Safe in the Green Zone

News

|

Posted 05/02/2016

|

4487

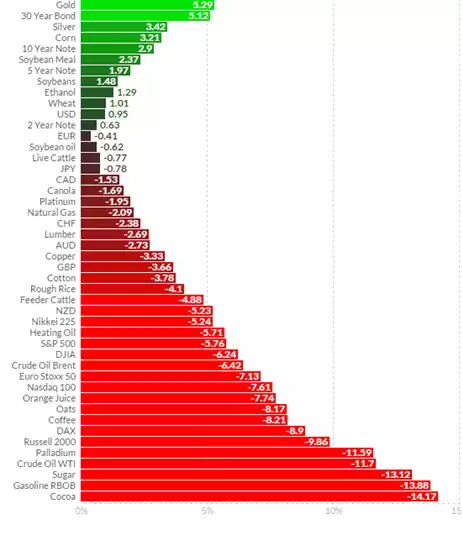

What a start to the year! The chart below shows clearly the carnage across nearly all markets over January. See how the AUD was part of that? Well that of course just made gold and silver even better in our currency with gold up 8.8% and silver up 6.1%. Our own All Ords (missing from below) was down around 4.5% too.

A month does not a year make, but it could well be instructive for what’s to come. There are no end of forecasts predicting, at the very least, huge volatility this year, or at worst 2016 being the end of this epic 40 year credit cycle. The article penned by The Daily Reckoning’s Verne Gowdie that we posted yesterday puts it very nicely (if you haven’t, it’s a must read).

This week we saw the All Ords have its biggest fall this year on Wednesday and then nearly recover all of that on Thursday (listen to today’s Podcast for why). Welcome to 2016! Whether we see the crash this year or next, it promises to be a volatile one and those with ‘investment insurance’ will come out better off. 7 of the 12 green bars (positive returns) above are traditional safe havens (aka ‘investment insurance’) – gold & silver, US Treasuries and USD. Gold and silver are currently/still at historically low prices, UST’s are near all time highs and USD near 10 year high. Just depends if you like buying low and selling high…