Same Signal as 70’s and 00’s – Gold Set to Soar

News

|

Posted 17/06/2022

|

7521

Another night of deep red on Wall Street last night and another night of gold and silver price strength in the face of it. Markets were rocked by the surprise rate hike of 50bps by the Swiss National Bank but more particularly the expected sell off of their mountain of US shares, particularly the ultra vulnerable FAANGs they’ve gone heavy on. The NASDAQ ended the session down 4.1%. But it wasn’t the Swiss alone. More broadly we are seeing a set up mirroring the huge gold rallies of the 70’s and 2000’s.

Last night’s session was also rocked by more evidence of an impending recession combined with higher rates. Stagflation. Both housing starts and permits plunged amid the strongest mortgage rate rises since 1987 (down 14.4% and 7% respectively against expectations of 1.8% and 2.5%! – are you listening Aussies?), US initial jobless claims rose again and now back to levels seen at the beginning of the year, and the Philadelphia Fed Business Outlook fell into contraction territory for the first time since COVID lockdowns commenced in 2020 and more importantly the 6 month outlook into contraction (-6.8%) for the first time since the GFC. As we discussed yesterday a recession is looking likely.

All of this, not surprisingly… was a surprise! Indeed the Bloomberg Economic Surprise Index just printed its lowest since July 2019 deep into COVID lockdowns and fallout.

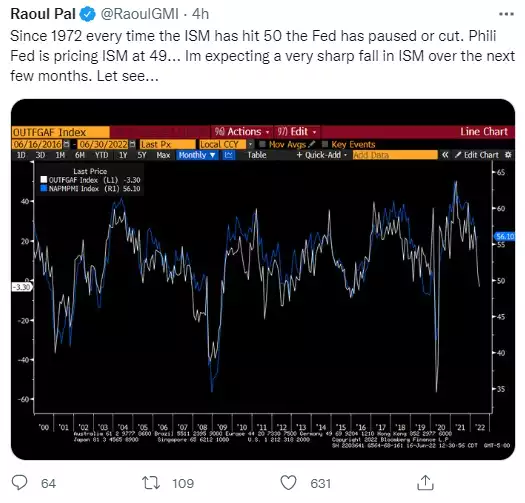

Going back to the Philly Fed print last night, Macro Insiders’ Raoul Pal rightly points out that every time previously this has happened the Fed has reversed course and loosened to save the day. However they are now too publicly committed, too trapped to contain inflation after acting too slowly, that they simply cannot ease off now and look certain to drive the US into recession and cause contagion globally on that and a stronger USD smashing all those USD debtors. If they capitulate and ease, back up the truck for crypto and gold.

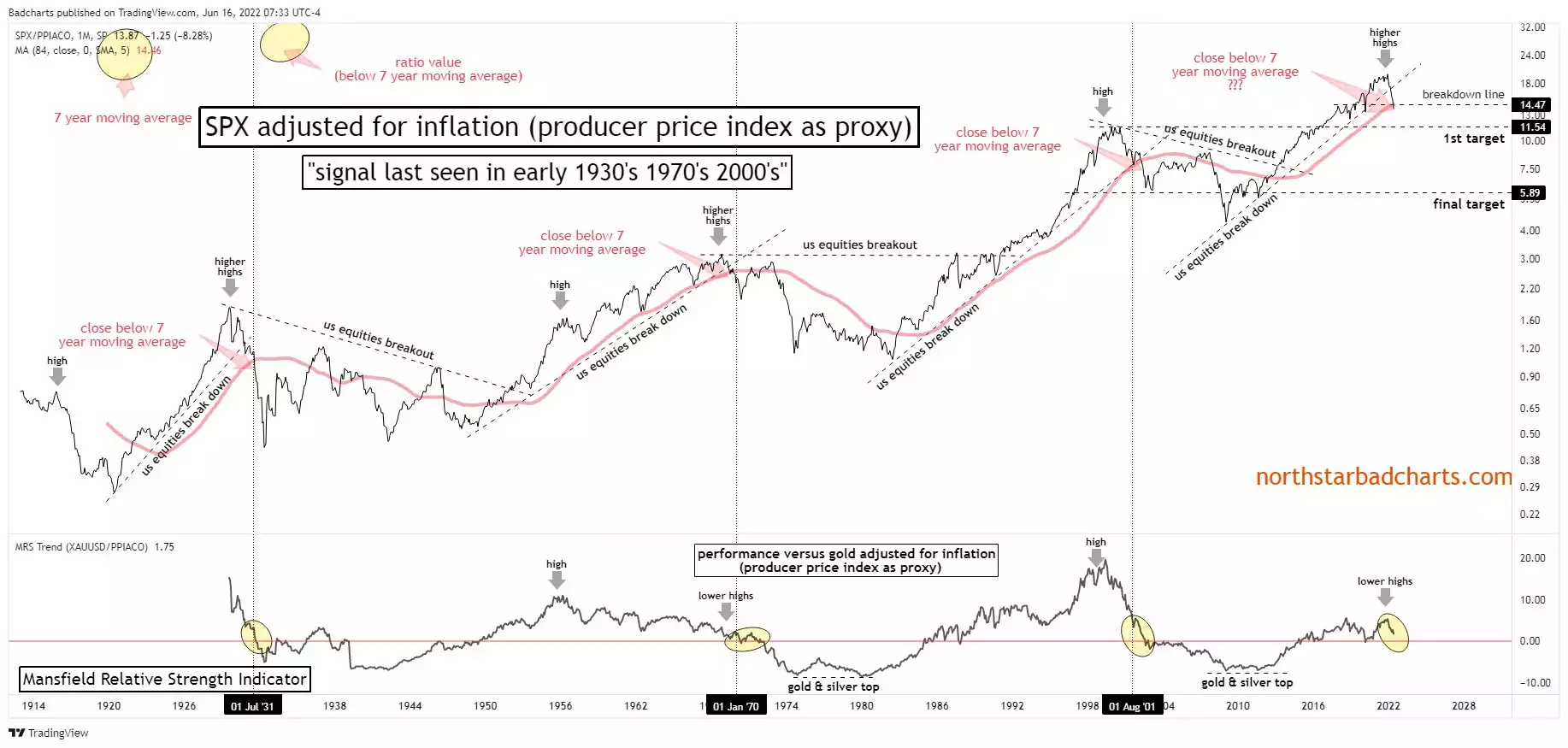

But let’s assume they keep on tightening. We keep reminding you that this stagflation setup, not seen since the 70’s, is historically uber bullish for gold. The chart below maps this very clearly when you see the S&P500 adjusted for inflation and the inflection point we are now at or nearing, starting a monster rally in gold just as we saw in the 1970’s and just as we saw in the 2000’s. We have only seen such a signal like this in the 2000’s, 1970’s and Great Depression.