Silver Supply Demand Fundamentals

News

|

Posted 02/12/2021

|

7057

Silver remains in a long term structural supply-demand deficit with an expected silver mine deficit of 461 million ounces in 2021. With the total physical demand for the year to come in at 1290 million oz and global mine production flagged for 829 million, fundamentals point to a supply crunch.

For the most part, silver supply doesn’t actually come from silver mines. It’s estimated that only roughly 20% of all silver production comes from “silver mines”, with the balance coming as a by-product from copper, lead, gold, zinc, nickel mines. Primary silver producers over the last ten years have either folded or shifted their strategy towards mining both gold and silver. Case in point is the former Silver Wheaton rebranding to Wheaton Precious Metals in 2017. Even First Majestic Silver with the synonymous ticker “AG” on the NYSE derives more than 30% of its revenue from gold production.

With lengthy approvals processes often taking mining projects more than 10 years to go from application to first pour, higher prices are unlikely to be met with a flood of new supply. Even the existing supply from operating mines is increasingly coming under threat. Incoming governments often take aim at the mining sector, a recent example is Fortuna Silver whose stock tanked 25% in a day, after a ten-year environmental permit wasn’t extended. While they have managed to continue operations under an appeal, that mine alone is worth 6.2 million ounces of silver a year.

When supply shortages hit and futures contracts are being paid out in cash rather than metal, the only source of additional metal is going to be silver stackers. Holders of silver accumulate on lower prices, and, if anything, are even less likely to sell when prices are moving higher.

With the Fed now letting the term ‘transitory’ go, as discussed yesterday, investors are now increasingly questioning ‘fiat’ as a safe haven. Testament to this is the entrance of the word ‘fiat’ into the popular vernacular. Speaking with CNBC on Tuesday, Bridgewater Associates’ Ray Dalio cautioned against cash, stating, "Cash is not a safe investment…because it will be taxed by inflation". Rather, Dalio argues that a well-balanced portfolio with rotations of wealth is the key to long-term success.

With bonds providing ‘return-free risk’, equities selling off and cash decaying in bank accounts world-wide, Silver has managed to slide back down into the low 20s USD after it’s run in the first half of November came to an end. In times of distress with the Fed warning “The threat of persistently high inflation has grown”, investors are increasingly looking to hard assets that cannot be controlled by centralised authorities.

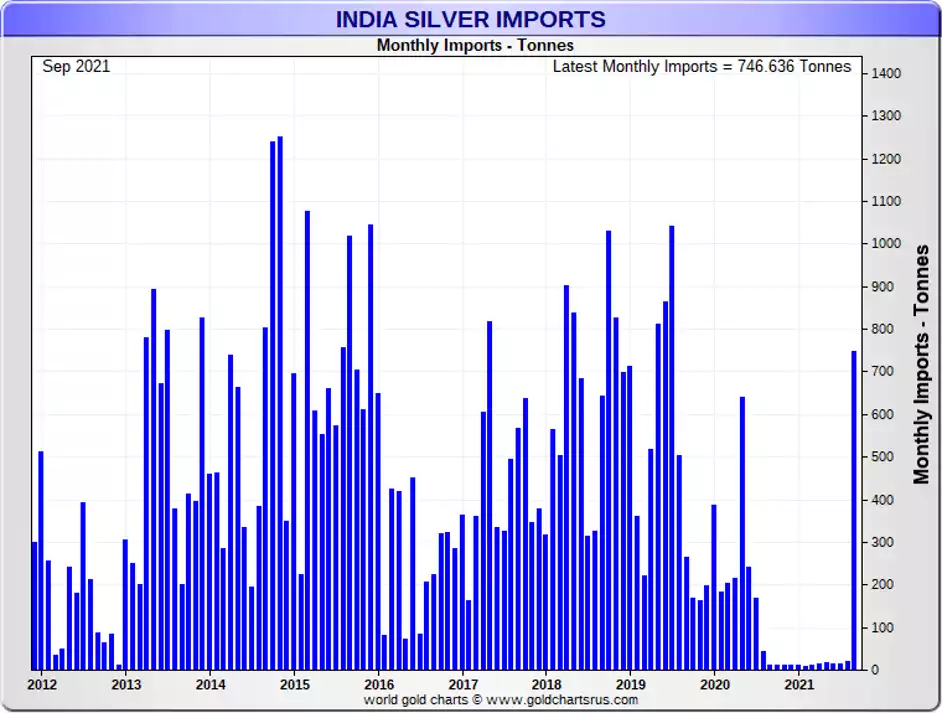

From a demand point of view, India had gone AWOL on silver imports from mid last year in the aftermath of COVID lockdowns. Well look who just stepped back up to the plate with a whopping 747 tonne of silver imported in September alone and intel suggesting October was similar!

Technicals also look bullish for silver, with current price trending towards support at the bottom of a horizontal channel. After a major step up from the March 2020 lows, silver looks to be consolidating and building up energy for the next leg up.

And in the words of a young customer yesterday, silver at these levels appears “juicy”.