The Reflate Debate

News

|

Posted 11/01/2021

|

8050

The hot word in financial markets as we start the new year is Reflation. Investopedia defines it as “Reflation is a fiscal or monetary policy designed to expand output, stimulate spending, and curb the effects of deflation, which usually occurs after a period of economic uncertainty or a recession. The term may also be used to describe the first phase of economic recovery after a period of contraction.” Now of course we have seen the first part of that definition since the GFC but never really saw the latter. Reflation being the trade de jour now is all about that second sentence. With a blue sweep seeing the Democrats taking control of both houses, Biden openly talking about “trillions” in stimulus and the Fed confirming they are "not even thinking about thinking about raising rates", the market is now ALL IN on the reflation trade.

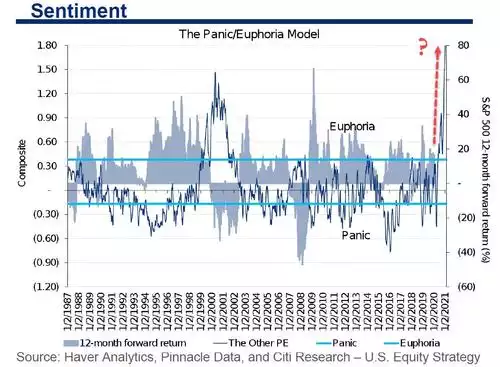

Such a reflation trade is normally bearish for the USD and bonds (hence yields up), and bullish for higher risk equities and commodities. So ‘ears pinned back’ is the market that Friday’s shocking NFP employment figures (140,000 jobs lost, the first decline since April), the political and social dramas around capital hill, and new record numbers of COVID cases and deaths, that the market…. rallied. Yep, everything is awesome. Citi bank’s Panic / Euphoria model just printed a never before seen high:

In commenting to the implications of returns from here Citi’s chief economist said there is now a "100% historical probability of down markets in the next 12 months at current levels." But the market doesn’t care.

But for now euphoria remains, reflation is the trade and this saw big losses in gold and even silver as the falling bond prices saw yields surge and, more relevantly for gold, real yields rise too as inflation lags. We say ‘even silver’ as it would normally perform well in a reflation trade given its dual attributes of monetary metal and more relevantly industrial metal. This may well have been a ‘buy the rumour sell the fact’ trade for silver given its strong returns in 2020 on expectations. The reality is, we are still firmly in the rumour phase of this reflation narrative, people are just misinterpreting expectations or hope with reality or fact.

The elephant in the room is inflation. Real rates are nominal rates less inflation. Nominal rates are indeed rising, for now. Inflation on the other hand has been technically absent, or at least below the Fed’s 2% target, but stealthily (and certainly practically) rising. The chart below shows clearly however it is now breaking a near decade long resistance line. Add in “its going to be trillions” Biden with a supportive congress and all of a sudden the stimulus is going to be a full double whammy of both fiscal to people’s wallets ($2000 cheques etc) and Fed monetary stimulus.

And herein lies the perpetual post GFC dilemma. Pump in money hand over fist and risk losing control of runaway inflation. Alluring to some extent to extinguish some of this debt, but devastating if too strong because of the interest on servicing that very same debt. Tighten, like they tried in 2018 and remove the only ‘real’ thing supporting record high markets and crash the whole house of cards.

This has the experts somewhat torn. Two of Real Vision’s greatest minds, Raoul Pal and Lyn Aldon are at opposite trades. Pal believes this is the most one sided trade he has seen in a long time and one not taking into account the current realities of record COVID cases, deaths and forced shutdowns with any vaccine relief too far out to change the mass of insolvencies already beyond stopping. All one sided trades inevitably correct sharply and he is taking the contrarian trade. Aldon believes the reflation trade will play out but purely on the basis of continued stimulus, without which it will end badly.

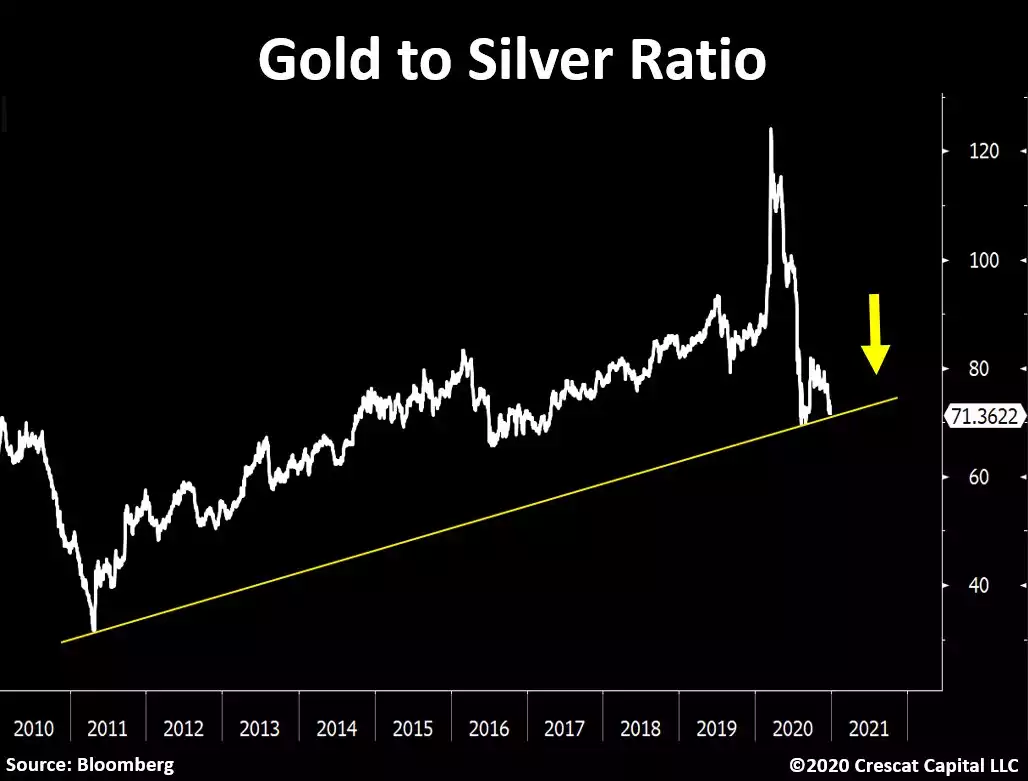

Should the reflation narrative actually turn to fact, silver is likely to be the pick of the precious metals. Silver would normally ride the commodities boom that comes with reflation. That many stimulus packages will be tied to green initiatives just adds weight to this given its solar panel uses. Likewise platinum for its use in green energy vehicles. Silver’s monetary market then presents are great hedge or each way bet. The market appears to be acknowledging this with the falling gold silver ratio looking to break out again:

Gold presents a more complex proposition. Should the reflation trade play out to actual reflation but the stimulus keeps coming as promised (they won’t risk another December 2018 ‘taper tantrum’) then we should inevitably see strong inflation against capped bond yields as the Fed must fight to contain them. That brings bigger negative real yields and gold shines.

Should the reflation trade fail and the recovery does not materialise you then have an inevitable flight to safety into hard assets, even more stimulus as the Fed and Biden double down, more debasement of currencies amid potentially crashing markets. All great for gold.

If however we get rising rates via bond yields, a strongly growing economy of an order to overcome the debt burden AND contained inflation then that will present headwinds for gold.

2021 promises to be a year of market volatility amid such conflicting narratives and unknowns. Our trademark of ‘Balance your wealth in an unbalanced world’ would make a great new years resolution….