Russia investigating Gold-Backed Stablecoin

News

|

Posted 27/01/2022

|

7839

The Central Bank of Russia (CBR) is investigating a gold-backed stablecoin, a “golden ruble” according to Chairman of the State Duma Committee on Industry and Trade, Vladimir Gutenev. He argues that gold is undervalued compared with the US Dollar, Euro and other fiat-backed currencies. With no national fiat currency holding any tether to gold since 1971, Russia may well be positioning themselves for a first mover advantage in a new global gold standard.

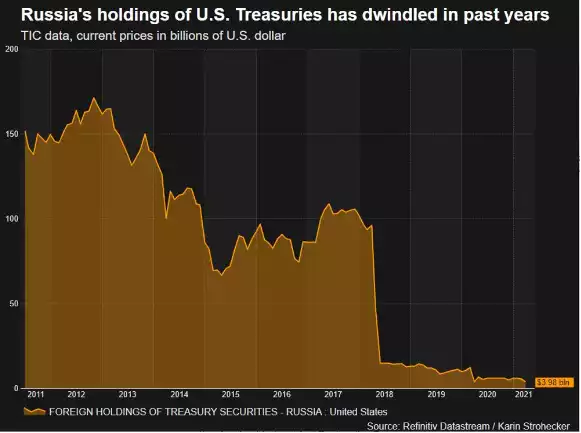

The proposal has been discussed with CBR Governor Elvira Nabiullina - Russia’s equivalent of Jerome Powell at the Federal Reserve. The move is likely to have support, if not explicitly initiated by, Putin, who earlier this month warned that the US is “sawing the branch it is sitting on” by using the dollar to impose economic sanctions around the world. The Russian leader also mentioned that they are watching US national debt and the country's inflation rate, warning that they may sell yet more of their $3.72bn in US treasuries if holding the reserves was no longer in their long term interests. Dropping the greenback would be unsurprising seeing that Russia has been moving steadily away from the US dollar since 2018 when it sold $96bn in treasuries in retaliation to economic sanctions out of Washington.

Russia doesn’t even make the Top 30 Holders of US Treasuries, being beaten out of on the scoreboard by some unexpected names No. 4 Luxembourg ($334bn), No. 7 Cayman Islands ($265.8bn) and No. 20 Bemuda ($72bn).

One would expect the last treasuries to be shed if the US follows through by sanctioning US dollar transactions by Russian banks and ejecting Russia from the SWIFT system if they invade Ukraine.

During the same decade, Russia has expanded it’s on record gold holdings significantly from 883 tonnes in late 2011 to 2298 tonnes in Q4 2021.

This increase in gold holdings brings Russia up into sixth place behind the US, Germany, IMF, Italy and France. If you are wondering where Australia is at, we are No. 42 with 79.8 tonnes. The only problem is that our gold is kept in the Bank of England and audit reports are hard to come by.

All of this comes as Russia’s gold and foreign currency reserves surge to historic highs. Russia now holds $638.2 billion in foreign exchange reserves, with 7.7 billion being added from January 7 - 14 - a bump of 1.2% in a week. Putin has sought to “dedollarise” by lifting gold holdings and non-US dollar reserves such as the Swiss Franc, Euro and Yen.

Russia certainly has every incentive to establish a gold-backed stable coin in competition with the US Dollar. We know from history that all fiat currencies eventually return to their intrinsic value of zero. With the UK announcing 5.4% inflation in 2021 off the back of 7% from the US, a global inflationary environment is certainly emerging. This week also saw Australia’s CPI blow away expectations rising 1.2% in just the last quarter. The US dollar has been the cleanest shirt in the dirty washing basket, but by backing the rouble with gold, Russia has the chance to come out ahead of the pack with a new Tier 1 asset.

Contrary to popular opinion, currencies that are backed by gold don’t need to have a 100% backing. From 1913 - 1965, the Federal Reserve was required to maintain a 40% backing for all federal reserve notes. This meant that the Federal Reserve needed to bring more gold onto it’s balance sheet before issuing new dollars into circulation. For every $1 worth of gold (still $35/oz in 1965), the Fed could issue $2.50 of paper currency. This also limited government spending as the Central Bank couldn’t buy an unlimited amount of new debt issued by the Treasury. While American citizens weren’t able to trade in their fiat dollars for gold during this time, it did place a natural limit on monetary supply expansion. The key is not the degree of backing, but that the peg is maintained. There is a natural inflation rate as miners bring gold out of the ground, but monetary supply is largely stable.