Shares or Bonds or Gold?

News

|

Posted 29/04/2021

|

6487

Last night the Fed confirmed they have no intention of lifting the monetary stimulus pedal from the metal, dismissing rising inflation as purely ‘transitory’. And so printers will continue to go brrrr and near free money available to go and inflate the debt bubble further to buy over inflated financial assets and houses. Not surprisingly then, the USD sank further and bonds, gold, bitcoin and shares were all up. Yes that’s right, both the safe havens of bonds, gold and bitcoin were up together with shares. The historic lack of correlation between these classes is for now gone. So which is right?

RealInvestmentAdvice.com’s Michael Lebowitz just wrote a piece titled “The Battle Royale: Stocks Versus Bonds (Which Is Right?)”.

“The S&P 500 is at valuations higher than those in 1929 and rival those of 1999. Despite a recession, the index is 25% above where it was trading before the pandemic. The equity stampede is undoubtedly bullish about corporate earnings prospects and, by default, economic growth.

As the stock bulls party, bond investors are glum about future economic prospects. Bond yields are below where they were before the pandemic started. Current yields warn of paltry economic growth and little inflation in the future.”

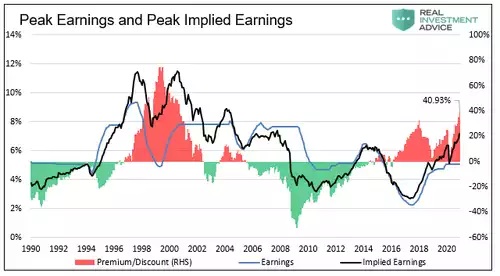

Lebowitz looks back over the last few decades mapping the US market’s actual peak earnings against what market valuations are implying if assuming the numerator or Price in the Price / Earnings ratio is correct (as is the base assumption when buying shares). In reference to the following chart he says:

“Stock investors are betting that earnings growth (blue) will accelerate markedly and reverse the multiple decade-long trends. Such implies that GDP growth rates will also turn up.

It is worth highlighting the cyclicality of earnings forecasting errors, as shown in red and green. Periods in which forecasts were higher than actual earnings are often followed by periods where the market underestimates earnings.

We remind you: Periods in which equities are overpriced with high valuations are followed by periods with lower returns. Conversely, periods when stocks are cheap, are often followed by periods of strong returns.”

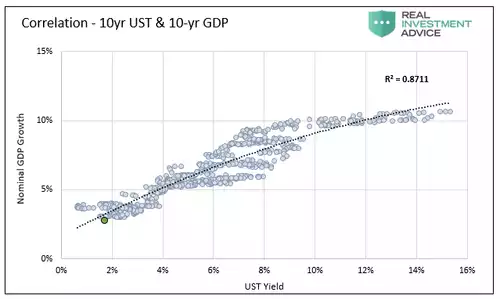

However bonds are telling a very different story. The chart below shows the remarkable correlation between 10 year US Treasury yields and 10 year nominal GDP growth. The green dot, way down in the far left lower corner, is where we are now….

“The bond market currently implies sub 2% GDP growth, well below the current trend. Bond yields expect the decades-long trend lower in GDP growth to continue. By default, bond investors forecast earnings growth will continue to trend downward.”

And so we have US shares implying 7.17% earnings growth over the next decade compared to bonds telling us we have at least a decade of sustained poor sub 2% economic conditions.

Lebowitz points out that the macro environmental realities of demographics, productive capex and growing debt burden support the bond case. The demographics arguments was just boosted by the latest US data showing their population grew at its slowest rate since the 1930s, and prior to that, the late 1700s through a combination of lower birth rates and immigration. On top of this we have the baby boomers leaving the workforce, a double whammy of loss of productivity and need for retirement social welfare. On the debt burden he reminds us:

“More debt doesn’t lead to more robust economic growth rates or prosperity. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the change in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.”

And so, as the Fed’s Powell himself agreed, inflationary forces may well be transitory and the unprecedented wholesale rate of currency debasement and debt accumulation via central bank stimulus is more likely to prevail until the house of cards collapses under that debt or a black swan prick of the bubble.

Whilst Lebowitz uses bonds as the comparison here, the argument is more supportive of gold and silver going forward as the investment to counter these trends. Even the Raoul Pal, who made the hero trade in bonds over this last decade is now saying bonds have little room now to move as they are already near zero bound. Gold and silver by comparison are still coming off recent lows and seemingly have more upside going forward. Bitcoin of course is hardly coming off lows, being the hero trade since the end of the bond bull market, however proponents are still calling big gains from here off this very same thesis.