THE IMPENDING END OF A MANIA

News

|

Posted 16/12/2019

|

18933

Today we depart from our commitment to ‘keep it short’ because we came across a still relatively concise (and dot point) list of the macro economic imbalances before us and the catalysts that could see these unwind in a ‘highly destructive’ manner. It is timely as celebrations of a ‘new trade deal’ between the US and China are likely to see a renewed risk-on rally despite none of the previous such announcements sticking in anyway and confusing that element of the economic setup as the only show in town as well. Put together by the economists at Crescat (who’s funds performances speak for themselves), it is a timely reminder before we get carried away with the ‘everything’s awesome’ narrative.

“Macro Imbalances

There is a laundry list of dangerous assets bubbles in the global financial markets today that have built up over a record long US economic expansion:

- Highest ever global debt to GDP levels;

- A passive investing and ETF craze that has led to historic lofty US equity valuations across a composite of fundamental measures tracked by Crescat;

- Impossibly valued currency and credit markets in China at an extreme for any large country relative to the size of its economy;

- China’s banking assets are valued at USD 41 trillion, including substantial hidden non-performing loans in our analysis, a major mismatch compared to its much smaller and stumbling 13.6 trillion GDP economy;

- Record $17 trillion of negative yielding sovereign debt which may have just peaked in August 2019;

- Private equity/VC excesses in opaque assets, highly leveraged companies, and frequently unprofitable businesses masquerading as new economy disruptors;

- Record indebtedness of US public and private corporations combined relative to GDP;

- Crowded “risk parity” positioning among large hedge funds and institutions who are long stocks paired with leveraged long bonds, a strategy that worked exceptionally well in a forty-year backtest as well as the last ten years that it has become popular, but it’s one that would likely get decimated in a rising inflation paradigm;

- Fashionable short volatility strategies which are yield enhancement strategies for an income starved world, but the extra yield is earned in exchange for accepting asymmetric downside risk;

- High valuations and crowding into sectors traditionally viewed as defensive (including utilities, REITs, and consumer staples) with utilities being the most fundamentally questionable among them in our view; and

- Tech bubble 2.0 with extraordinary valuations in SaaS, certain FANG+ stocks, many recent IPOs.

Catalysts

The unwinding of these imbalances is likely to be highly destructive to the investment portfolios of unprepared global savers today. Below, we list the confluence of macroeconomic timing signals, including social and geopolitical forces, now bearing down for an assault on overvalued financial assets. Most of these have been uncanny warning signs directly ahead of past bear markets and business cycle peaks.

In the US:

- The Treasury yield curve recently exceeded the critical 70% inversion threshold that has preceded each of the last six recessions with no false signals;

- The Conference Board’s consumer expectations survey has diverged strongly to the downside compared to its unsustainably high present situation index;

- Job openings are declining while the lagging and contrarian unemployment rate is at cyclical lows;

- Both the Atlanta and New York Fed’s real-time GDP trackers have been trending steadily down for almost two years and appear to be approaching recessionary levels;

- Corporate earnings of the Russell 3000 already contracted on a year-over-year basis in the last reported quarter;

- US share buybacks are now 30% lower than 2018;

- Increased insider selling of stocks;

- Declining CEO/CFO confidence surveys;

- M&A transactions drying up;

- ISM manufacturing PMI at recessionary levels;

- Construction spending declining;

- Bearish deteriorating stock market breadth while indices reach highs;

- Implied volatility for stocks retesting low levels that preceded previous selloffs;

- Smart money flow index diverging from the recent run-up in the S&P 500;

- Leveraged loans stumbling;

- Busted/delayed/cancelled IPOs;

- Recent liquidity crisis that spiked interest rates in the overnight US Treasury rehypothecation market;

- Inflation rate above the entire Treasury yield curve;

- Core and median CPI at 10-year highs diverging from long-term inflation expectations at 40-year lows;

- Capacity utilization now falling;

- Commercial & industrial loans declining the most since the housing bust;

- Auto loan spreads rising as delinquency rates rise;

- Net exports of services now falling the most since the GFC and tech bust;

- Increased election uncertainty and rising political polarization creates unknown binary opposite outcomes for future tax policy which is now friendly for financial markets but could swing 180 degrees;

- Trump impeachment proceedings might impair his credibility in maintaining a hyped-up economic narrative in face of deteriorating macro fundamentals; and

- New bipartisan willingness to embrace fiscal stimulus and rising government deficits could change the inflation paradigm sooner rather than later and be detrimental to financial assets.

Worldwide:

- Yield curve inversion with the US dollar as the world reserve currency versus an unprecedented 19 economies now with 30-year yields below USD Libor overnight rates;

- Like the US, Hong Kong, Canada, and Japan all recently breached critical 70% inversion levels within their sovereign yield curves;

- Emerging market currencies have been falling despite recent easy Fed policies indicating that dollar liquidity globally is still tight amidst record dollar-denominated foreign debt;

- Ongoing trade and cold war between the world’s two leading economies with diametrically opposed political systems, each with its own historically extreme financial imbalances;

- The China yuan recently broke the key 7 level and looks poised for an accelerated devaluation that would almost certainly take global investors by surprise;

- Tariff increases that go into effect in December are a catalyst for an RMB shock if trade negotiations continue to stall which is our base case;

- Accelerated yuan depreciation is the rhino in the room that would be a likely contagious global risk-off event feeding back to US, European, as well as other Asian and emerging markets as we have seen on multiple occasions since 2015 with only minor devaluations;

- There have already been material disruptions in the global manufacturing supply chain due to the trade war;

- Frontloading of Chinese semiconductor inventory and CAPEX spending in 2019 amidst the threat of escalating US intellectual property purchase restrictions sets up earnings weakness ahead for this market leading but cyclically vulnerable industry;

- The global manufacturing PMI has already dropped to recessionary levels;

- Multiple political and economic crises have already been erupting in emerging and frontier markets;

- Rising populism and nationalism more generally around the globe is causing disruption in world trade and financial markets; and

- Last but not least, Brexit.

The two closest analogs to today’s excessive fundamental valuations for US stocks were the 2000 Tech Bubble and the culmination of the Roaring Twenties in 1929. Our work suggests that today’s valuations are even higher than those two periods. The nifty fifty stock mania of 1972 is another comparable period that featured excessive valuations in a popular group of large cap growth stocks that became widely regarded as “blue-chip” buy and hold positions. Institutions and retail investors were taught to cling to these stocks through thick and thin, throwing fundamental analysis and valuation principles out the window. The same idea is the prevalent passive investing dogma of today.

From today’s valuations, a mere cyclical mean reversion in stock market multiples implies a 50+% drawdown in prices. Yet, too many investors remain oblivious to these valuation risks. Many today have further been lulled into believing that central banks have their backs and will keep markets rising. Such bullish sentiment on the heels of recent Fed liquidity injections has emboldened a late cycle speculative push higher in the indices even as the market internals have been noticeably deteriorating. Never mind that the last two Fed easing cycles after tightening cycles coincided with and were confirmations of major bear markets and recessions underway rather than prevention of them.”

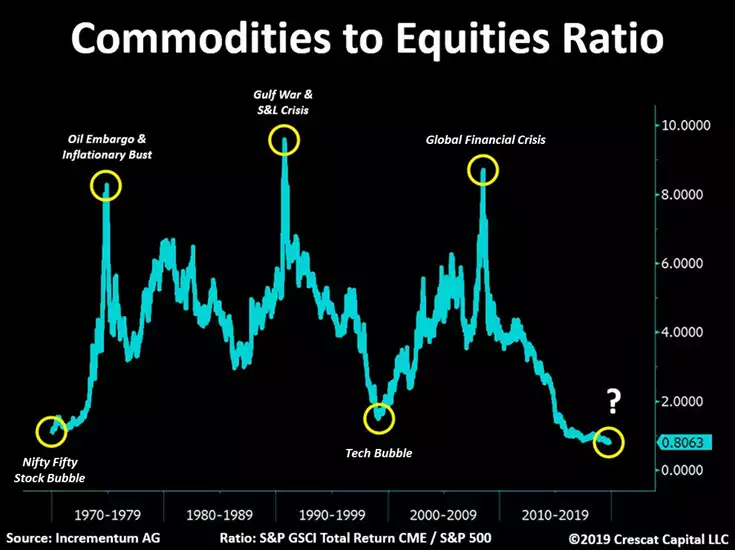

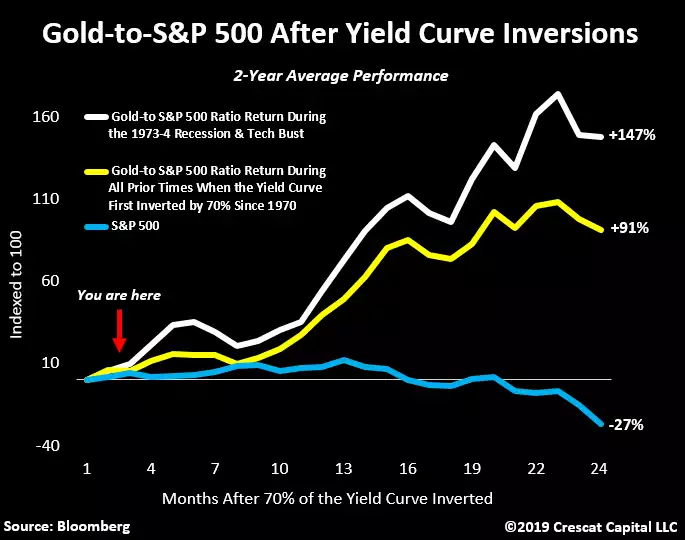

In a couple of ‘pictures’:

And where best to invest at this juncture?

And if that’s not clear:

“At Crescat, precious metals are overwhelmingly our preferred hedge against fiat money printing and over-valued financial assets. It’s important to note that cryptocurrencies provide an additional outlet for investors to flee stocks and bonds as well as fiat currencies today and thereby to help make rising inflation in those currencies a self-fulfilling prophecy. Bitcoin is a bet on technology and cryptography as well as a vehicle to disrupt and even circumvent government control over money. Bitcoin is limited in supply like precious metals and in that sense could be a valuable call option on inflation. As the first mover, it has the network-effect advantage over other cryptocurrencies which are abundant and therefore unlike precious metals as an asset class. We believe a small position in bitcoin could provide diversification and hedging with significant upside, but we do not advocate for more than one or two percent of a portfolio at this time given its high risk. For those living under authoritarian governments with strict capital controls, it is important to note that cryptocurrencies provide a functional and disruptive means of escape which plays into our bearish view on the Chinese yuan.”