The Social Inequality Paradigm Shift

News

|

Posted 18/10/2019

|

18150

In terms of where the debt lies, commentary suggests Australia and the US could not be more different. The US has a staggeringly high public or government debt of $22 trillion (not counting unfunded liabilities) and yet purportedly has good rates of saving by private individuals. We on the other hand have essentially no public debt (that beloved surplus we talked of yesterday) but are second only to the Swiss for the highest private debt level in the world, most of that in a fragile property market.

That private savings rate in the US is often referred to, to somehow give some comfort to the US financial situation. Following on from Lance Robert’s work we referred to yesterday, and again in reference to the coming social inequality revolt, Roberts delves a little deeper into the US ‘savings’ situation.

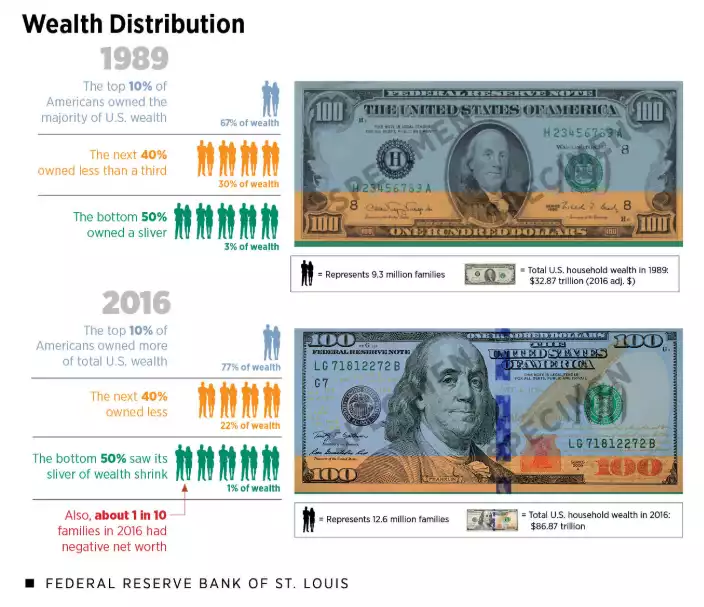

We’ve all seen the statistics of struggling ordinary US citizens. Some 80% of the 327m or 261m US citizens are living ‘paycheck-to-paycheck’ and around 40m are receiving food stamps. To put this into further perspective the US Fed released a report on the growing inequality including the following graphic:

In other words the top 10% own 77% of the US household wealth and the bottom 50% own just 1% and 1in 10 of those actually have negative net worth.

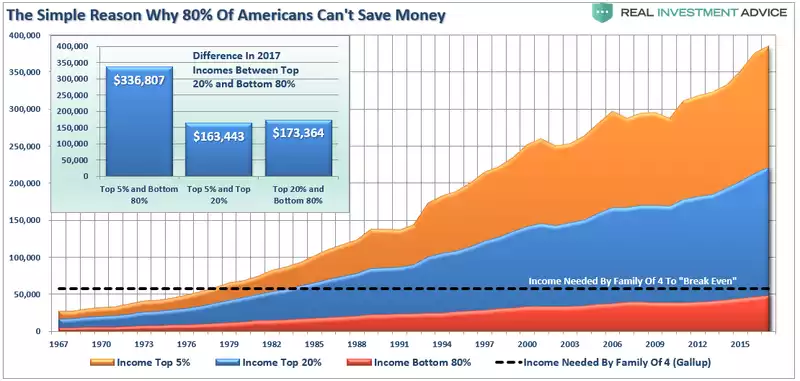

Understanding that, Roberts looks at this supposed savings rate and finds that when you remove the top 20%, American aren’t saving at all, and indeed they are taking on more and more debt just to maintain their lifestyle.

Off the back of a Gallup survey that found it required $58,000 to support a family of four in the U.S. That is just support, not having discretionary ‘enjoyment’ money.

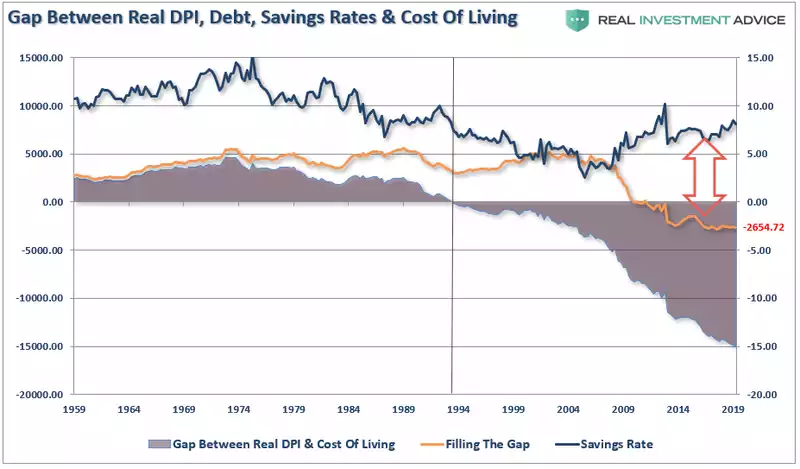

So it should come as no surprise then that from around 1990 the 80% started to use debt to meet the cost of living and as you can see from the chart below, from the GFC even that hasn’t filled the gap (between Disposable Personal Income and Cost of Living):

Put against that supposed increasing ‘savings rate’ you can quickly see the fallacy.

As Roberts concludes:

“Savings rates didn’t fall in the ’80s and ’90s because consumers decided to just spend more. If that was the case, then economic growth rates would have been rising on a year-over-year basis. The reality, is that beginning in the 1980’s, as the economy shifted from a manufacturing to service-based economy, productivity surged which put downward pressure on wage and economic growth rates. Consumers were forced to lever up their household balance sheet to support their standard of living. In turn, higher levels of debt-service ate into their savings rate.

The problem today is not that people are not “saving more money,” they are just spending less as weak wage growth, an inability to access additional leverage, and a need to maintain debt service restricts spending.

That is unless you are in the top 20% of income earners.”

So what does all that have to do with gold you say? A couple of things. Firstly have a look on the charts above where things start to go wrong. Around the time we left the gold standard. How often do you see that juncture in history precipitate an economic paradigm shift? Leaving the gold standard starts a new credit cycle. Throughout history this ends badly because man’s greed and political ambition goes unchecked for decades. Previous major financial crises or resets have been triggered by or heralded the unravelling of major social upheaval. Ray Dalio speaks to this often (see here) and also talked more recently of what he sees as the paradigm shift before us. If you missed reading that, it’s a must read here.

Owning gold, silver and arguably quality crypto allows anyone protection when the credit based house of cards collapses. Some call it the great reset or leveller as those ‘rich’ in the myriad of credit inflated ‘assets’ see them disappear before their eyes. Gold and silver have been doing this for 5000 years….

Also if you haven’t registered yet don’t for the Gold and Alternative Investments Conference in Sydney next week we highly recommend you do. We will be speaking on the Saturday and there are a host of great speakers. Click on the image below for more details: