The Last 2 Times This Happened – GFC & Dot.com

News

|

Posted 12/04/2017

|

5084

Whilst Monday we reported the massive surge in debt over the last decade (and more) today we look at the potentially more concerning sudden reduction of Commercial & Industrial debt. What? How can reducing debt be bad?…. We touched on this last week (here) where Morgan Stanley and Ambrose Evans-Pritchard warned of the current sudden contraction in bank lending.

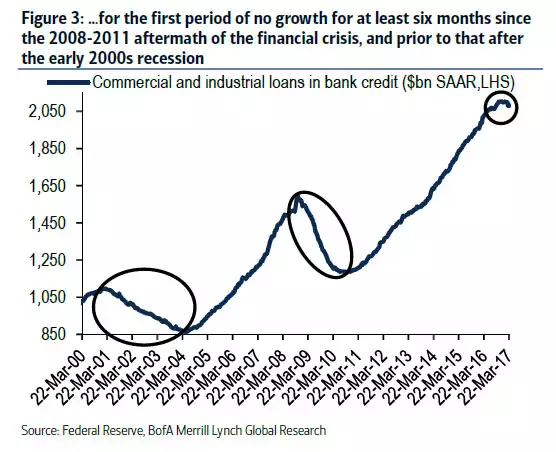

Bank of America Merrill Lynch have joined the chorus with their chief analyst talking to the following chart:

You might remember the previous two times circled as the dot.com and GFC crashes.

This is happening at a time when the Atlanta Fed just downgraded their Q1 GDP forecast to just 0.6% and it is becoming clearer by the day that Trump will not get his tax reforms through.

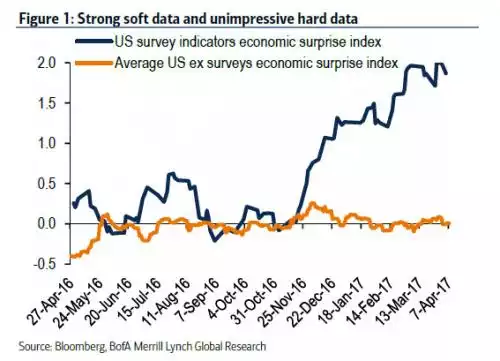

Combined with the change in the trend for the so called ‘soft data’ of business surveys (we discussed at length in last week’s Weekly Wrap podcast) meeting that of the ‘hard data’ such as Durable Goods and NFP employment, most of which are currently ‘ordinary’ to say the least, BofAML seem to be taking a darker view of things.

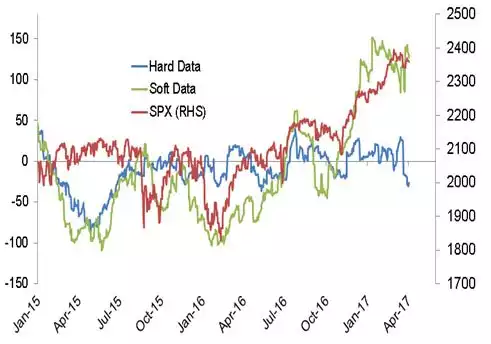

“As tax reform by House Speaker Ryan's own account is not going to happen anytime soon, and likely will be watered down as the Border Adjustment Tax (BAT) is replaced by a Value Added Tax (VAT) and the elimination of net interest deductibility for corporations, the biggest near term risk to our bullish outlook for credit spreads we maintain is a correction in equities - most likely prompted by weak hard data.”

Or using ZeroHedge’s chart including the S&P500 transposed…

Now only if Trump could come up with something to divert the attention away from economic reality….