The Purchasing Power of “Real” Money

News

|

Posted 06/04/2018

|

7503

We live in volatile and uncertain times. President Trump is displaying a show of military might at the U.S. and Mexican border and his tariffs potentially risk starting a trade War with China (as discussed yesterday). The DOW is under pressure from the FANG (Facebook, Amazon, Netflix and Google) technology stocks over privacy concerns. Closer to home we have the quietly ushered in bail-in laws, and the Royal Commission into the banks which could see tighter lending standards leading to a fall in housing prices and further pressure on indebted families. With so much happening economically and politically, it can be difficult to maintain perspective of the bigger picture. Longer term trends can be slow to unfold but are often even more important to our long term financial success than any pressing concerns of the day. One such longer term trend is the loss of purchasing power of the dollar over time, and it is worth reviewing.

We have reported numerous times, including in our article titled “History Lesson on Real Money”, fiat currencies worldwide have failed time and time again, and on average have a lifespan of around 27 years. As soon as the USD was removed from the gold standard in 1971 by President Nixon (47 years ago by the way), the USD became a fiat currency, backed by nothing more than a promise. The flow on effect led to Australia floating the AUD and becoming a part of the fiat currency scheme.

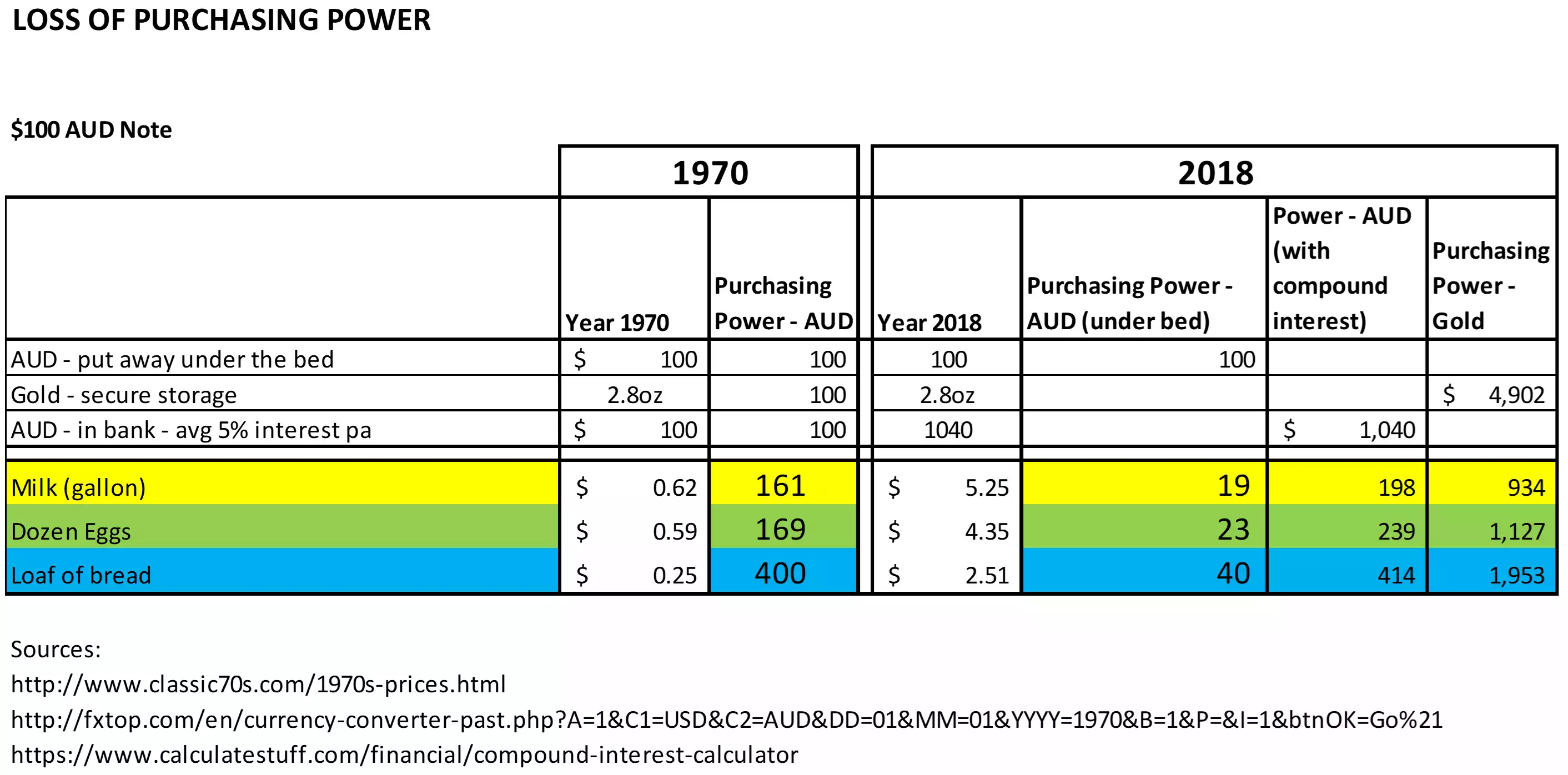

As can be seen from the table below, in 1970 $100 would have bought you 400 loaves of bread. Fast forward to today and that same $100 note will only buy you 40 loaves of bread, a staggering 90% decrease in purchasing power!

However, imagine that alongside the $100 note you had tucked up nice and safe under the mattress you also had 2.8 ounces of gold ($100 worth in 1970). Still shiny, the gold is now worth approximately $4,902. So, in effect, $100 stored in gold over the last 52 years would have not only retained its value of being able to buy 400 loaves of bread but you would now be able to buy over 1,500 extra loaves as well.

Another interesting example involves looking at house prices in terms of how many ounces of gold it took to buy an average priced home in Brisbane, back in 1975 compared to 2015. The gold price in Australia at in 1975 was around $110 per ounce. According to Social Researcher and Demographer Mark McCrindle, the average price of a house in Brisbane in 1975 was $17,500. Therefore, 159 ounces of gold would have allowed you to purchase an average Brisbane home. Let’s assume though, that you didn’t purchase the home but instead stored your 159 ounces of gold in a secure storage facility while at the same time invested another $17,500 cash into an interest earning account with your bank.

McCrindle’s research shows that the price of an average Brisbane home in 2015 had risen to the value of $473,924. The value of gold had also increased over time to $1,449.44 AUD/oz, so the 159 ounces of gold in 2015 had a value of $230,461. Taking advantage of compound interest at an average rate of 5% per annum over the period 1975 to 2015 calculates a total of $182,022 of savings in the bank from the original deposit of $17,500.

Therefore, once again gold has clearly outperformed fiat currency as a store of value over time. The 159 ounces of gold (stored from 1975) would have purchased around half of the average priced Brisbane home in 2015, whereas the fiat currency stored in the bank (even with a generous rate of compounding interest and not taking into account the tax implications), would have only been able to purchase 38% of the same home.

After thinking through the examples provided, gold truly is “real” money as it reliably retains its purchasing power over time. This is in stark contrast to Voltaire’s famous quote, “fiat money eventually returns to its intrinsic value – zero”.