Taper Take-off versus Tantrum – “practically miraculous”

News

|

Posted 04/11/2021

|

5477

Buy the rumour sell the fact became sell the rumour buy the fact last night as the Fed confirmed it will commence tapering this month and shares….. went up!?

In a classic human behavioural response given the almost certain announcement, the market clearly hasn’t put the following 2 charts side by side…

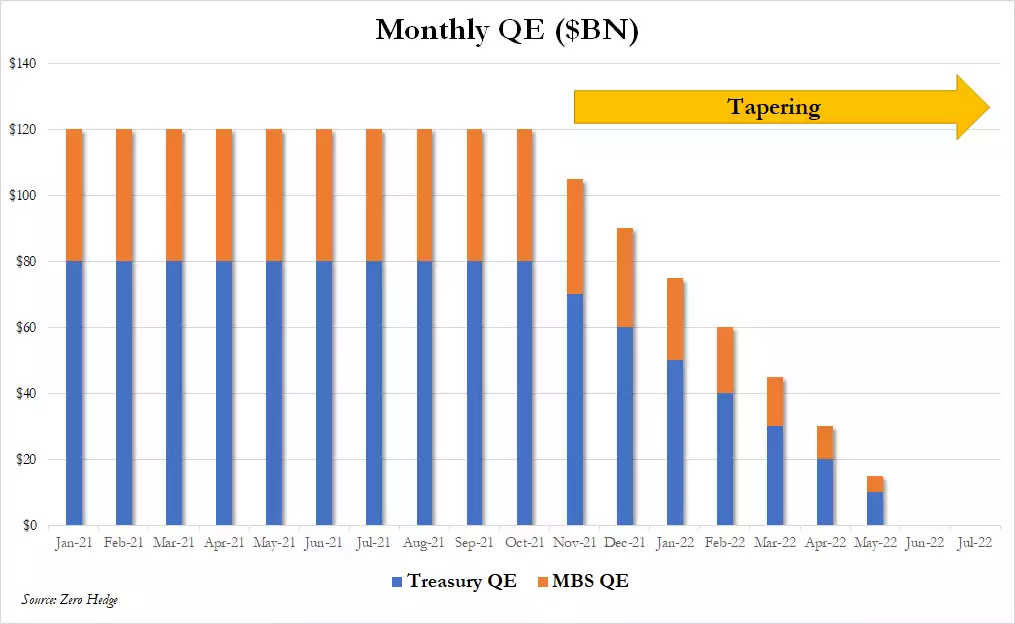

For podcast listeners, the first chart shows an incredibly tight correlation and simultaneous upward projection between and of the S&P500 and the amount of money printed by the Fed since Biden came into power. The second chart shows the $15b/month reduction of the current $120b/month money printing program seeing it end in June next year…

And whilst shares rallied last night on “its different this time” (the 4 most expensive words in finance) other cooler heads saw this all for what it is… a major policy mistake of too little too late AND maybe not even what the 2nd chart above implies.. Curvature Securities last night pointed out a nuance missed by most:

"The tapering announcement was generally as expected, but at the same time, a little different. Yes, the FOMC announced the Fed will purchase $15 billion fewer securities beginning in November. Basically, as expected.

However, here's the interesting part. The Fed pre-announced a second tapering of $15 billion in December. That means that beginning in January, tapering is still a "wild card." We will expect another cutback of $15 billion in January, however, it's not guaranteed.

Theoretically, they could stop tapering in January or they could increase the pace of tapering.

Overall, it looks like the December FOMC meeting will be important for the markets"

It’s probably nothing, as the market reaction whether they said “but we never committed!” or not will be just as brutal.

Whilst the Fed subtly changed their wording from inflation definitely being transitory to it being “expected to be transitory”, they are still talking down any raising of rates for some considerable time. Last night the interest-rate future markets brought forward their expectations of hikes now as early as June and 2 by the end of the 2022, much more aggressive than the Fed forecast.

Chief Investment Officer for Guggenhiem, Scott Minerd didn’t mince words saying “We clearly are setting ourselves up for a policy error….There is no way that we have engaged in the scale of asset purchases in the pandemic where there’s going to be a policy which ultimately is going to be perfect and not cause some sort of interruption to asset prices or something else that would be destabilizing. I think that would be in the realm of practically miraculous.”