The “Other Side” of QE

News

|

Posted 27/10/2016

|

4651

Yesterday we wrote about the warning from Société Générale’s global head of quantitative strategy, Andrew Lapthorne on the fatal mix of US corporate debt and declining earnings.

Lapthorne has very recently provided another fascinating insight into the precariousness of the US sharemarket in the context of the Quantitative Easing (QE) employed by the US compared to that of Japan who arguably have gone harder than the US in such monetary expansion.

As we Aussies know full well the US and Japanese sharemarkets have rallied far more strongly than others since the GFC. Our market is still below the pre GFC highs whereas the US has reached much higher highs. This is in very large part simply down to their respective QE programs pumping heaps of money into markets. And in that sense he says he is “worried about its consequences”.

Interestingly he points out that the way in which this freshly created money inflated the US and Japanese sharemarkets was quite different and that difference could well spell out very different “consequences”.

Per yesterday’s article, much of the driving force behind the US sharemarket has been corporate share buybacks. Those buybacks are largely via (for now) cheap debt from the US Fed’s member bank recipients of all this freshly created money. That means a lot of the US QE is sitting on public company balance sheets. ‘Over to you’ mum and dads…

The Bank of Japan on the other hand bypasses the banks and simply buys Japanese shares directly. As we’ve reported previously this has been to the extent where they are top 10 holders of a large proportion of the Nikkei.

Lapthorne points out that when (not if) the market turns the outcomes will be very different.

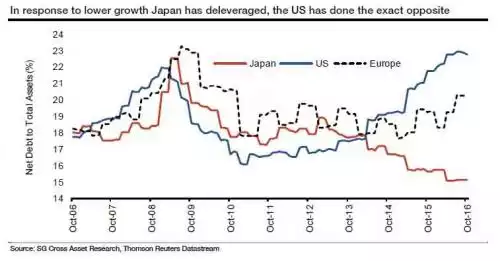

“In a market downturn, equity market losses will lead to the BOJ having to mark to market its equity holdings at a lower price. In the US, lower equity markets will lead to balance sheet disruption with the inevitable job losses and cuts in capital spending. In a low growth world debt is dangerous; in a deflationary world, debt is toxic. Japanese companies through years of experience probably understand this and have deleveraged as a result, US corporates, perhaps foolishly, have done the exact opposite.”

Enter exhibit A below. And again, like yesterday, have a look when the last time the chart got so high….GFC. But again, it’s probably different this time yeah?....