The Point of No Return

News

|

Posted 21/02/2022

|

6346

While the world’s central banks have been buying government bonds with freshly printed currency hand over fist since the GFC, the Bank of Japan stands out as both the first to monetise debt in such a way, starting in 2001, but also facilitating Japan holding the title of world’s most indebted nation with a debt to GDP ratio of over 260%.

Ray Dalio has previously argued their real debt burden, including private debt, stands at around 450%! This all came from the Bank of Japan desperately trying to reflate the economy after it crashed in the 80’s. What should be a poster child of the ultimate failure of constant easy money policy from a central bank sadly has become the norm. BoJ has been suppressing rates (to the point of being negative for years) and printing money since the early 90’s and still the economy is tepid and unable to reach their target inflation rate of 2%.

On 10 February 2022, whilst all western central banks are talking of tightening amid inflation, BoJ announced it would buy an UNLIMITED amount of 10 year government bonds (JGB’s) at 0.25% to counter the rising bond yields around the world and suppress local lending costs. From Reuters on the day:

“The announcement came after the benchmark 10-year Japanese government bond (JGB) yield rose to 0.23% on Thursday, the highest since 2016 and close to the implicit 0.25% cap the BOJ set around its target of 0%.”

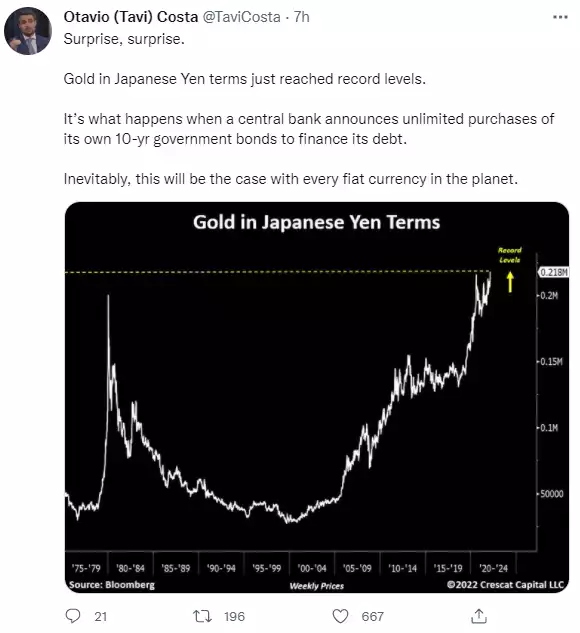

Topically, Crescat’s Otavio Costa just tweeted…

But again, Japan was just the first. The G4 central banks have now amassed over $30 trillion of debt instruments on their balance sheets. They have been able to manage that via record low, and in many instances negative interest rates. But something is changing.

The inevitable hand brake of inflation had been absent. The only inflation was in financial assets that they and their rich buddies were enjoying the fruits of and which, indeed made everything look AWESOME! But now we have real inflation at the consumer, or to call it out, at the voter level and now they need to act. To leave the ‘rest’ behind in growing wealth since this experiment began is one thing, but now to effectively tax them through inflation on top of that will ultimately see a revolt and that’s just not politically palatable. Such the quandary…

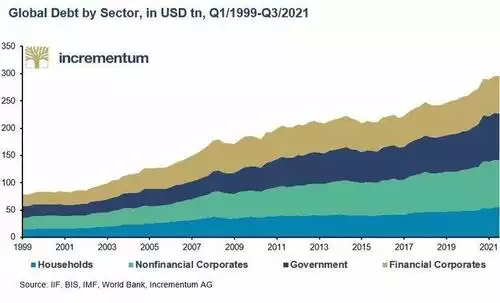

The world is now sitting on a debt pile of gargantuan proportions, some $300 trillion of the stuff…

As with the Japan example, when this destined to fail experiment does fail, gold will inevitably shine. Short term gyrations are merely that. Threats of war come and go but sometimes wars are a convenient means of resetting such a mess…

Matthew Piepenburg of GoldSwitzerland.com puts it nicely into perspective:

“As currencies expand, and in turn debase, as bubbles rise, and in turn crash, as pundits squawk and in turn vanish, and as debt rises and in turn destroys, gold is always the patient real asset which, unlike any other, gets the last word over the increasingly discredited words we are hearing from on high today.

For those who know as much about history and math as they do about currencies and debt bubbles, the daily gold price is never a concern, as the long-term play is always clear and always the same: Gold is the ultimate insurance against currencies and systems already burning to the ground.”