Smart Money Running to Safety

News

|

Posted 05/06/2019

|

7374

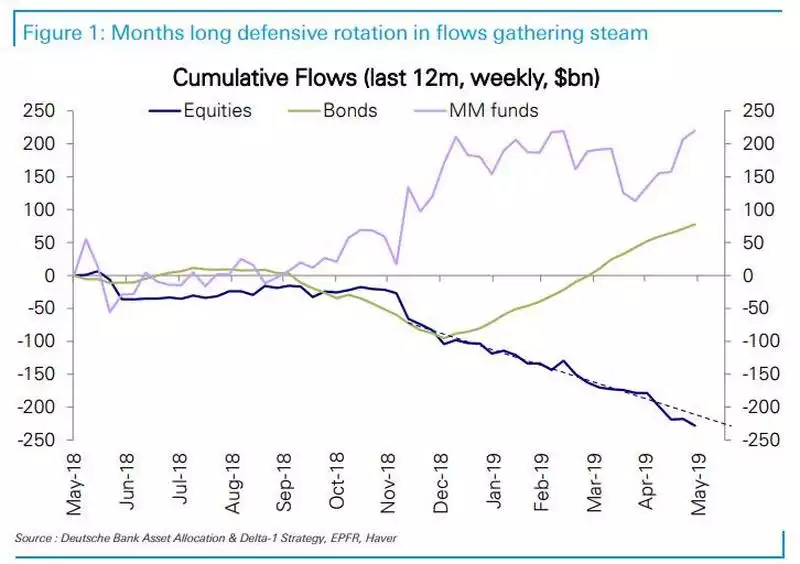

The disconnect observed this year in the US sharemarket between price of shares rising against bonds yields falling and general economic data worsening had many perplexed. Since the big sell off late last year shares jumped back up to new highs in the following early months of 2019 in complete contradiction. Deutsche Bank plot the exodus of institutional funds from equities and the corresponding pivot into money-markets and bonds. So clearly the institutional money wasn’t ‘buying’ the rally with funds flowing out at a great rate. That leaves mums and dads and of course corporate buybacks to prop it up.

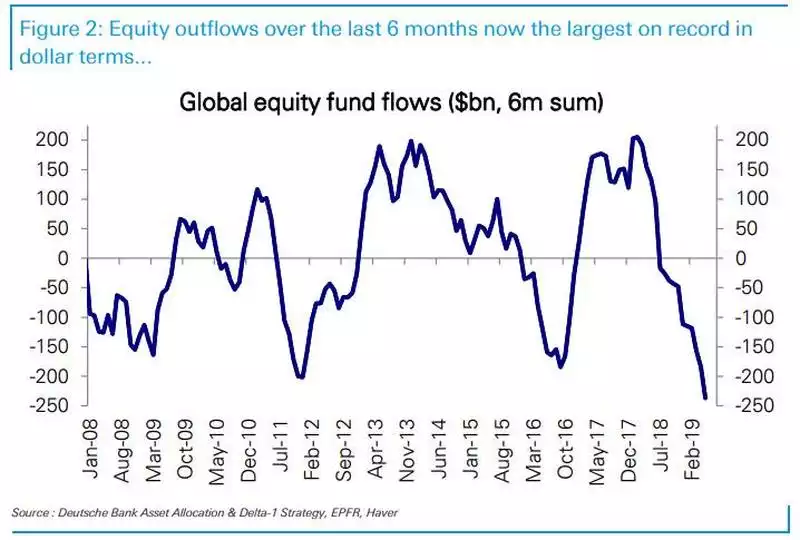

Indeed that exodus was the largest 6 months on record across the globe by value:

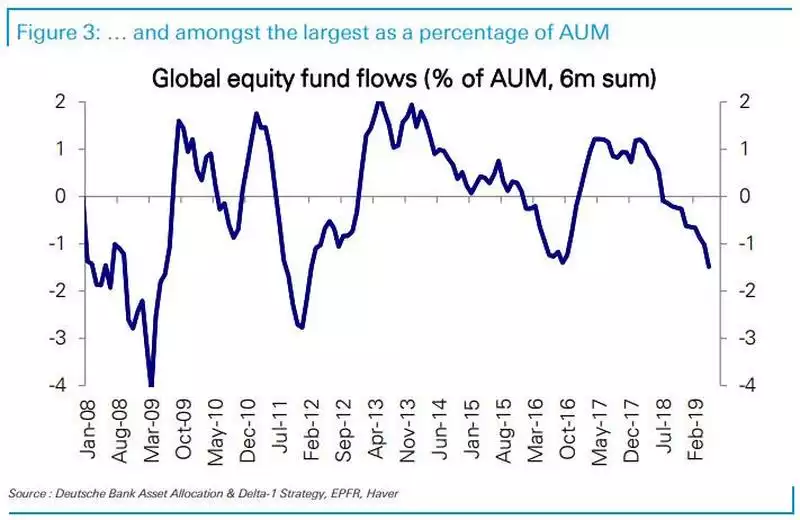

…and by percentage of total assets under management only ever beaten by the GFC rout:

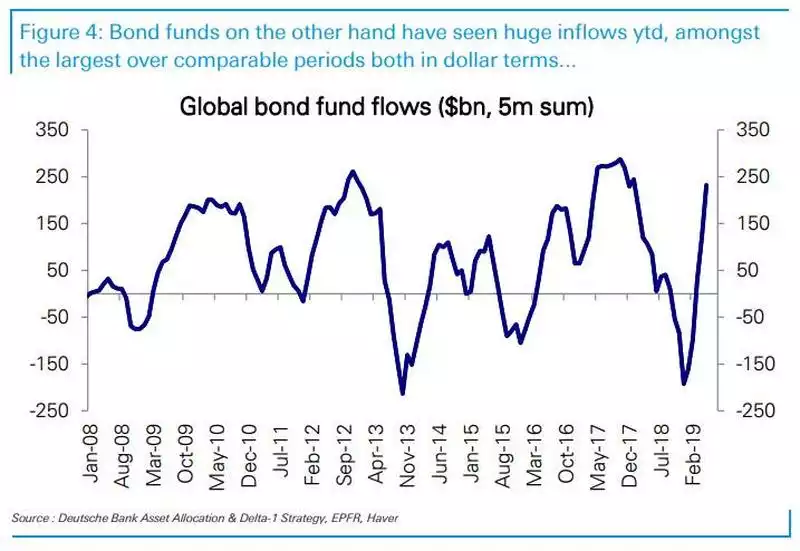

The chart below shows the extent of flows into bonds, again amongst the largest on record:

However last month the S&P500 saw its worst May in decades as the exodus spread. Interestingly May has also seen an exodus from High Yield bonds (those corporate bonds we keep banging on about) just as we saw before the big sell off last year.

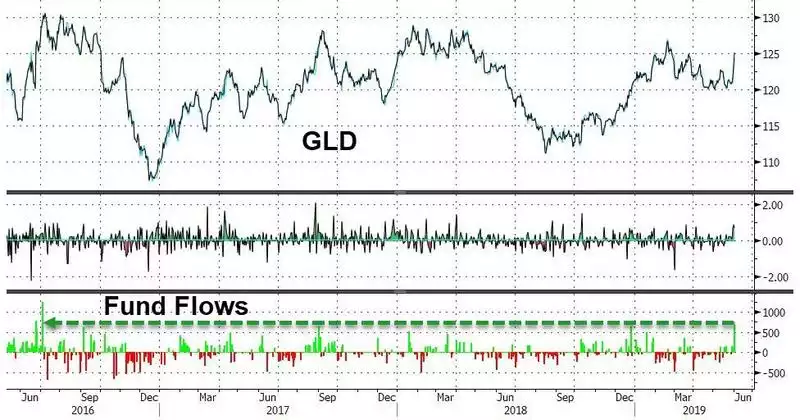

May is also notable for gold rising from US$1280 to US$1326 as we write this. As you can see from the chart below for the world’s largest gold ETF, GLD, this week saw the biggest single day inflow since Brexit…

You will note the inflows that occurred during the sharemarket correction late last year as well.

It appears the smart money is in the process of leaving financial market for the traditional safe havens amid growing evidence of an imminent recession.

Lance Roberts of Real Investment Advice lists just a few of these warnings in his latest article:

- The “debt ceiling” will return with a vengeance given the deeply divided Congress as the 2019 Government budget ends. There is a risk of another Government shutdown looming.

- Earnings estimates for 2019 fell sharply as I previously stated and 2020 estimates are now on the decline.

- Stock market targets for 2019 are too high along with 2020.

- Rising geopolitical tensions between India, Pakistan, Russia, China, Iran, etc.

- The effect of the tax cut legislation has disappeared as year-over-year comparisons are reverting back to normalized growth rates.

- Economic growth is slowing.

- Chinese economic data has weakened further.

- European growth, already weak, continues to weaken and most of the EU will likely be in recession in the next 2-quarters.

- Valuations remain at expensive levels.

- Asset prices remain well deviated above long-term trend lines.

- Long-term technical signals remain negative.

- Trade wars with both China and Mexico are weighing on consumers, exports (which make up 40-50% of corporate profits,) and economic growth.

- Rising loan delinquency rates.

- Auto sales are signalling economic stress.

- Housing continues to weaken despite low interest rates.

- The yield curve is sending a clear message that something is wrong with the economy.

- Clear stress on the consumption side of the equation from a sharp slow down in retail sales and personal consumption.