The Complacency Cocktail

News

|

Posted 10/08/2020

|

8039

ABOVE: View todays article from the Ainslie Youtube channel.

Whilst both sides of US Congress bicker over how much more money they will splash into the economy, on Saturday Trump signed an executive order to take actions in to his own hands and in part answer the question on everyone’s lips, what and when was the Whitehouse going to spend the incredible $1.7 trillion they had printed but kept in the Treasury General Account (TGA). Whilst obviously a slush fund to buy votes in November the timing and means were unclear. Part of what Trump announced was more direct payments and hence the helicopter is starting to whirl.

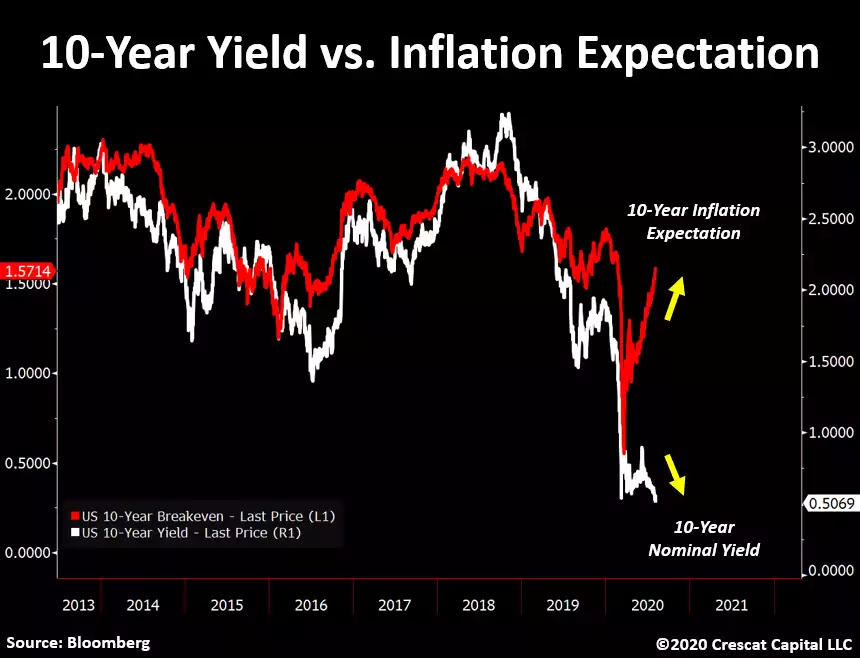

One of the key drivers for gold’s rally has been growing inflation fears as the Fed has made it quite clear they will let inflation ‘go’ more than they ordinarily would whilst they continue their extremely accommodative stance of stimulus. The chart below shows the disconnect playing out right now between inflation expectations and nominal 10yr Treasury yields:

As the author of the chart, Crescat’s Otavio Costa tweeted:

“Remarkable how inflation expectation and nominal yields are moving in opposite directions. The Fed's new mandate, suppress yields at all cost. Meanwhile, US Treasury keeps raising its borrowing estimates: $947B in Q3 $1.2T in Q4 Just the beginning of a frenetic gold rally.”

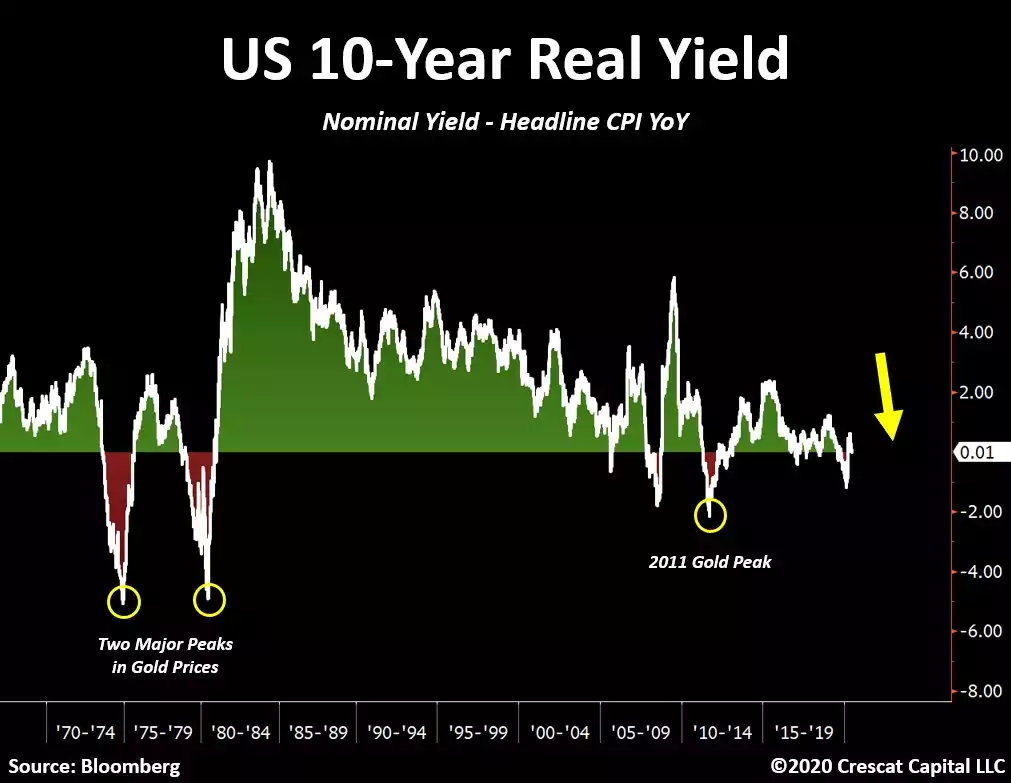

Combing the 2 and you get ‘real’ rates, being nominal less inflation and the chart puts the current situation into historical context:

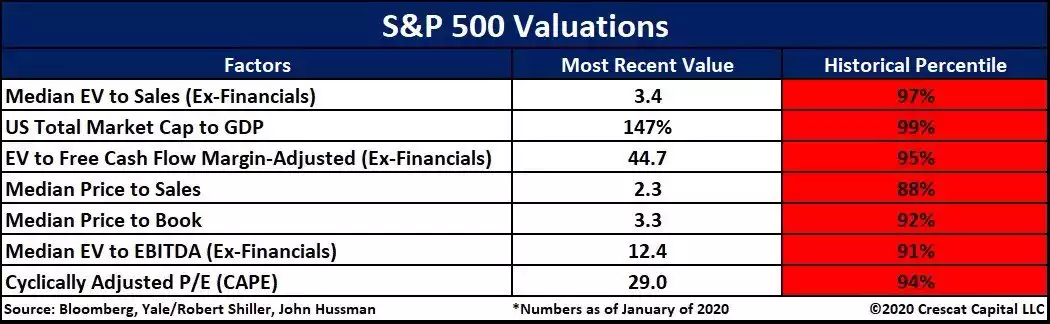

The fact is we have US corporations with record levels and degrading quality of debt. That already poor quality means they simply cannot handle any rise in interest rates whilst in zombie mode. And so again the Fed is stuck leaving interest rates low whilst inflation looms. Raise rates and we have an insolvency tsunami; leave them low and lose control of inflation whilst the US Government splashes cash on voters on deficit spending given tax incomes are in a recession. Trump also sees the sharemarket as his proof of Making America Great Again, though missing the point that only the rich enjoy the spoils. That sharemarket is at the absolute upper bound of valuations on nearly any metric as you can see from the table below:

When reading that table too, you have to remember the historically unprecedented concentration of the FAAMGs distorting the ‘awesome’ narrative. Amazon, Apple and Facebook shot the lights out on earnings on Friday bolstering the entire S&P500 stage. However ‘the rest’ are struggling and a stagflationary environment of high inflation and low growth will be devastating.

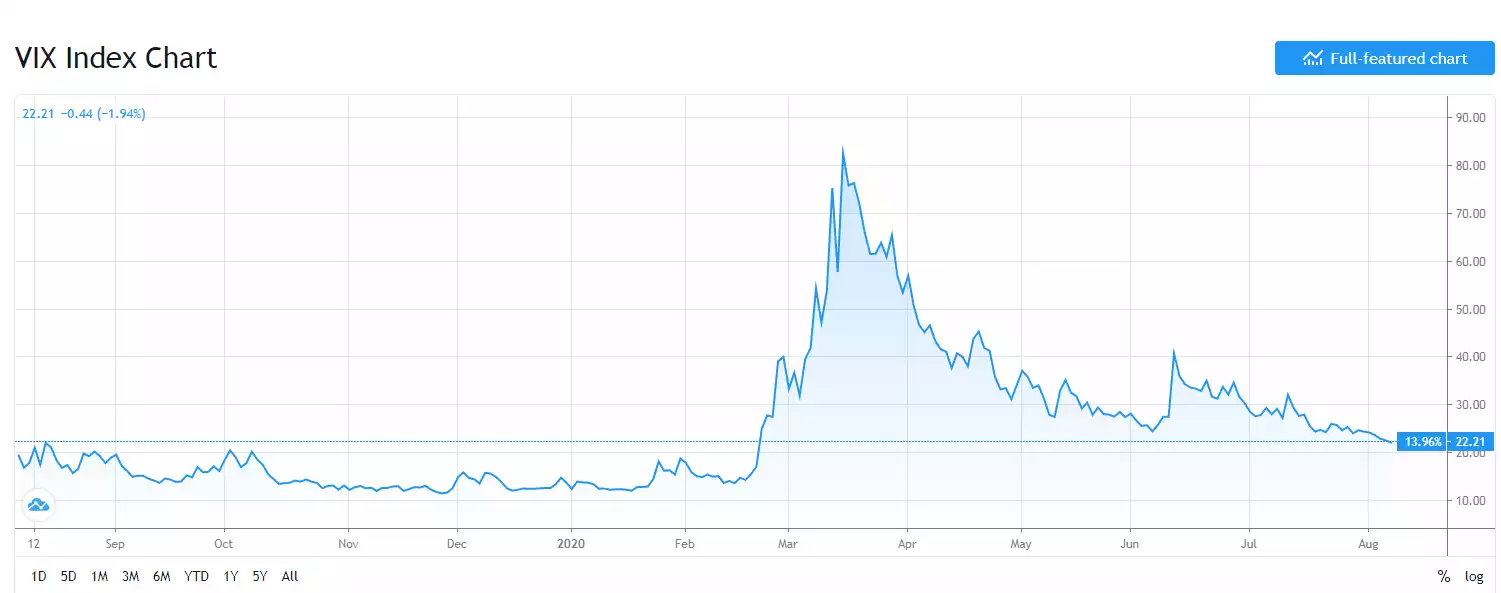

It is quite incredible the level of complacency in markets. The notion that the Fed somehow can keep it all under control is playing out in volatility as well. The VIX is trending lower and lower as if we aren’t in a recession with the sorts of percentiles in the table above.

There are few who think this rally in gold and silver is done, and many who thinks it’s just beginning, and that’s because of this cocktail of helicopter money from governments, monetary expansion and record low interest rates from central banks supporting markets, sky high equities valuations in a recession and amongst all of that….complacency. That never ends well.