Silver – Poor Man’s Gold in Short Supply

News

|

Posted 14/03/2016

|

6082

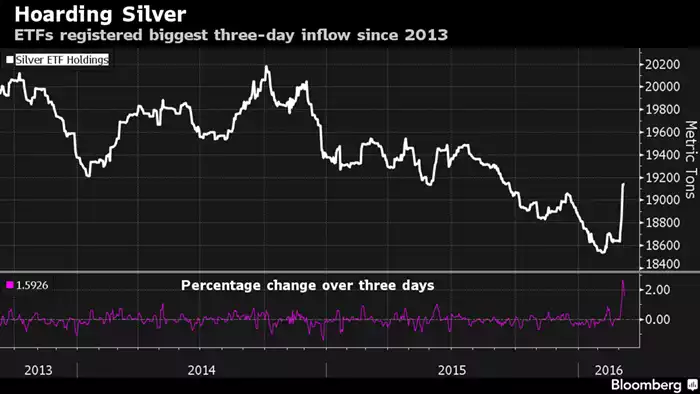

You may have read the article on Bloomberg titled “Why Poor Man's Gold May Be About to Get More Investor Love”. It was largely pointing to the gold : silver ratio (as we reported recently), falling supply, and the recent record inflows into silver ETF’s as investment demand surges (see below).

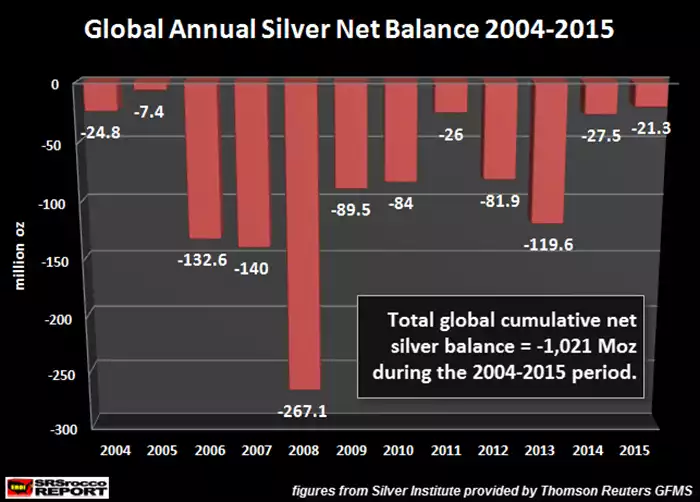

However the article included a statement by CPM group’s Jeffrey Christian that they had ‘mixed minds’ about silver based on his assertion that silver was in oversupply. But for some strange reason CPM do not include investment demand in their demand calcs. If you take the GFMS Team (Thomson Reuters), who include investment demand, numbers you get a very different outcome. Christian also talks of concerns about industrial demand for silver in a sick global economy but this ignores the main uses of solar, electronics and medical that tend to be less sensitive to such growth slow downs and indeed the relative size of growing investment demand overcoming any decline.

The Bloomberg report is otherwise bullish on silver’s prospects, and the above clarification removes the rubbish from CPM out of the equation. This again reaffirms why many are calling silver the most undervalued asset in the world right now. Tomorrow we will discuss the effects of just a small percentage of the investment world moving to it….