The $51trillion Global Threat

News

|

Posted 14/09/2017

|

7453

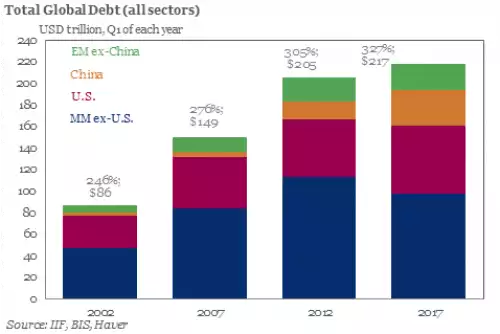

Bank of America Merrill Lynch (BofAML) just issued a report painting a very concerning picture about global financial markets. Back in April we wrote an article on the Institute of International Finance issuing a warning on the “eye watering” global debt explosion. In June they updated that to reveal total global debt hit a new all time high of $217 trillion, over 327% of global GDP, and up $50 trillion over the past decade. That looks like this going around the world (EM = emerging markets, MM = mature or developed markets):

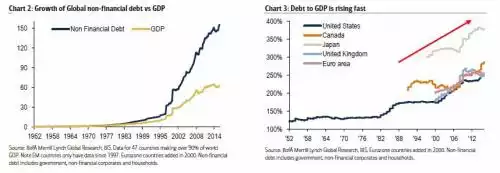

BofAML broke this down further and took out financials debt and just looked at government, household and non-financials corporate debt and exactly what all that debt had ‘bought’ in the way of GDP (output). They found that $150 trillion of debt achieved just $60 trillion of GDP. The following graphs lay that out clearly, and again we ask you to ask yourself if you think that looks like a sustainable trajectory?

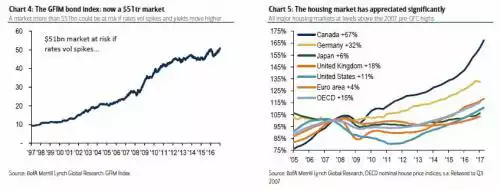

The danger BofAML highlight is the sheer amount, $51 trillion, of fixed interest products (bonds) in the market and how susceptible the market now is to shocks if rates and yields move higher. As usual central banks are the big culprits - "amid a record amount of assets acquired by the central banks we have seen the global fixed income market growing to the largest size it has ever been."

That of course, as we’ve pointed out many many times has seen yields (and rates) at record lows, meaning cheap debt, meaning asset bubbles forming everywhere. Their chart below highlights the effects on property alone "amid record low funding costs the housing market is also experiencing rapid price gains in some regions as prices are now higher than pre-GFC levels. All main housing markets (US, Europe, Japan and UK) are above the 2007 highs, propped-up by record low yield levels." (Australia would be up around Canada levels if shown)…

They point out that the world simply cannot afford (literally) rate spikes on this mountain of debt and central banks are likely to keep stepping in whenever that threat presents itself. That has 2 dangers – firstly that resulting debt trajectory simply cannot continue, and secondly, there may well be a major shock that no manner of rescue package could overcome. The theme of the 2016 financial market correction and corresponding gold rally was a loss of faith that central banks ‘got this’. We are reminded of the Superman movie when Superman catches Louis Lane falling off a building. He says “Don’t worry I’ve got you” to which she says “Yes but who has you?!” Central Banks, despite their self belief, aren’t Superman.