Silver Surges on “not recession” recession

News

|

Posted 29/07/2022

|

9750

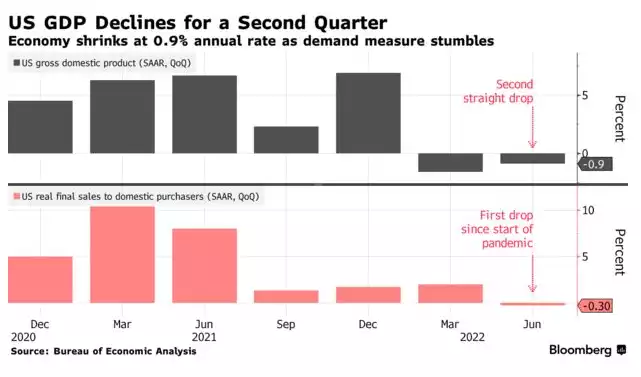

Apparently a recession is no longer the quantitative measure of two consecutive quarters of negative GDP growth as the US just printed last night with a -0.9% GDP print for Q2 (after the -1.6% print for Q1). No, apparently it can be the qualitative measure of ‘the vibe’ from a group of academics at the National Bureau of Economic Research. ‘Nothing to see here, please move along’….

The 0.9% drop was despite a 0.4% increase expected and, the biggest contributor of consumer spending, rising 1.2% which disappointed at 1%, itself also a decline on Q1.

The market yet again did it’s ‘bad news is good news’ and bought the recession. Again, everything was green barring the USD as surely, surely this means the Fed will pivot soon and we get our free money again?

And again, just like yesterday, the precious metals rallied in unison. BUT, this time we saw a massive rally in silver in comparison.

Silver investors will know all too well the little brother to gold has languished awfully against the benchmark these past months. This week, at 94, we saw the Gold Silver Ratio (GSR) rise to a level not seen since the 1990s recession if one removes that anomalous yet incredible spike to 121 we saw during COVID. In that event gold front ran super strongly as shares crashed amid the panic. But as normally happens in a metals bull run, silver, which has probably just painted a lower low, slingshots past gold to inevitably paint a higher high. Welcome to the more volatile ride that is the smaller market of silver. However, if you play that GSR and buy those lower lows and swap to gold at the higher highs, it becomes a MUCH more profitable trade. For instance in that COVID run we saw gold rally above US$2038, up 38%, compared to silver which rose 135% to nearly US$30 as the GSR plummeted from 123 to 63.

Last night silver performed over 3 times better than gold and we saw the GSR fall to 87.6 at the time of writing. 87.6 is still sky high and if you believe in nothing else in this economic mess other than reversion of the mean, it’s an extremely compelling case. But let’s look beyond that to possible timing..

If you like technical analysis and charts, check this out for a cup and handle formation (before last night):

Combing TA with GSR we get the following which was posted by Badcharts BEFORE last night and at 87, would see Step 2 in play. Liftoff?

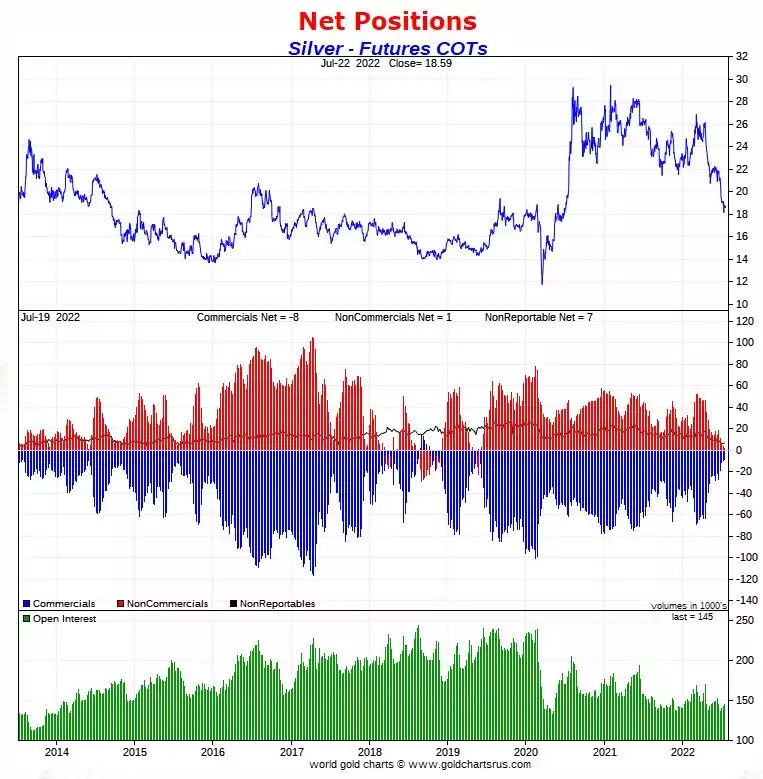

Some see causation not effect in the COMEX future markets. So how is that going? The chart below, which importantly takes data cut off from last Tuesday and so will, with the price action since then (before last night) almost certainly be even more compelling, shows an amazingly bullish set up for silver.

From analyst Ed Steer – “the gross short position of the Managed Money traders [50,452 contracts] is now much larger than the gross short positions of either the Producer/Merchant...28,061 contracts...or the Swap/Dealers...35,676 contracts...in the Commercial category.

Like last week -- and the week before, I've run out of adjectives to describe just how off-the-charts white-hot bullish the current set-up is in the COMEX futures market for silver.”

Remember too that the likes of JP Morgan may be far more reluctant to play their games with silver futures now they have been convicted…

Bigger picture too is that silver is a key component of green energy infrastructure and technology industrial demand. Half of silver is used in industry. What do governments do every recession? They unleash debt funded fiscal stimulus and the funded projects de jour of course are green energy. More debt, currency debasement and industrial demand speaks doubly to silvers monetary asset and industrial metal dual proposition.

Keep a close eye on silver from here. Remember too you can let the ‘math do the work’ and buy the GSR bundle on CoinSpot using our Gold Standard and Silver Standard 100% bullion backed tokens which you can learn more about here - https://www.coinspot.com.au/bundle/goldsilver-ratio-bun

Alternatively Ainslie has the full range of silver products including our brand new, stunning 10oz and 1oz minted silver bars and of course there are still a couple of days remaining on our Perth Mint 1oz 2022 Kangaroo Silver coin sale for July.

We have plenty of bullion stock and the best prices in Australia!