The Deutsche Domino

News

|

Posted 14/07/2016

|

5355

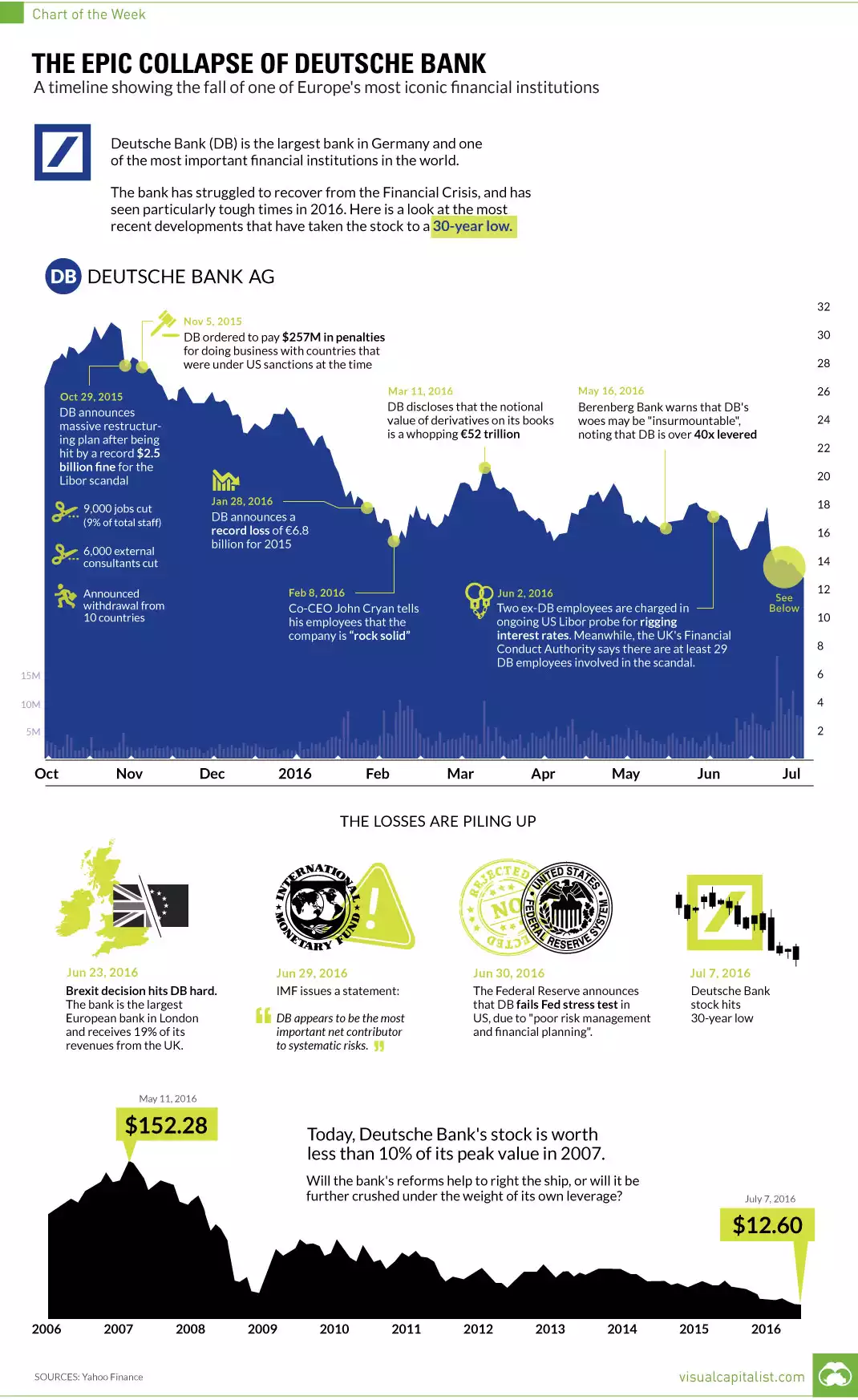

We’ve written a number of times about Deutsche Bank, most recently here when the IMF announced it poses the greatest systemic risk to the global financial system. Why are we harping on about it? The world’s financial system was brought down in the GFC by the failure of Lehmans Bank precipitating a debt based domino type collapse. That collapse was halted before fully playing out through the monetary stimulus intervention of central banks around the world. Today we find ourselves in a system with over 40% more debt than before the GFC, more overvalued financial assets (bubbles) everywhere, and clear signs of distress in the system. Gold, silver and bonds are surging just on these initial signs alone. But this time there is little ammunition left to the central banks to catch it. Some prominent economists and analysts are saying the next crash will make the GFC look like a hiccup. So take good note of the following pictorial and keep a close eye on what could well be the next Lehmans tipping of the dominos…