Sprott Gold Report – Key Takeways

News

|

Posted 23/08/2018

|

6687

Much of the headwinds for gold at present is the strong USD. The latest Sprott Gold Report talks to this and presents some compelling views around the headwinds ahead for the USD itself which then become tailwinds for gold.

As they state and investors know full well, the US summer has seen weakness in the gold price, nicely summarised as follows:

“The summer of 2018 has shaped up to be a frustrating stretch. The Fed’s dual policy agenda of simultaneous rate hikes and balance sheet reductions has ratcheted-up peripheral financial stress at a pace faster even than we had anticipated. To date, though, cognitive dissonance over the U.S. dollar’s contributing role has preserved its safe harbor status. As the scale of emerging markets dislocation expands on a weekly basis, the stored force in collapsing EM currencies is still funneling towards a strengthening dollar, and in turn reflexively pressuring the gold price. Even the weekly circus of President Trump’s impetuous tariff crusade, as unsettling as it has been for market confidence, has thus far weighed on gold through the tractor beam of a collapsing commodity complex.”

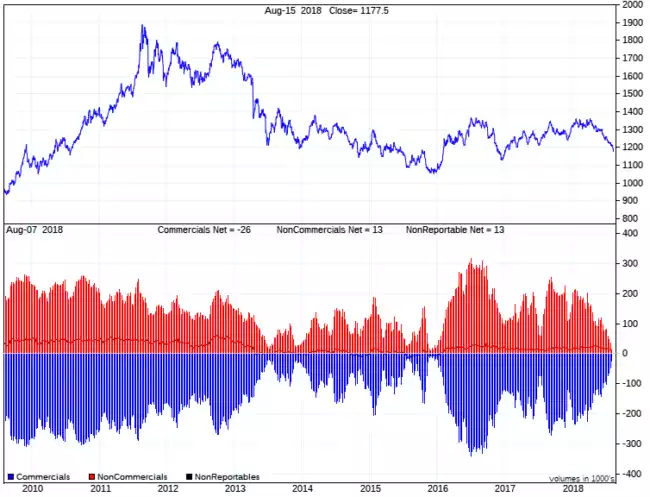

The key takeaway in that paragraph for us is the ‘cognitive dissonance’ observation. Contributing factors to its strength amid significant factors weighing against it have people in two minds and the ‘gut feel’ is saying something’s not right. Simplistically you could say that is what’s playing out in COMEX futures markets too. We shared a chart below on Monday showing the reduction of long positions by the simple momentum play hedge funds and the reduction in the shorts by the Commercials.

Sprott presents the same but on a longer time scale to show how extraordinary this set up is:

“As of 8/7/18, the net-long position of large specs had contracted to just 12,688 contracts, and the commercial net-short position had contracted to just 25,609 contracts (zero-sum difference being a 12,921 net-long position held by disregarded small specs), both new lows dating all the way back to the week of 12/1/15, which marked the end of spot gold’s four-year bear market and kicked off bullion’s 31.4% rally during the first half of 2016.

Interestingly, the dynamic behind the collapse in the large-spec net-long position has been an explosion in gross shorts by hedge funds (not their normal bailiwick). In the eight weeks between 6/12/18 and 8/7/18, large specs actually increased their gross longs modestly, from 192,752 contracts to 208,292 contracts, but over the same span almost tripled their gross shorts, from 72,512 contracts to 195,604 contracts. While we tip our hat to hedge fund prescience in aggressively establishing gold shorts these past eight weeks, it will now require repurchase of the equivalent of 12.3 million ounces to determine the degree to which recent hedge-fund bearishness has been self-fulfilling. In the meantime, participating hedge funds should find it a bit ominous that their highly atypical gross short position (195,604 contracts) currently exceeds the gross short position of the wily commercials (179,812 contracts) for the first time in the history of these statistics!”

i.e. Shorting is selling something you don’t own yet and needs to be bought to deliver. The Specs are nearing that time which can often trigger a ‘short covering rally’.

But let’s get back to that USD dynamic where Sprott shares some great insights. They cite 2 fundamental flaws in the bullish case for the USD which we will present in reverse order. The second is a macro / geopolitical influence, being Trump effectively weaponising what is supposed to be the world’s reserve currency:

“Second, bullish dollar arguments turn a blind eye to rapidly hardening global resentment of the dollar standard system. Historical burdens endured around the globe from unilateral impacts of Fed policy pale in comparison to President Trump’s outright weaponization of the U.S. dollar. By way of recent example, Russian resentment of President Trump’s capricious April sanctions on selected Russian companies spurred the Russian central bank to liquidate $81 billion of Treasuries within weeks.

Along with levying metal tariffs on Canada, Mexico and the EU, the Trump administration has now imposed sanctions on no fewer than 11 countries: China, Columbia, Cuba, Iran, Libya, North Korea, Pakistan, Russia, Syria, Turkey and Venezuela. As if Triffin dilemma strains were not burdensome enough for the archaic dollar standard system, President Trump is now expanding the dollar’s role well past being a stable unit of account or serving as a global reserve currency, to becoming a blunt instrument for the punishment of nations not on board with the Trump agenda. Are dollar bulls so jingoistic they believe the world has no choice but to accept a global monetary framework subject to borderline blackmail?”

Domestically though the hurdles ahead are far clearer:

“First, it relies on longstanding relationships between asset classes which hold diminished relevance amid contemporary realities of excessive global debt levels and systemic fragilities. Citing just one of many examples, dollar bulls are content to extrapolate Fed tightening as telegraphed, and conclude that FOMC policy divergence will simply power a strengthening dollar as it always has in the past. This reasoning, however, sidesteps the likelihood that existing debt levels have become too onerous for the Fed to tighten meaningfully without triggering a damaging wave of debt defaults. We would cite the collapsing Treasury yield curve in concise counterpoint to dollar bulls’ expectations for rising U.S. rate structures. For the past 37 years, any meaningful backup in 10-year Treasury yields has quickly led to financial crisis. Why do dollar bulls think U.S. rates are suddenly free to rise without causing collateral damage today, when they have been unable to do so for almost four decades?”

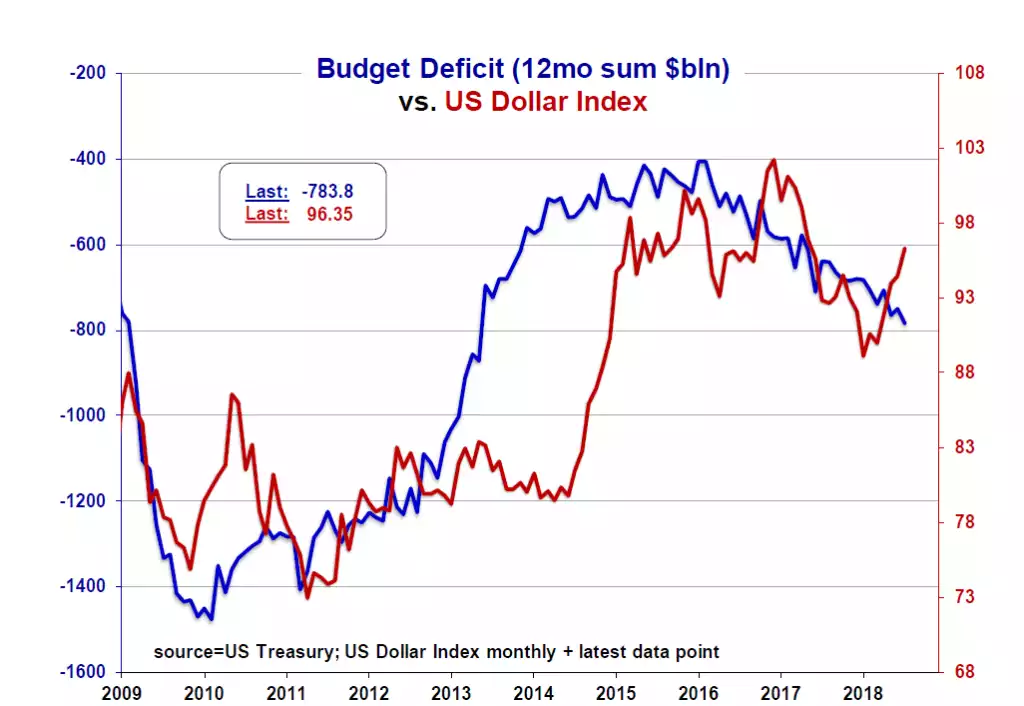

“To us, the dollar’s most significant challenge is the rapidly deteriorating U.S. fiscal position. Surprise, surprise, the Treasury Department reports that Trump’s corporate tax cuts have reduced first-half 2018 tax revenues far more than expected. H1 year-over-year corporate tax receipts fell by a third, greater than the 2009 collapse and near a 75-year low (nominally and as % of GDP). The Trump administration OMB (Office of Managament and Budget) mid-year review (July) tacked $100 billion to annual budget deficits for each of the next several years (2019-21 now $1.1 trillion, $1.1 trillion and $1.0 trillion). As shown in Figure 5, the DXY’s summer rally is likely to be overwhelmed by harsh budget realities in very short order. Should historical relationships hold true, a DXY target in the low 80’s should be in play by mid-2019!”

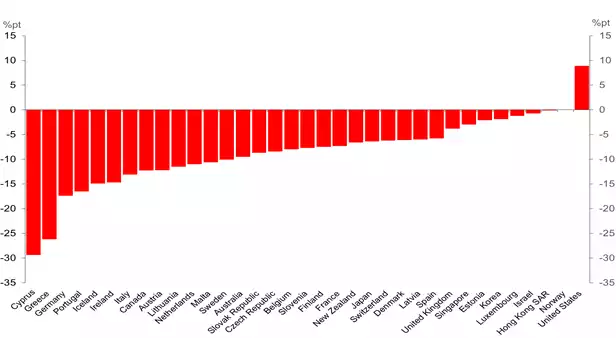

In conclusion they leave us with a very telling chart:

“During the final four months of 2018, we expect euphoria over “strong” S&P Q2 earnings to fade into consensus recognition that corporate profits have been financed through the zero-sum misdirection of an exploding federal budget deficit. As the Treasury conducts its second half issuance now projected to total $769 billion (bringing total 2018 issuance to $1.33 trillion), we expect significant erosion in feverish dollar sentiment now in play. Additionally, modest 2018 upticks in the average interest rate paid on U.S. public debt are already straining Federal budget projections with geometric increases in debt service obligations.

As final perspective on the U.S. fiscal position, we offer Figure 6 [below], the IMF’s five-year forecasts for the percentage change in government debt-to-GDP ratios in “advanced economies.” Note there is only one nation projected to increase its debt-to-GDP ratio during the next five years. Does this look like a recipe for relative dollar strength?”