Silver Price Below Cost

News

|

Posted 23/05/2019

|

7443

After yesterday looking at the gold:silver ratio and Russell3000:Silver ratio, today we briefly highlight another compelling part of the silver story.

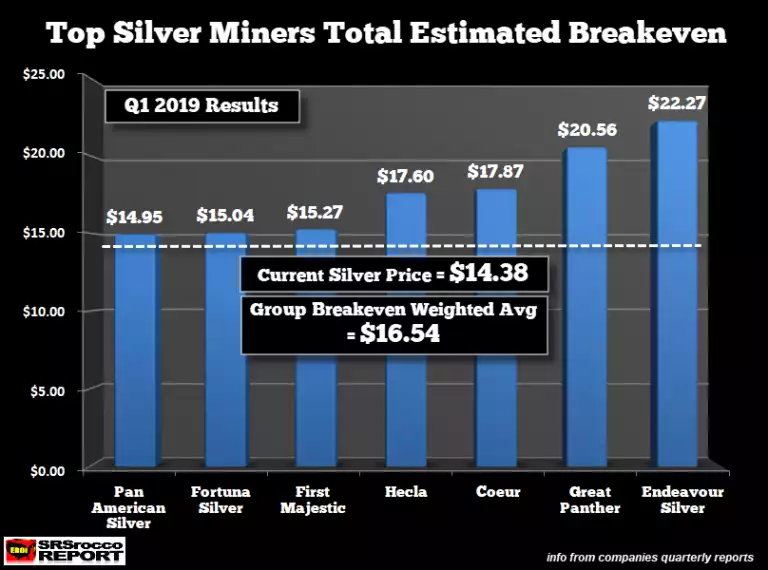

The SRSRocco Report looked at the average breakeven price for the top primary silver producers from the first quarter of this year. As you will note on the chart below, that was $16.54 by weighted average across the 7 companies listed. At the time of the report the silver price was $14.38 ($14.46 at the time of writing this article). So in other words these companies on average are losing over $2 per oz.

A large contributing factor is the price of oil. The chart below shows that since 27 February when silver started to fall this year, to be 10% lower as we speak, the price of oil went up 11%. Now over halfway through Q2, this doesn’t bode well for the Q2 results getting any better unless we see a solid rebound in the silver price.

Now there are some caveats in simply interpreting this data. Firstly that list of companies excludes the biggest primary producer (Fresnillo) as it doesn’t report quarterly. Also, only around 40% of the world’s silver production comes from primary producers. 60% of silver mine supply is as a by-product of copper, zinc and lead mining. However as they note, when we do enter this recession or the trade wars do see material reductions in base metal usage, you will see mines cut back base metal production and with that the silver by-product as well. That this reduction in secondary silver production may coincide with increased demand for its monetary/precious metal properties, could be further tailwinds on the price.