The Great Credit Illusion

News

|

Posted 10/03/2017

|

4646

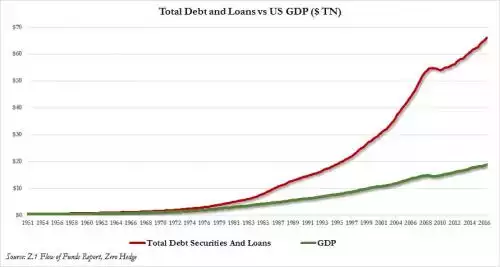

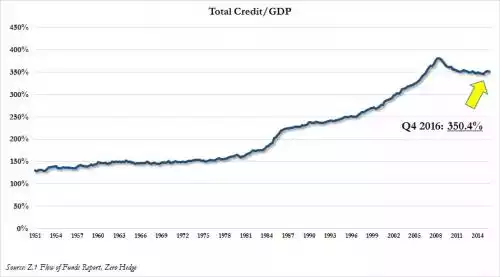

We discussed recently that Australia’s GDP growth over the last year came at the cost of $5 in new debt for every $1 of GDP growth. Well it’s not much better in the world’s biggest economy, the US. Official figures for 2016 show that in just that one year the US added $2.51 trillion in new debt, taking their total credit to a new record high of $66.1 trillion. What did they get for that $2.5 trillion in new debt? Just $632 billion in additional GDP… yep $4 of new debt for every $1 of new economic growth. Against the official GDP for 2016 of $18.86 trillion that also takes total credit to GDP to an eye watering 350%.

The thing is, since the GFC when that figure got to 380% and then went pop, it has stayed relatively level. That is now rising again...

Many will know of Bill Gross (aka the Bond King) who headed PIMCO, the world’s largest bond fund, for many years. He summed up the danger in this situation in his latest news letter:

“In 2017, the global economy has created more credit relative to GDP than that at the beginning of 2008's disaster. In the U.S., credit of $65 trillion is roughly 350% of annual GDP and the ratio is rising. In China, the ratio has more than doubled in the past decade to nearly 300%. Since 2007, China has added $24 trillion worth of debt to its collective balance sheet. Over the same period, the U.S. and Europe only added $12 trillion each. Capitalism, with its adopted fractional reserve banking system, depends on credit expansion and the printing of additional reserves by central banks, which in turn are re-lent by private banks to create pizza stores, cell phones and a myriad of other products and business enterprises. But the credit creation has limits and the cost of credit (interest rates) must be carefully monitored so that borrowers (think subprime) can pay back the monthly servicing costs. If rates are too high (and credit as a % of GDP too high as well), then potential Lehman black swans can occur. On the other hand, if rates are too low (and credit as a % of GDP declines), then the system breaks down, as savers, pension funds and insurance companies become unable to earn a rate of return high enough to match and service their liabilities.”

We discussed this in different detail in today’s Weekly Wrap and its worth a listen.

Credit as you know is a result of fractional reserve banking where $1 deposited is turned into around $10 in credit on the assumption not everyone will ask for their $1 back at once. Bill goes on:

“While the recovery has been weak by historical standards, banks and corporations have recapitalized, job growth has been steady and importantly – at least to the Fed – markets are in record territory, suggesting happier days ahead. But our highly levered financial system is like a truckload of nitro glycerin on a bumpy road. One mistake can set off a credit implosion where holders of stocks, high yield bonds, and yes, subprime mortgages all rush to the bank to claim its one and only dollar in the vault. It happened in 2008, and central banks were in a position to drastically lower yields and buy trillions of dollars via Quantitative Easing (QE) to prevent a run on the system. Today, central bank flexibility is not what it was back then. Yields globally are near zero and in many cases, negative. Continuing QE programs by central banks are approaching limits as they buy up more and more existing debt, threatening repo markets and the day to day functioning of financial commerce.

Don't be allured by the Trump mirage of 3-4% growth and the magical benefits of tax cuts and deregulation. The U.S. and indeed the global economy is walking a fine line due to increasing leverage and the potential for too high (or too low) interest rates to wreak havoc on an increasingly stressed financial system. Be more concerned about the return of your money than the return on your money in 2017 and beyond.”

Gold and silver are the oldest form of money in the world and if (and only if) you hold physical metal you have no ‘fractional’ issues nor any counterparty risk at all.