SWIFT, Russia and Shifting Tectonic Plates in Payments

News

|

Posted 28/02/2022

|

7914

With “What does SWIFT do? And why does it matter to Russia?” trending on Twitter, it seems like WWIII is quickly turning into a conflict defined by digital payments. Opposing forces are seeking to freeze eachother’s assets and cut off each other’s payment gateways with almost as much tenacity as those in armed conflict on the ground and in the air. Does Ukraine represent a tectonic shift in global payments and currencies?

On Saturday, the United States, Britain, Europe and Canada moved to block Russian access to the international payment system SWIFT. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a messaging system that runs on a network of financial institutions. It is used by thousands of banks worldwide to communicate information on financial transactions in a secure and standardized way. As a critical part of the DNA of international financial transactions, many commentators are arguing that exclusion from the system may bring into question the solvency of banks that are outside of it.

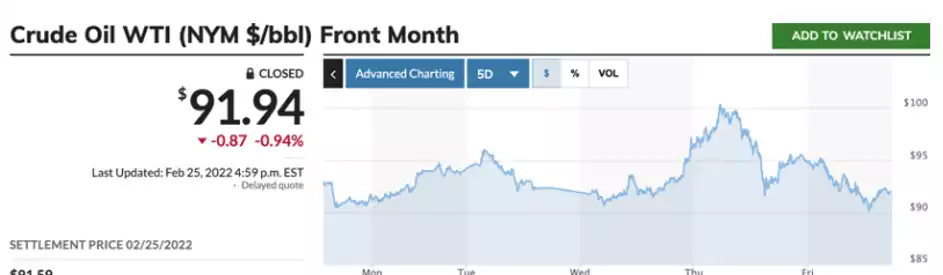

While many may see Russia’s delinking from SWIFT purely as an evaporation of access to dollars, on the other side of the transaction, Russia will now be selling its oil for other currencies. India and Russia are already in talks to set up an Oil for Rupee trade. Russian exporters are reportedly opening bank accounts in New Delhi so that they can trade on rupee terms. India has a long-standing relationship with Russia, who supplies them with gas, coal and fertilizer. With the Saudis dropping their exclusivity agreement with the US dollar agreeing in 2021 to Oil made its first pass triple digit psychological resistance on Thursday.

Seeing sanctions on major Russian exports Oil and Gas initially saw the two move higher as markets priced in reducing supply. When the second tranche of sanctions were effectively more of the same (i.e. more sanctions on banks, export ban on technology to Russia, more restrictions on individuals in Russia), markets saw that there was no further targeting of oil and gas. With that, prices in the two energy commodities cooled off. Russian oil accounts for approximately 9% of global output.

However, these market reactions, as well as the raft of other sanctions, were most likely expected by Russia. We have drawn readers’ attention multiple times to the Russian Central Bank’s accumulation of gold reserves over the last number of years. Being kicked out of SWIFT upon their ‘crossing of the Rubicon’ can’t be coming as a surprise to Moscow. If leaving SWIFT leaves the western world without Russian oil, cost of living pressures at the petrol pump are about to start heading north in Western Europe.

Gold, Silver and Platinum all followed similar trajectories to oil: flying up on fighting breaking out, and cooling off soon after. Some market commentators have pointed to Bank of America unloading more than 1 billion oz of Paper Silver on the COMEX as having had something to do with silver coming back under the 200DMA. Another analysis has investors seeing that the sanctions unveiled as unlikely to upend the global economy, therefore the ‘risk off trade’ is no longer necessary. A yet more simplistic analysis would simply say ‘nothing moves up or down in a straight line’, and the move really was nothing short of spectacular for a while there. We could also take a feather out of Ben Bernake’s book when he told Congress in 2013: “Nobody really understands gold prices, and I don’t pretend to understand them either”.

There have also been reports that $640 billion in foreign exchange reserves were being held on computers in New York, London and Frankfurt. While they may be password protected, individuals may have root access. If this comes to pass, major state actors are going to be looking more closely at technology without a backdoor, and ledgers of holdings that are actually fully decentralised with no hidden ‘kill switch’. While this may represent a short term gain politically, other Central Banks and non-Western institutions that rely on data centers in the west have probably taken notice.

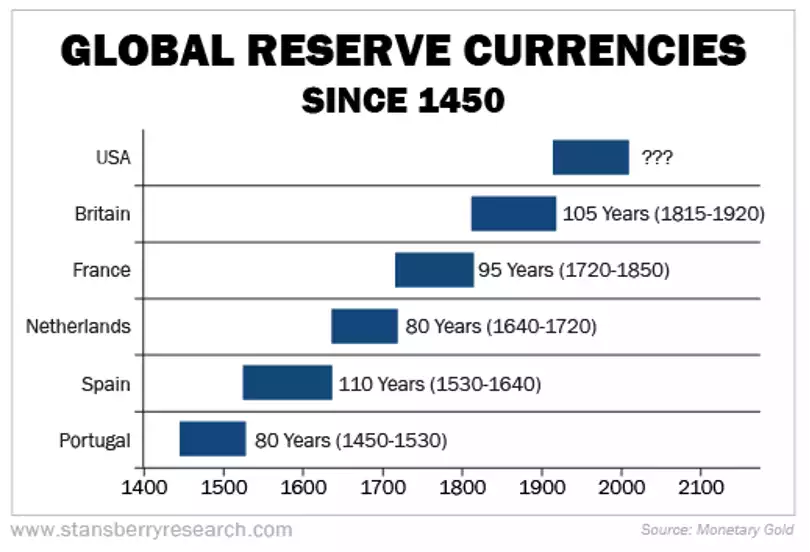

As we discussed in late January, Russia has been investigating a Gold-backed stablecoin. With increased fragmentation of global payments, we may well be seeing the incipient stages of a new global monetary system. We are well overdue for one as they tend to last approximately a hundred years.