Stagflation is already here: Jeffrey Gundlach

News

|

Posted 10/03/2022

|

6275

With Oil now well over US$120, official inflation persistently moving towards 10% p.a across the world, and GDP growth in the low single digits: we are now in Stagflation. A period of Stag(nant In)flation is the worst of both worlds as economic growth, and productivity are low to nil, and inflation eats away at what wealth there is. Wall Street’s “Bond King” Jeffry Gundlach makes the case as to why we are already in the midst of stagflation after years of threats, and what is likely to happen.

In our modern interconnected global supply chain where a large proportion of goods are imported, almost all prices are influenced by transportation costs. While the cereal and diapers everyday Australians are picking up from their local supermarket don’t contain any Nickel, which is up 69% on the week, it does cost money to transport those products, and increased oil costs are going to see price hikes for consumers, or profit squeezes for retailers. In reality, both groups take part of the hit. Faced with higher prices, consumers buy less, which leads to lower volumes on already thinning margins.

Yesterday, President Joe Biden announced that the US would be banning Russian oil and natural imports - approximately 8% of total national supply. It doesn’t sound like a lot, but it represents approximately 672,000 barrels per day. “Defending freedom is going to cost”. With Americans already forking out record high prices at the petrol pump, continued pain for motorists but anyone who consumes anything which needs to be transported or delivered - which is almost everything last time I checked.

Gundlach predicts that Crude is set to max out at approximately $200 a barrel this year, and that the 7.5% inflation rate is more than likely to continue to ramp up as the ongoing stimulus takes time to make its way through the system, just as oil prices affect incoming supply not the stock already on the shelves. Gundlach criticised the Fed, arguing that they will be forced to raise rates as the economy falls into a deep recession, which has never happened before. Previous recessions have been met with interest rate cuts to soften the blow. However at 0 - 0.25% nominal rates, there is nothing left to cut. With the NASDAQ moving officially into bear market territory at better than 20% beneath all time highs, the air is coming out of the bubble.

Oil is far from the only commodity demanding a pretty penny. As covered in yesterday’s news, a critical shortage on the London Metal Exchange in nickel saw a massive spike in price as shorts rushed to cover and sellers dried up. Trading is now halted, and when the market does reopen, it will have a max daily movement of 10% before trading will be halted again. If it wasn’t already obvious, the derivative-dominated world of commodities have reduced markets’ price discovery. They can only be repriced when supply actually dries up completely.

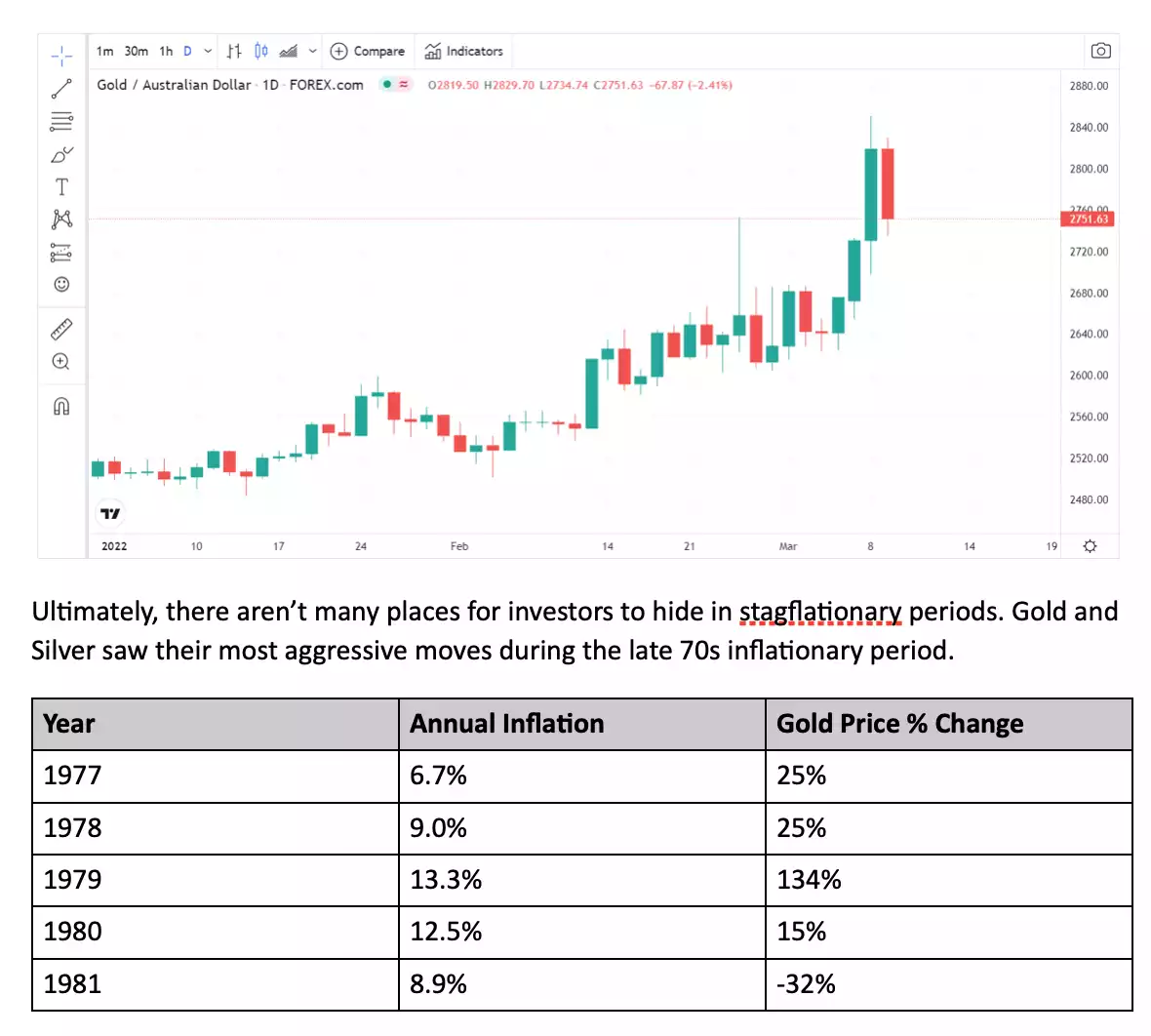

What does this mean for gold and silver? Both monetary metals are having a big week and big month up 12.4% and 13.7% respectively. That doesn’t do justice to the major price fluctuations which show just how explosive the metals can be when faith in fiat wavers.

Ultimately, there aren’t many places for investors to hide in stagflationary periods. Gold and Silver saw their most aggressive moves during the late 70s inflationary period.

|

Year

|

Annual Inflation

|

Gold Price % Change

|

|

1977

|

6.7%

|

25%

|

|

1978

|

9.0%

|

25%

|

|

1979

|

13.3%

|

134%

|

|

1980

|

12.5%

|

15%

|

|

1981

|

8.9%

|

-32%

|

From Mid 1980 until mid 1983, interest rates were almost always north of 10% and over 20% in 1980 which made bonds attractive to investors as an alternative to gold as an inflation hedge.

Stagflation is terrible for almost everything except for commodities, and in particular, precious metals.