The Inflation Genie Lurks

News

|

Posted 10/04/2018

|

8093

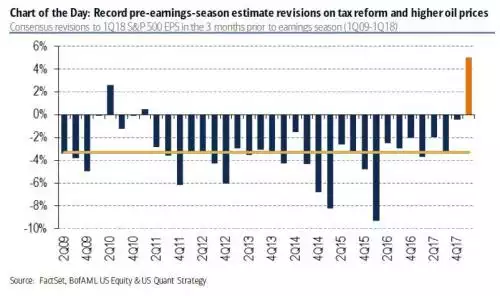

There is a view amongst some that the 2.3% year to date fall in the S&P500 and the subsequent fall in PE multiples has somehow alleviated the risk of a market crash occurring. This is bolstered by the very strong revisions to 1Q18 US earnings growth, ostensibly off the back of the tax cuts and a rising oil price (up over 20% in the last year):

Paradoxically, however, therein lies the risk. You see, many analysts believe these earnings are already fully priced in. The market is in full belief mode. The problem then, in an environment of unknowns around trade wars and central banks tightening, is any disappointment in actual earnings could see panic in a market now seeing volatility again after a historically long ‘calm’ run.

However it is the potentially toxic mix of the factors above that should see both markets wary and gold owners comfortable. It is the mix of inflation and central bank tightening that could (and always has) seen this end badly. The head of the world’s biggest bank Jamie Dimon of JP Morgan just warned:

‘Many people underestimate the possibility of higher inflation and wages, which means they might be underestimating the chance that the Federal Reserve may have to raise rates faster than we all think.’

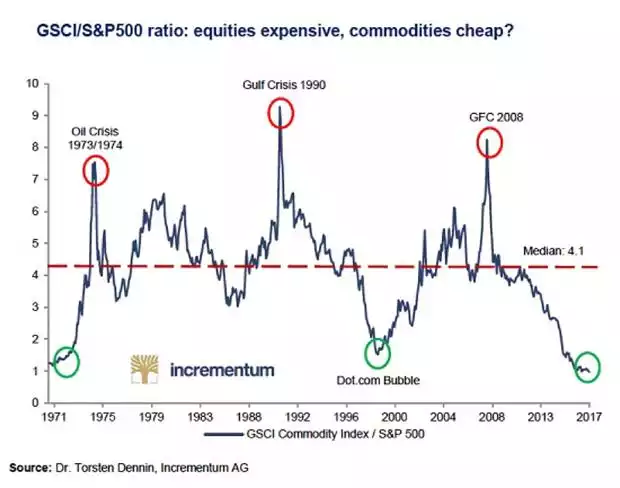

Whilst BOFA ML quote oil as a big factor in the chart above, it is commodities in general that we need to watch carefully. The Bloomberg Commodity Index is down at 1991 levels, more than 60% lower than 2008. Whilst oil has already starting rising we are yet to see commodities take off, but that seems an historic certainty at these levels.

This presents an exciting triple prospect for gold and silver holders. A rising commodities market, rising inflation and the increasing prospect of a major financial market crash are all very bullish factors.