Taper Tantrum or Volmageddon Ahead?

News

|

Posted 19/02/2021

|

6752

The ‘everything bubble’ is starting to look increasingly shakey. Last night, literally everything except platinum, which seems bullet proof at present, was sold off… everything. Even the Bitcoin rocket briefly levelled out but admittedly Ethereum surged again to new highs.

Whether cause or effect, that of course included US Treasuries which saw 10yr yields rise above 1.3% and into territory that is becoming scary for this bubble. As Bloomberg Macro Strategist Laura Cooper penned over night:

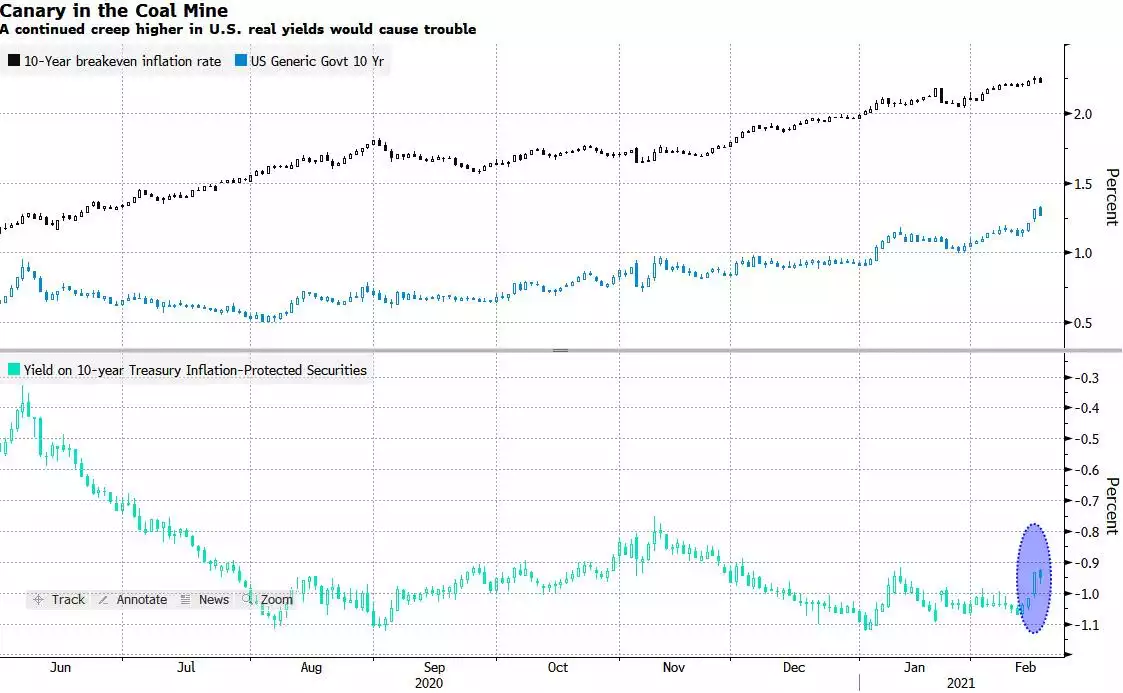

“Rising U.S. real yields could eventually derail the everything rally. Gains across stocks, credit and emerging markets are predicated on forever-loose monetary policy, and lofty valuations are harder to sustain when conditions hint at future tightening.

Stimulus-fueled growth prospects have rekindled the typically positive relationship between real U.S. yields and inflation expectations. And that can trigger outflows on higher-yielding assets like equities.

Market-based inflation expectations are comfortably priced for a medium-term overshoot, above the Fed’s 2% target. Near-zero Fed rates sent real yields deeply into negative territory last year, without the growth-element to boost nominal yields

As a massive fiscal impulse underpins the economic recovery, a corresponding increase in policy tightening expectations could drive up the inflation-adjusted benchmarks, removing a key tailwind to the broad risk rally.”

Throw into this cocktail the breaking news that in addition to Biden’s $1.9 trillion relief plan and the $4 trillion already unleashed by Trump, the Whitehouse is now proposing a $3 trillion ‘Build Back Better’ program of infrastructure and other job creating initiatives. This tsunami of spending (both more debt and on things more likely to create inflation) and emptying of the huge Treasury General Account (TGA) has some analysts concerned we could see the equivalent or worse of the 2013 so called taper tantrum as Cooper explains:

“The Fed risks getting caught behind the curve should tapering bets ramp up as the economic recovery extends. That raises the odds of a repeat of 2013’s taper tantrum. When real yields rose sharply, more than nominal rates, the repercussions rippled across risk assets -- over a four-week period, the S&P 500 fell 6%, EM equities tumbled more than 15% and speculative-grade credit saw spreads blowout by ~100bps.”

The other thesis or concern is this near record high VIX (volatility index) shorts amid this tectonic shift could see a repeat of the February 2018 so called “Volmageddon” equities volatility shock that saw the S&P500 drop 6.5% in just 2 days triggered by increased Fed tightening concerns (yes we get the irony, but remember this is a market hooked on stimulus juice).

Either way we are now at a very interesting juncture in financial markets. Whilst gold and silver got sold off last night, so did the USD, and so did shares. This is not a normal functioning market of historic correlations. What history does tell us, is that when financial assets crash, gold and silver rise. History doesn’t always repeat, but it certainly often rhymes.