome. In their July investor update, that was exactly Crescat’s thesis:

“Our proprietary multi-factor macro models that measure current economic activity and inflation have never been stronger for a series of consecutive months now on both fronts. The issue is that, historically, higher inflationary periods tend to be stickier than high real growth periods. It is growth, not inflation that is more mean reverting. We believe a slowdown in the economy is likely ahead of us. Keep an eye on the macro data that will be coming out in the next several months. For instance, non-seasonally initial jobless claims increased 3 weeks in a row. The last time we saw that was in April 2020. Additionally, the Bloomberg Economic Surprise index has been moving lower, particularly since April. Also, average work hours are starting to roll over. We think there is a high probability we could be entering a stagflationary environment in the coming months and quarters.

See on the chart below that the Baltic Dry index just reached decade highs while 10-year yields fall. These are two opposing bellwether indicators.”

“With inflationary pressures rising in the US, we believe investors will be rotating out of over-valued long duration financial assets and into undervalued commodity cyclicals and inflation hedge assets, including scarce natural resource stocks. First and foremost, we see a coming renaissance in precious metals exploration stocks after a decade long bear market for this segment of the industry that only ended in March of last year.”

Crescat have the ability to minimise the risk in investing in PM exploration shares through their research and expertise. The key word there is ‘minimise’. The adage that the definition of a gold miner is a ‘liar standing beside a hole in the ground’ underscores the risk involved. Buying the actual precious metal asset removes all counterparty risk. Indeed gold, silver and platinum bullion are one of the only investments you can make with zero counterparty risk. Bullion is no one’s liability. Now go back and look above at the rate at which they are printing Fiat ‘money’ at present….