Stagflation Road Ahead for Australia

News

|

Posted 08/06/2022

|

8999

Stagflation Road Ahead for Australia

Old news now but let’s talk about the implications of that surprise 50bps RBA rate increase yesterday. That it happened on the same day the World Bank dramatically downgraded global growth and openly conceded stagflation, is a reality that cannot be ignored.

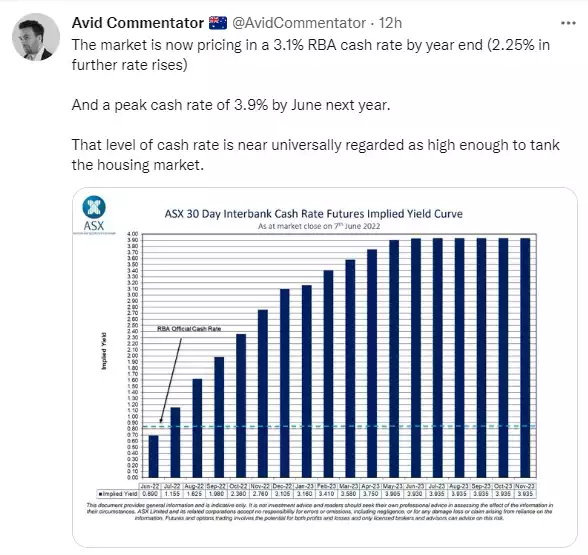

For the first time since 2000 the RBA hiked by 0.5% (as opposed to the ‘normal’ 0.25% increments) taking the official rate to 0.85%, higher now than the US Fed rate of 0.77%. The Fed have been more incremental as opposed to the ‘late to the party’ RBA.

Whilst all the focus is on property prices because of the now higher interest payments, this is not a simple equation. Already this morning Westpac have passed on the full 0.5% hike to mortgage holders and the RBA and market are signalling hikes all the way to 3% before this year is over. Such an increase would not simply in itself see defaults on home loans as the scaremongers would contest. Higher mortgage payment, along with the already rampant inflation they are trying to address, will most likely see reduced discretionary spending by heavily indebted households which eventually contributes to a recession and job losses. That is when you see forced sales of homes and more markedly reduced prices compared to the more gradual declines we are seeing now.

Few see the blunt instrument that is central bank interest rates rising against out of control inflation for what they are. Recessions are always the inevitable result because they always hike late cycle, they always hike at full employment, and they always hike to the point of capitulation to reduce said inflation that itself is so often a result of economic largesse. However this time the inflation appears largely fuelled by the exogenous effects of supply chain disruption and a war imposed energy crisis unlikely to just evaporate off higher rates.

Cue the World Bank last night…

"The world economy is expected to experience its sharpest deceleration following an initial recovery from global recession in more than 80 years,"

“The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,”

The reality of stagflation is hard to ignore. The chart below of global growth and inflation has no easy solution.

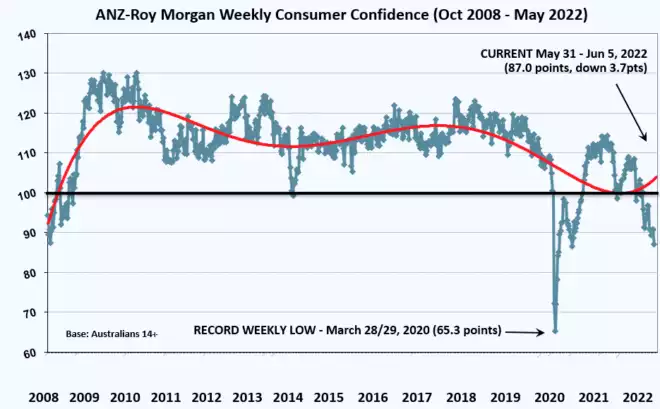

This is exacerbated further for Australia as we have had comparably much weaker wage growth at just 2.2% annualised last quarter. You can now say goodbye to upward wage pressure on that figure. We also are not at that ‘peak awesome’ that normally comes at such a time of peak employment. Indeed Aussie consumer confidence has never been this weak at the beginning of a rate tightening cycle and it is already running below the GFC lows.

Somewhat tellingly the AUD rallied on the higher than expected rate hike but very quickly reversed. Paying a higher ‘yield’ than the US probably saw that initial knee jerk rise. However the reality of the very hard road now ahead for Australia clearly hit home and back down it came.

Australia’s economy is largely ‘houses and holes’. Houses clearly have a very hard road ahead. Our biggest ‘holes’ are for iron ore which some reports have a challenging time ahead for given China’s slowdown and having reached a point where recycling steel and stockpiled ore will see little demand for our cash cow commodity. The saving grace may be ‘need to live’ commodities such as energy, food and renewable energy metals such as copper, nickel and silver. Clearly however the government need to reconcile domestic and international demand for these sought after products as we are seeing right now with gas and coal.

Silver and platinum stand out as a double bet in delivering both a monetary metal play against the ensuing economic pain ahead (along with gold), and as a key tech / green renewables metal play. Buying the physical metal removes all the counterparty risk ahead as this economically strung out system of derivatives and correlated/entwined financial markets potentially unwind in a very messy way.