Silver Buy Signal Impossible to Ignore

News

|

Posted 22/05/2019

|

7397

Silver is testing the patience of many an investor at the moment. If you bought at the turn of the century when both gold and silver commenced their decade long bull market you’d still be sitting on one of the best investment performers of that period. However if you got caught up in the hype of 2011 and didn’t sell, you may well be kicking yourself regardless as it lost nearly half its value in 2013. If you bought amongst the hype you are sitting on losses and a market that has bounced along the bottom since that 2013 plunge.

The dynamics of that journey are clearly on display right now in a number of indices but none more than the Gold:Silver Ratio (GSR). On Monday (20May) that ratio hit a high of 88.8, a level not seen since 1991, and before that 1941. In other words it’s almost unprecedented. Let’s look at the chart below for the last 20 years:

When the precious metals rally started in 2003 (and in earnest in 2005) silver was trading around $4.70/oz. It hit a high of $18.80 in July 2008 during the GFC. The subsequent liquidity squeeze when ‘everything’ was sold to cover margin calls etc during the sharemarket and property crash saw silver drop to $10.32 before recovering to around $19 by the end of the GFC (whilst shares were still down 50%+ and US property decimated). It took a bigger hit in that liquidity squeeze relative to gold as you can see in the GSR spiking to 80 (and even close to the current 88 intra-day) in late 2008. From that spike however, the GSR proceeded to plunge to just 32 in April 2011 when the silver price hit around $45. If you had been a follower of the GSR you may well have sold down some or all of your holdings and made 860% on your 2003 purchase when the GSR hit 80 or 450% on your November 2008 purchase when it also hit 80.

Since that GSR low of 32 we are now at 88.4 and silver at just $14.45 at the time of writing. Again, a GSR level not seen in the last 28 years and a price near 10 year lows. All of the above is in USD and our softening AUD has seen better gains that the USD for Aussies, but the GSR trend is the point of this article and the AUD GSR is of course identical to the USD GSR.

So what are the takeaways?

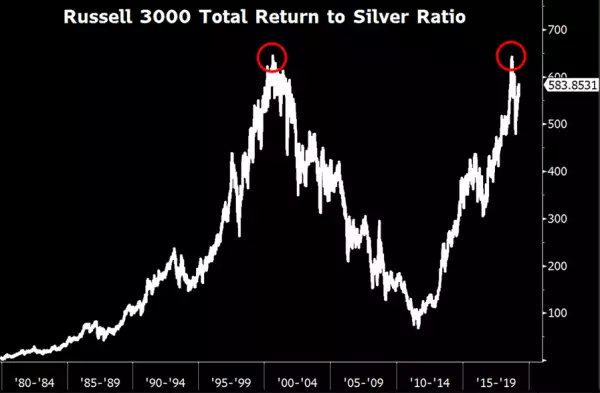

If you are a long term holder of silver and feeling somewhat despondent, take solace in history and math. Everything cyclical reverts to the mean. Remember too why you probably bought silver in the first place; as an uncorrelated asset to financial markets. Those financial markets are near all time highs but looking decidedly near the end of their run. The following chart from Crescat is a good reminder. Using the Russell 3000 (smaller cap shares in the US removing the gravity of the FAANGs) against the silver price, it is screaming sell high, buy low.

If you are considering buying silver for the first time or heavily weighted to gold and looking to ‘play’ the GSR by swapping gold for silver you are presented with what looks to be a very rare opportunity to buy an historically undervalued hard asset at the same time you are looking at historically overvalued financial assets or (in AUD terms) gold near all time highs courtesy of our softer AUD.

Ainslie make it easy to swap gold for silver if you are looking to play that ratio whilst still remaining in precious metals at a time when that is looking more and more prudent.