Silver Demand Surge

News

|

Posted 27/01/2016

|

4152

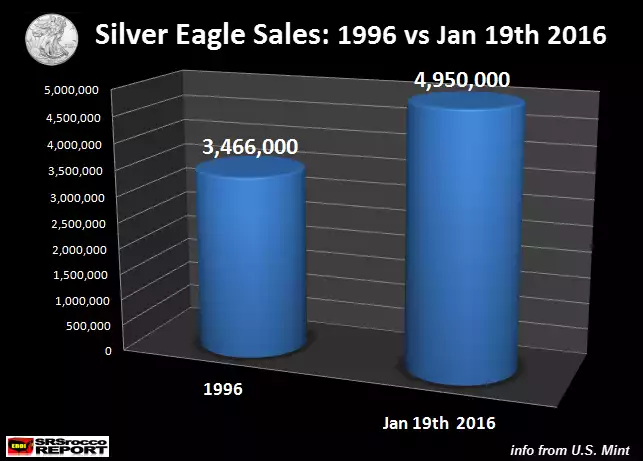

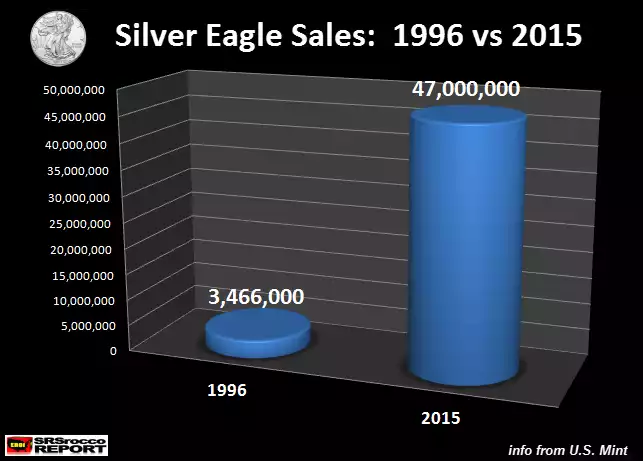

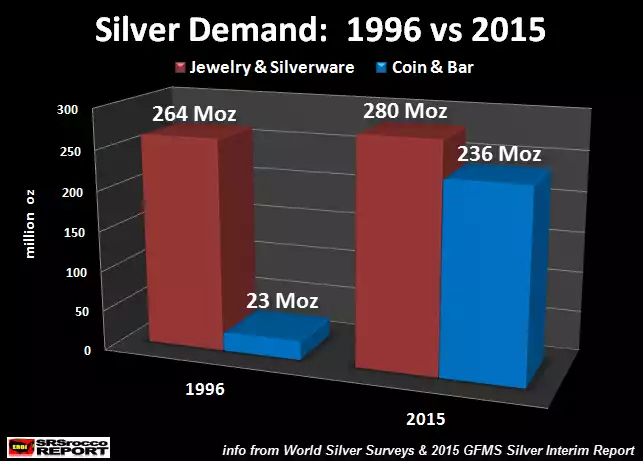

Chinese stocks plunged another 6.4% yesterday, their lowest level in 13 months. It will be interesting to see what happens here today after US shares surged on the back of more desperate liquidity injections by China (biggest one day ever!). At the same time gold and silver continue to rise albeit less so silver and remain one of the very few assets appreciating this year. What is very interesting is that despite the silver price being up, 7.28 million oz have been withdrawn from the biggest ETF SLV – by rights a rising price should see rising (not falling) stocks supporting the paper promises. Where is it going? Also US Silver Eagles sales, which already saw a record 47m sold last year continue to sell heavily with 5m in just the first couple of weeks this year. Indeed there are more Silver Eagles sold than the US mines. What makes this more amazing is that retail sales in the US are apparently only modest. COMEX analyst Ted Butler says he has proven that JP Morgan, the US’s biggest bank, has amassed 400m oz of physical silver. He believes they are the big buyer that keeps cleaning out the US Mint of Silver Eagles. He goes on to point out that they are also one of the biggest short sellers of silver futures on COMEX. i.e. short paper trades to lower the price and scoop up 400m oz of physical silver at a bargain. The big question is when will they ‘let her go’ and how much longer will this epic buying opportunity last?

SRSRocco released these 3 interesting graphs that put the current buying in context when compared with 20 years ago.