Sentiment Reversal Bodes Well For Gold & Silver

News

|

Posted 29/08/2018

|

7436

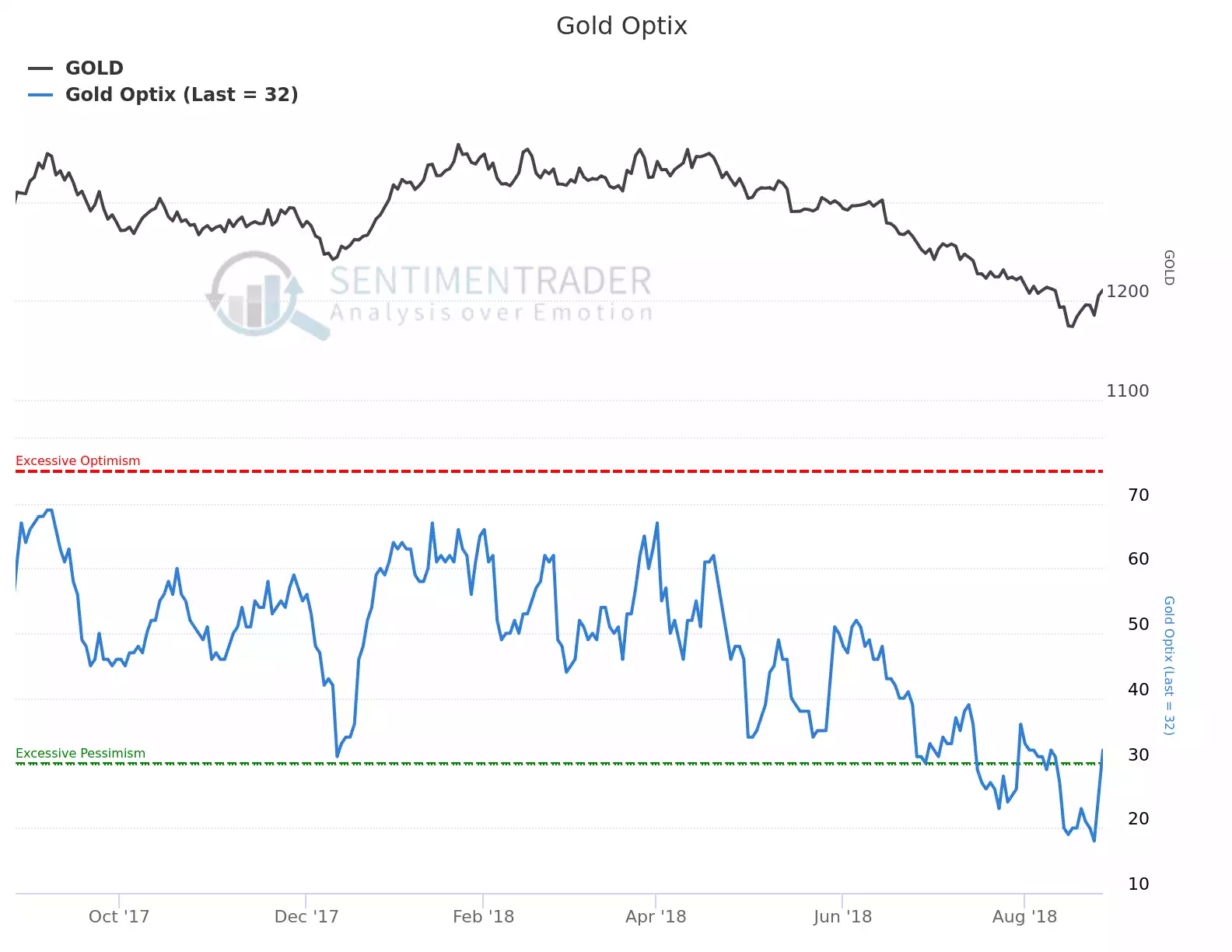

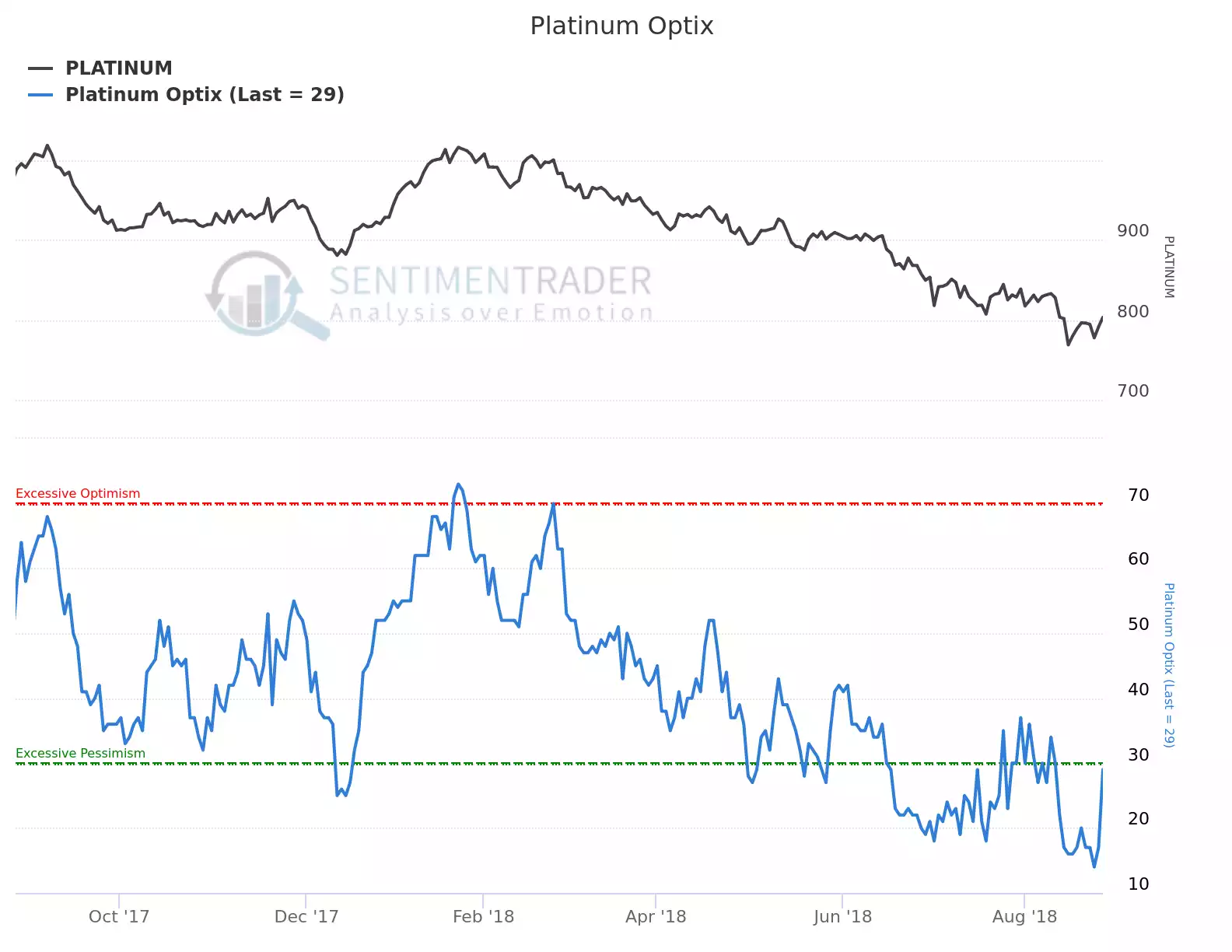

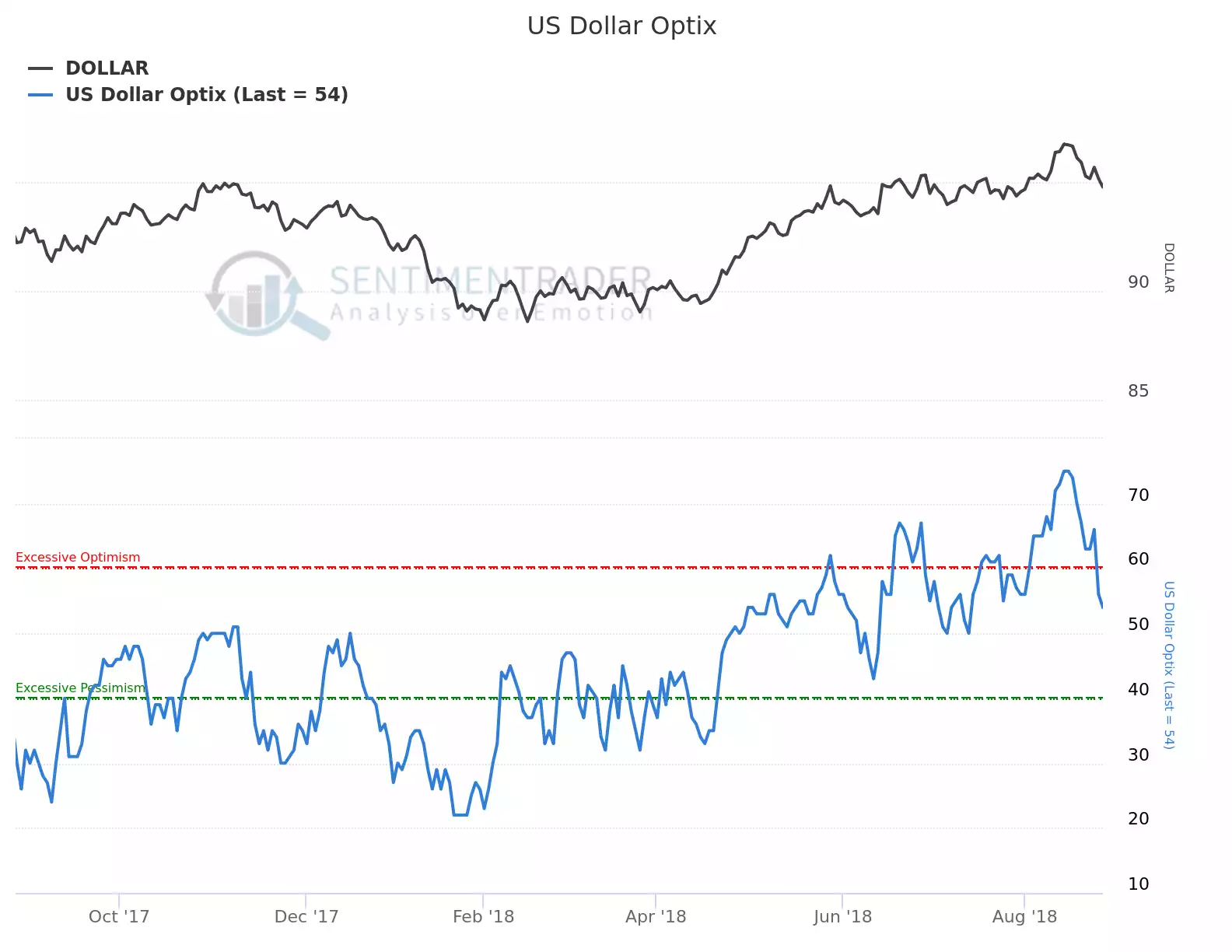

Two weeks ago we shared this article speaking to the historic lows in sentiment in precious metals markets as opposed to historic highs in the US Dollar. We talked about this being a sign of capitulation from which history shows prices usually rebound strongly. So 2 weeks later, how are they looking? The following are the same charts but zoomed in to a 1 year look back. Check out the last article to see the 10 years.

As you can see, we are seeing the anticipated reversal playing out right now. To clearly articulate the historic relevance of this, there have been five similar signals since 1991, leading to a positive return over the next three months four times, with one minor loss. Its risk averaged only -1.8% versus a reward of +5.4% as sentiment continued to recover in the months ahead. The dates were 18/2/1997, 24/12/1997, 20/1/1998, 8/9/1998, and 27/2/2001. Of course that last one was the beginning of the epic ‘noughties’ bull run we spoke of yesterday.

Last night gold and silver yet again saw a decent drop, wiping out a lot of the gains of the last few days. Critically though, gold bounced off the $1200 resistance line. We mentioned in our Monday article that J P Morgan still had some shorts left on COMEX whilst most other Commercials were out. It begs the question, as we come up to the end of month COMEX contract delivery, whether that was their last attempt at spoofing the market down to exit their final shorts and ready to enjoy a bull market with their ‘tanks full’ of physical metal?

Regardless, history is on the side of upside from here.