Shares v Safe Havens – Turning Point?

News

|

Posted 06/04/2017

|

4654

Last night we saw US shares rally on good jobs data and then fall on the Fed meeting minutes to close down to the day whilst gold rallied. (As usual we will discuss in Friday’s Weekly Wrap podcast).

Why? Well the Fed minutes gave clear indications they thought share prices were “quite high” and warned of "downside risks" to forecasts if "financial markets were to experience a significant correction". Over the last couple of months we have presented many charts showing share valuations on a range of metrics are in nose bleed territory (for example here, here and here).

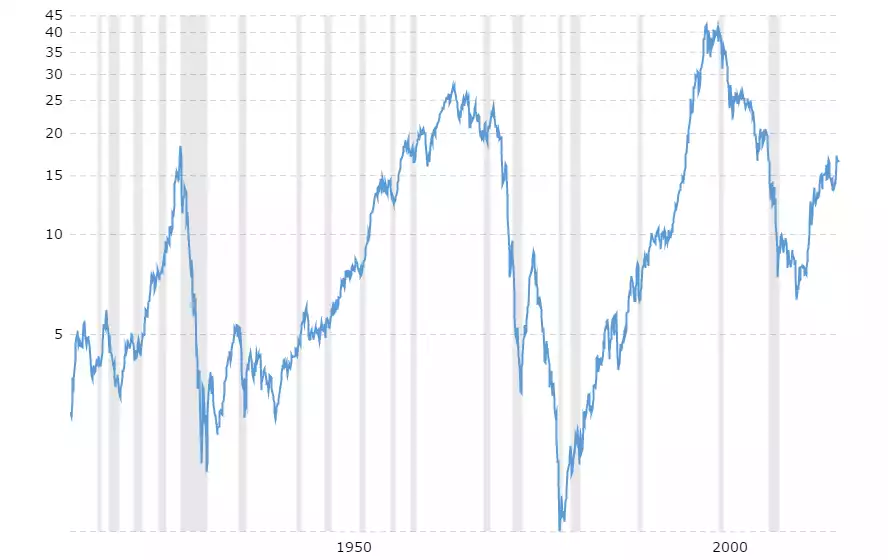

We wrote last year of the dow-gold ratio hitting a new high and here is an update:

You can see it started to turn in the gold rally early to mid last year but then Trump-phoria turned that around. But for how long? Last night was another indication that many are worried ‘not long’.

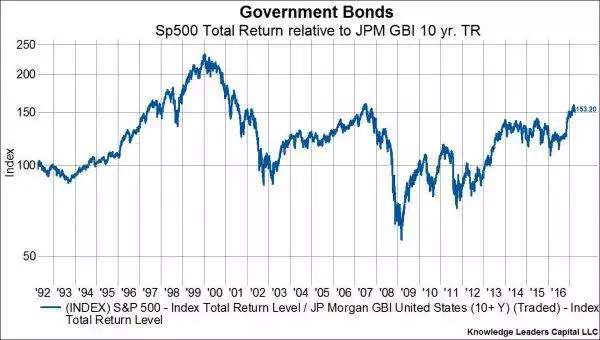

Like gold, bonds are considered a ‘go to’ safe haven investment when investors get nervous. Like gold they slid (and yields rose) on everything being awesome with Trump in power but that has since reversed, just like gold. We find comfort in a debt instrument when the next crisis will almost certainly be caused by too much debt just a little counterintuitive but, hey, that’s what markets do right? Below is a graph again showing a similar picture to gold, this time against the S&P500 not the Dow:

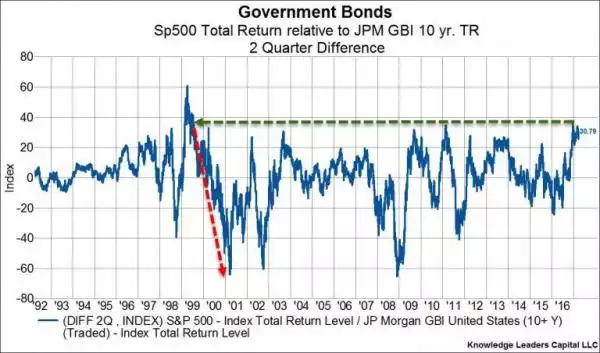

That, according to Gavekal Capital, only tells part of the story and in itself should not be a surprise…just another chart showing shares are very high. What should be concerning is the recent pace of the rise. They break it down over a 2 quarter period and discover the recent pace has only been faster in the lead up to the dot.com crash:

Now getting back to gold v bonds, last night was also notable for the Fed minutes suggesting they will start selling some of their $4+ trillion of US Treasury bonds (that they bought to print money in their QE program) this year. Not surprisingly bond prices came off last night on the news whilst gold rose around $10. One of these two safe havens is a hard asset with no counterparty risk, the other yet another debt instrument that markets take as ‘safe’ because they are issued by a government. We are reminded of a couple of quotes…

Charles De Gaulle - "Betting against gold is the same as betting on governments. He who bets on governments and government money bets against 6,000 years of recorded human history."

George Bernard Shaw - "You have to choose [as a voter] between trusting to the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold."