The 2021 Global Financial Experiment

News

|

Posted 26/11/2020

|

6836

We are in extraordinary times right now. That is not an unusual statement to hear this year but it is now made for very different reasons. In financial terms, the word unprecedented has been oft used but almost exclusively in the negative context. Biggest recession, biggest money printing program, biggest deficits, lowest interest rates, etc have been the norm. However the times have more recently turned to some unprecedented ‘positive’ news – like Dow breaches 30,000, Wall St at all time highs, biggest GDP jump, best November on record, etc. These seem incongruous at best and outright baffling to most. Whilst yes the news is awash with vaccines and smooth US presidential transitions, these are not silver bullets to a much larger problem.

This paradox could be observed in our store. This week has seen large trade volume however whilst this year has been largely one way traffic of people only buying, this week, with the gold and silver price falling has seen an almost equal weight of buys and sells. To be fair there has been a lot of rotation from languishing metals into flying crypto and conversely crypto profits into undervalued metal through Ainslie Wealth providing that seamless swap service. However there has also been a large contingent buying into the ‘it’s fixed’ narrative and selling their metal for cash. Conversely, those looking beyond the headlines are taking the opportunity to buy the dip and large trades have been flowing in.

There is also a growing sense that Australia is somehow different. We have a feeling of having beaten the virus, we are an island, and our main asset, property, seems to have survived… Like the US, but nowhere near to the same extent, our sharemarket too has rebounded. There was an excellent article in the ABC yesterday titled “Why is the stock market booming during the coronavirus recession?”

The article is repeated in full below this article but in essence it is the same story regular readers already know. We are in a suspended universe based solely on monetary stimulus leaving the big question no one is asking of ‘what happens when it ends?’…. Or from the article:

“Legions of highly paid traders, strategists and advisors will engage in baffling explanations littered with terms like rotation and differentials.

Ultimately, however, it all gets down to one thing; the sheer weight of money.

The great flood

The world's biggest central banks have slashed interest rates to zero and have been printing money like never before.

It is a process called quantitative easing.”

And the conclusion:

“The great challenge for the future is, how on earth will we ever be able to turn off the stimulus and return to normal interest rates, without causing markets to tank, which then might lead to a recession?

No-one has the answer. No-one wants to hear the question.”

It is an excellent article worth reading below.

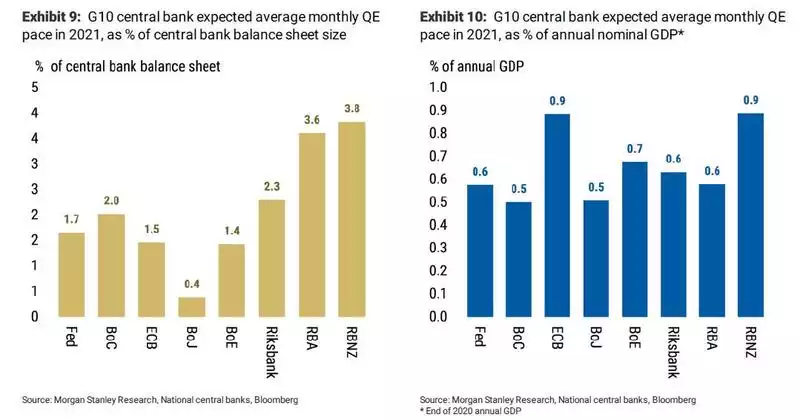

However lets look again at this central bank issue a little further. Morgan Stanley economist Matthew Horbach says of the 8 developed market (excluding EM’s like China) central banks actively printing money through QE in 2021, they will collectively print the equivalent of 0.66% of annual GDP every month in 2021, that is 7.92% annualized! As he rightly warns “That is a rapid pace of global liquidity injection, the likes of which we haven't seen outside of 2020.” And again to bring little old “its all good here mate, she’ll be right” Australia in to perspective, we will be right up there with the worst as can be seen in Morgan Stanley’s charts below:

The central bank catch 22 of ‘stop and we go into a deeper recession than anyone could contemplate’ or go harder and cause the ‘biggest bubble in history’ is one the IMF just contemplated too without an answer. IMF chief, Kristalina Georgieva, yesterday spoke to the pressure central banks are under to keep on the same course of cutting rates and printing more money and warned "more of the same is not possible and will not be sufficient today.” Her ‘solution’ for central banks was - "going back to the lab, reviewing their frameworks to identify innovative strategies and tools that will support the recovery from this crisis and beyond." OK, so that’s very clear and instructive even if we now feel like rats in a lab. But be careful she warns, as "new strategies and tools might produce new side effects as well,” and "additional monetary stimulus may pose important risks to financial stability."

So clearly this is all under control and there’s ‘nothing to see here, move along’ and sell your useless gold….

The greatest financial minds in the world do not have a solution and every day we continue doing the same ‘perceived solutions’ we add more and more debt and dig a deeper and deeper hole, blowing a bigger and bigger bubble.

Lets read how the ABC lays it out as mentioned earlier…

“Why is the stock market booming during the coronavirus recession?

By business editor Ian Verrender – 25/11/20

The global economy may be in the grip of the worst recession in almost a century. But stock markets are soaring.

Wall Street's key indicator, the Dow Jones Industrial Average, blew through 30,000 points overnight going into Wednesday, a new record, while our market on Wednesday morning erased all this year's losses.

This begs the question, are investors being too optimistic?

How does this make sense, given the vast number of workers whose jobs have been laid waste by a pandemic that continues to wreak havoc across the northern hemisphere, and particularly in the US?

In the aftermath of the 1990s recession, stocks were in the doldrums for years. The Global Financial Crisis of 2008 saw share prices plumbing new lows for almost two years.

Not this time. In February, as the Australian market tanked (falls that accelerated in March), seasoned investors were stunned by the ferocity and speed with which fortunes were erased.

But rather than bounce around for a year or two, or even a month, the nadir lasted just one day.

From March 23, Australian stocks have been on the rebound, just as they have on exchanges across the globe.

The reason is as simple as it is complex.

Legions of highly paid traders, strategists and advisors will engage in baffling explanations littered with terms like rotation and differentials.

Ultimately, however, it all gets down to one thing; the sheer weight of money.

The great flood

The world's biggest central banks have slashed interest rates to zero and have been printing money like never before.

It is a process called quantitative easing.

Essentially, central banks — including our own Reserve Bank — buy government bonds, or debt, in the open market. That helps lower market interest rates and pumps cash into the economy.

They dabbled in the practice around the turn of the century, in an effort to drive down the value of their currencies, then kicked it into overdrive during the GFC.

By 2012, with the Western world's central banks holding close to $US8 trillion in government bonds, corporate debt and mortgage securities, fears began to grow as to how the process could ever be unwound.

No-one has ever quite figured that out. And what has occurred in the meantime is that whenever there is a problem — either in financial markets or the real economy — they resort to ever more financial stimulus.

Central banks now own $US24 trillion in financial assets. And that doesn't include the Peoples Bank of China, which has been going hell for leather with the money printing caper.

All that extra cash has to go somewhere. Some of it is borrowed for legitimate investment. But a very large portion of it finds its way to financial markets and real estate.

This time around, governments have jumped in on the act. With global interest rates at zero, they ditched their long-held attachment to austerity and decided to spend their way out of recession.

Where to from here?

For the past month, investors haven't been the slightest bit interested in bad news.

A much tighter than expected result in the US election didn't faze them.

Donald Trump's refusal to concede defeat, and the potential threat that posed, was largely ignored.

Even a huge resurgence in the pandemic across America was tolerated. Warnings from the International Monetary Fund that the economic recovery appeared to be slowing were brushed aside.

Joe Biden's win, however, was greeted with enthusiasm.

Donald Trump's decision to allow a transition was a trigger for a huge splurge. And the prospect of three vaccines, which may be available for widespread use in 2021, sent traders into a frenzy.

This November is shaping up to be one of the best on record.

Just a few weeks ago, the world's biggest central banks upped their cash injection programs. Coincidence?

It's not as though central bankers deliberately set out to push stocks to the moon. It just happened as a by-product.

What they wanted to do was to inject cash into the system and lower rates, so businesses and individuals would borrow and invest. That was supposed to create jobs and get things ticking along.

But they've created a Frankenstein. They now can't afford for stocks to plunge, even if markets are hugely overvalued.

That's because of something they call the "wealth effect". If we feel wealthy, we spend more, which is good for the economy. And if stock markets and housing are rising, those with assets certainly feel a lot more wealthy.

A crash, on the other hand, has everyone reining in the spending. And that can cause a recession.

The great challenge for the future is, how on earth will we ever be able to turn off the stimulus and return to normal interest rates, without causing markets to tank, which then might lead to a recession?

No-one has the answer. No-one wants to hear the question.”