Silver & Ripple v Gold & Bitcoin

News

|

Posted 16/05/2019

|

8864

Observing both the bullion and crypto markets at present, one can’t help but note the similarities between silver and Ripple (XRP) compared to gold and Bitcoin (BTC).

Gold and Bitcoin are principally monetary in their roles. They are a store of value and means of exchange without counterparty risk. Silver and Ripple share those properties but with the dual role of utility use as well. Half of all the silver produced is actually used in industry. Many of those industries are at a point in time of future expansion, be it electronics, PE or solar. Ripple too is principally around its utility as the fuel for what promises to be the most disruptive, high speed, low cost alternative to the 40 year old SWIFT international monetary transfer network. We last explained Ripple here.

The other similarity, love it or loathe it, is silver and Ripple’s volatility compared to gold and Bitcoin.

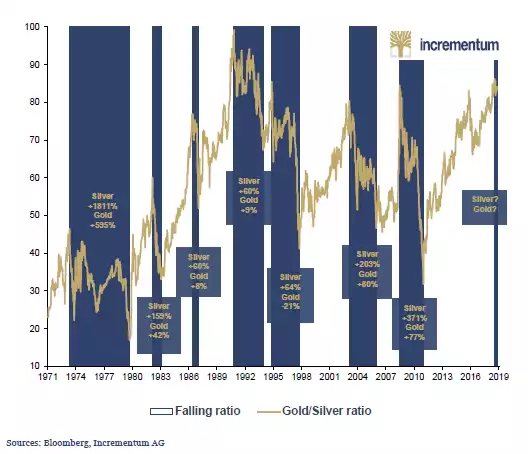

Whilst gold and silver generally track each other in price, silver routinely puts in higher highs and lower lows at the extremes. That amplification is measured in the Gold:Silver Ratio. Holders of silver now are painfully aware that that ratio is historically sky high at 87.5 against a century long average around 45. As you can see from the chart below, historically when such heights are reached there is a reversion and a sharp rise in the silver price in particular. That normally sees gold starting to rally first and then silver sling-shotting past it as the GSR drops. This year we have seen gold increase by 2% (after a strong finish to 2018) whilst silver has fallen 4%. However gold is on the increase and the GSR is still sky high. What’s painful for existing holders is simply tantalising for many new entries or ‘averagers’.

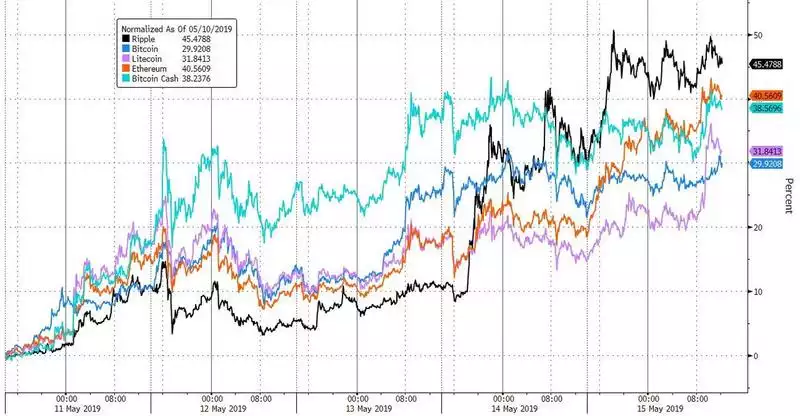

We’ve seen similar action in crypto markets where Bitcoin leads a rally and then Ripple shoots past it. We’ve seen that in just the last 5 days where the headline grabbing Bitcoin is up 30% and initially left Ripple behind until Ripple swept passed it and is now up 45% in just 5 days, outperforming the other ‘big 5’.

That said, XRP has shown over time to be one of the least correlated to other major crypto assets meaning it adds a level of diversification to a portfolio as well.

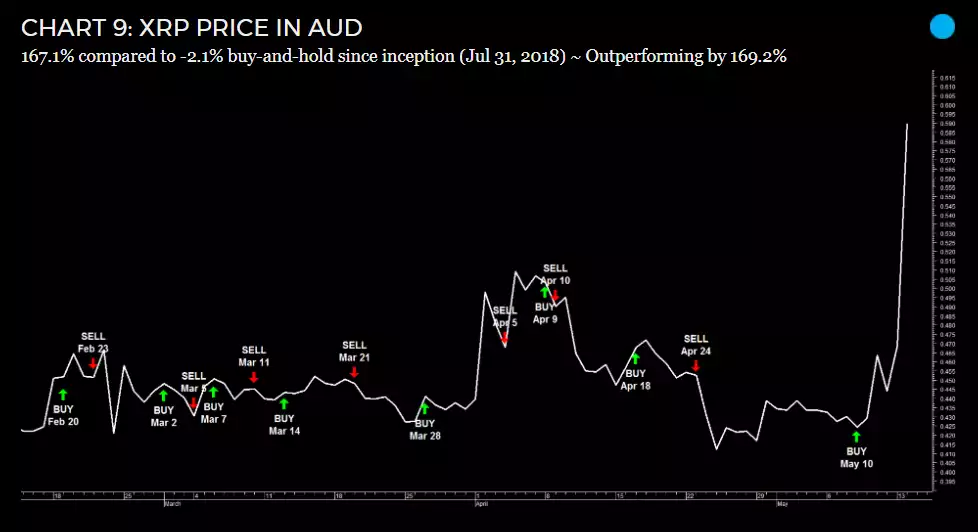

In terms of what our Ainslie Intelligence AI Trading Signals (which nailed the buy before this rally) is currently saying, it still seems to be a BUY. Subscribers will know more at 2pm today.

For some final further context (all in AUD). When silver, currently $21, saw its last ‘bottom’ in the GSR (around 30) the price peaked at close to $50 in 2011. Ripple peaked around $4.50 in January last year. Even after this rally it is still only $0.67 at the time of writing…. As we said earlier… Lower lows and higher highs. The discipline and reward is in buying those lows and taking profits at those higher highs. Many missed it in January last year, they were emotionally caught up in the hype. Using our Ainslie Intelligence AI Trading Signals and some still clear memories of how it feels not to have done so, should surely see buying these still relative lows, and more prudent profit taking next time we see those big highs again.