The Debt Wolf of Wall Street

News

|

Posted 31/03/2017

|

5384

We talk of the US debt pile often and that can overshadow Australia’s own. It shouldn’t. Just in the last week there have been a couple of editorials in major newspapers that highlight the issue. Here’s a couple of quotes:

From Peter Van Onselen of The Australian:

“The uncomfortable truth that no politician wants to confront is that Australia doesn’t have a plan to pay down the national debt. Worse still, there isn’t even a plan to develop a plan.

There’s lots of rhetoric about improving the budget bottom line, from both sides. But there is little or no focus on reducing the debt that has already accumulated. So bad has our addiction to debt become that we barely even discuss ways of paying down the accumulated debt any more. At best the focus is on lowering the deficit, which is a different thing entirely.”

Jeff Kennett just wrote for the Herald Sun:

“WE ALL want to live in good times and here in Australia we have been doing that for the past 25 years. But the downside is that we fall into the trap of thinking the good times will last forever. We become complacent, even selfish.” And

“Consider the economic facts. Our federal government debt is just under five hundred and forty nine thousand million dollars. That’s $549 billion. But consider all those noughts: $549,000,000,000.

Our state and local government debt is $158 billion. On top of that is our household debt, debt Australians have individually built up and that now stands at almost $2 trillion. That is 123 per cent of our national gross domestic product, the second-highest rate in the world as a percentage of GDP.

Those are unbelievable levels of debt. Add them together and you have a total of $2.707 trillion.

Divided by our population, say 24 million and we all have a government and consumer debt of $112,791.

If we continue along this path of spending more than we earn, borrowing more than we can afford, a day of reckoning will be upon us quicker than we thought possible.”

For some reason most people think anything but their own personal debt is somehow not real and it will all somehow ‘fix itself’. It won’t and there is nothing even remotely on the horizon to show a return to surplus let alone enough surplus to pay down debt. When, not if, the ‘day of reckoning’ Kennett refers to comes you will want to have your wealth in hard assets that don’t go down with the house of cards this has become.

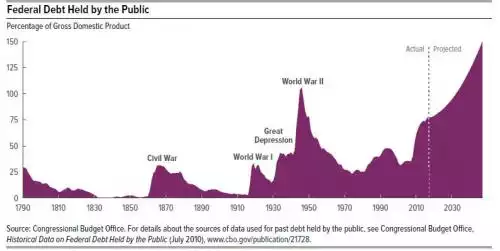

Let’s look at a graph produced by the independent, apolitical US Congressional Budget Office (CBO) illustrating the trajectory for the US.

The graph is notable for the difference of approach after the GFC to other major crises. We have INCREASED debt when the natural economic cycle seen previously is a ‘take your medicine’ crash and cleanse and start over. Central Banks intervened before the GFC became what it would naturally have become (much worse) by creating more debt to bail out the system. The debt is still there.

On the point of how this debt might bring down the system, the CBO provide one scenario:

“Greater Chance of a Fiscal Crisis. A large and continuously growing federal debt would increase the chance of a fiscal crisis in the United States. Specifically, investors might become less willing to finance federal borrowing unless they were compensated with high returns [loss of faith]. If so, interest rates on federal debt would rise abruptly, dramatically increasing the cost of government borrowing. That increase would reduce the market value of outstanding government securities, and investors could lose money. The resulting losses for mutual funds, pension funds, insurance companies, banks, and other holders of government debt might be large enough to cause some financial institutions to fail, creating a fiscal crisis. An additional result would be a higher cost for private-sector borrowing because uncertainty about the government’s responses could reduce confidence in the viability of private-sector enterprises.”

The timing is unknown. Some may suggest we have been ‘crying wolf’ for a long time and nothing has happened. That is correct. But the wolf is still out there, growing hungrier by the day and the sheeple are voraciously fattening themselves up on tasty financial instruments backed by debt.