Gold Focus 2021 Report & ‘Peak Gold’

News

|

Posted 24/06/2021

|

7320

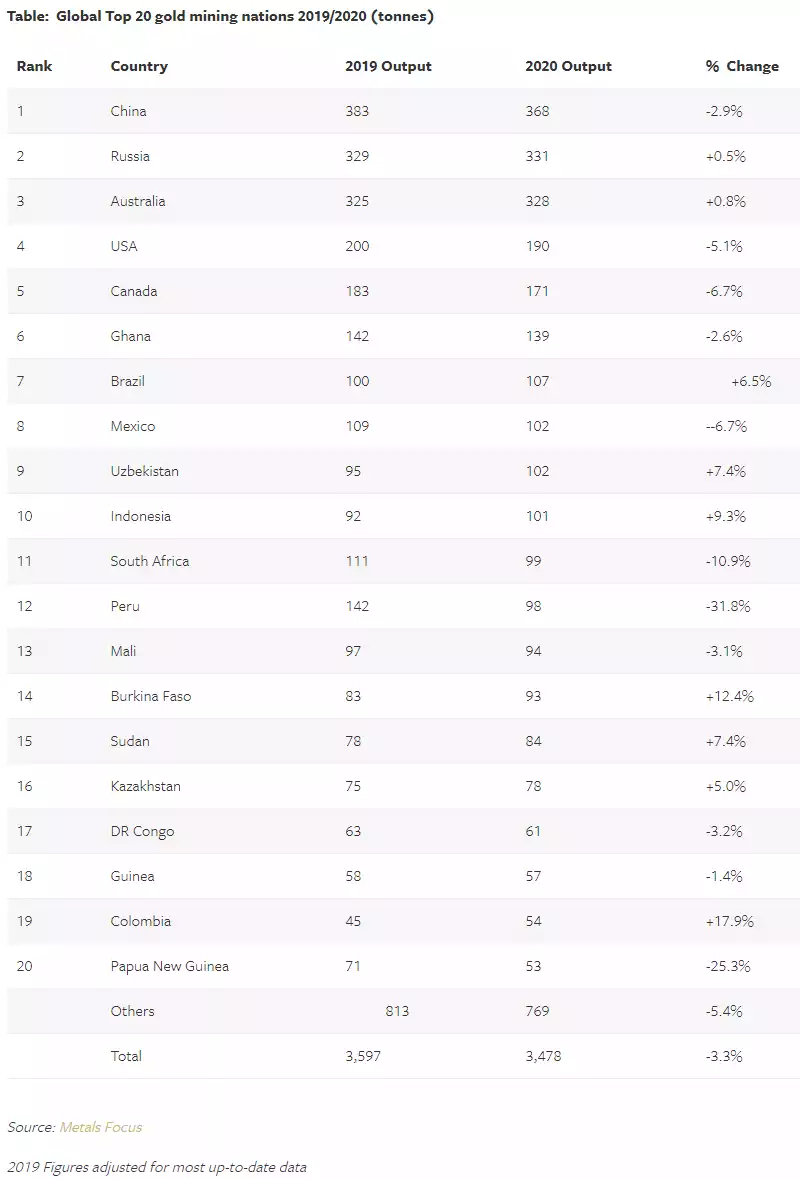

We recently saw the release of the annual Gold Focus report from the independent precious metals focussed consultancy Metals Focus of London. Not surprisingly, given COVID disruptions, global gold mine production saw the biggest year on year decline since they started the report in 2010. Production fell by 119 tonne (3%) to 3,478 tonne. Today we look at where this came from and look forward to changes in the supply dynamic.

You will see in the first table below that Australia is neck and neck with Russia but maintained its 3rd ranking in production. From a regional Australasian perspective, including PNG, we should see a pick up this year. Lawrence Williams explains:

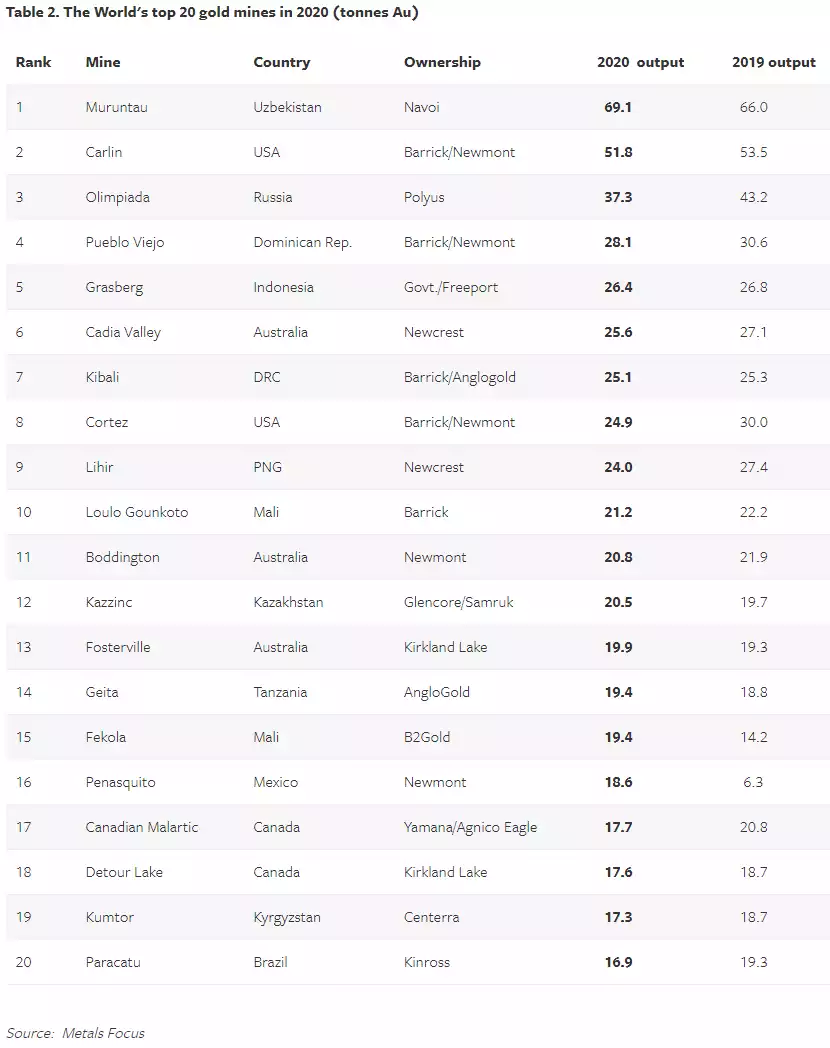

“Australasia also recorded an overall output fall but this was almost all entirely due to a substantial fall in Papua New Guinea due mainly to the shutdown of the big Porgera mine in a dispute between the government and the mine owners (Barrick and Zijin Mining). A tentative settlement of the dispute has been arrived at with PNG receiving a bigger stake in the operation and Barrick is working to reopen the mine (which at peak can produce a little under 20 tonnes of gold annually) later this year.”

Williams goes on to talk about the forecast for 2021 and of course the ‘peak gold’ question that always lurks given the lack of new discoveries.

“For the current year, Metals Focus sees a rebound in global gold production of around 6% to a new record of 3,693 tonnes, thus reversing the declines seen in the two prior years. The rise will largely come about due to the vast majority of mines operating at full capacity again, plus some new mines coming on stream during the year. ASM [artisanal and small-scale mining] production will also likely increase due to higher gold prices and the easing of COVID-related restrictions in some countries. We think, though, that this may be an overoptimistic forecast. We do see a likely rise in global gold production, but quite possibly not by as much.

Re. the elusive peak gold scenario, while a serious lack of gold exploration has led to a reduction in major gold discoveries, the gold growth baton has to be taken up by the development of medium and small sized gold projects mostly in countries like Australia, Russia, Canada etc. and perhaps in central and south America and Africa (which remains comparatively unexplored and undeveloped. There is a distinct lack of major new gold mining operations on the development horizon, and any which may yet be found could take upwards of 10 years to finance, permit and bring into production.

All that the industry can hope for is that these small and medium sized new mine developments prove to be sufficient to stave off global production falls from declining grades and closures of existing gold mines, but we fear this will be a losing battle despite higher gold prices, which could help see some marginal operations stay afloat. Global gold production therefore looks to have, at best, plateaued. Annual world production may therefore remain stable, or rise or fall by a couple of percentage points for another couple of years. Beyond that global gold output looks likely to be in continuing decline unless there is a major increase in the price of gold – and even then it may well come too late to stimulate any kind of significant global gold production. That is what peak gold is really about!”

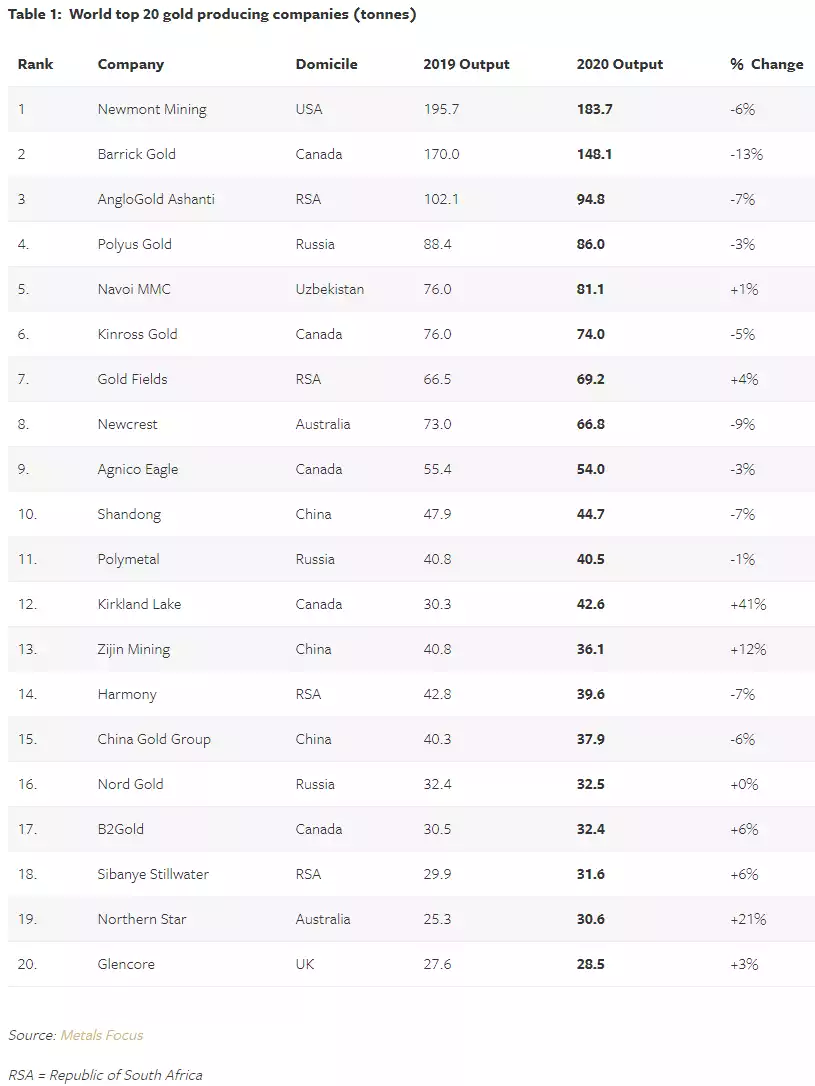

And so for the curious, the following tables show (for both 2019 and 2020) the Global Top 20 gold mining nations, World top 20 gold producing companies, and World's top 20 gold mines.