Russia & China – reaction to inaction

News

|

Posted 21/09/2015

|

5382

One could be forgiven for thinking that there is a certain “better the devil you know” sentiment guiding economic developments of late. FOMC inaction was last week’s major news. Commentary was prevalent on Friday and over the weekend with AFR reporter Vesna Poljak noting that “there are children who have seen more rolled Prime Ministers than they have Fed hikes”. The Greek elections have seen Alexis Tsipras returned to power, notwithstanding the acceptance of European demands for bailout measures that he once opposed.

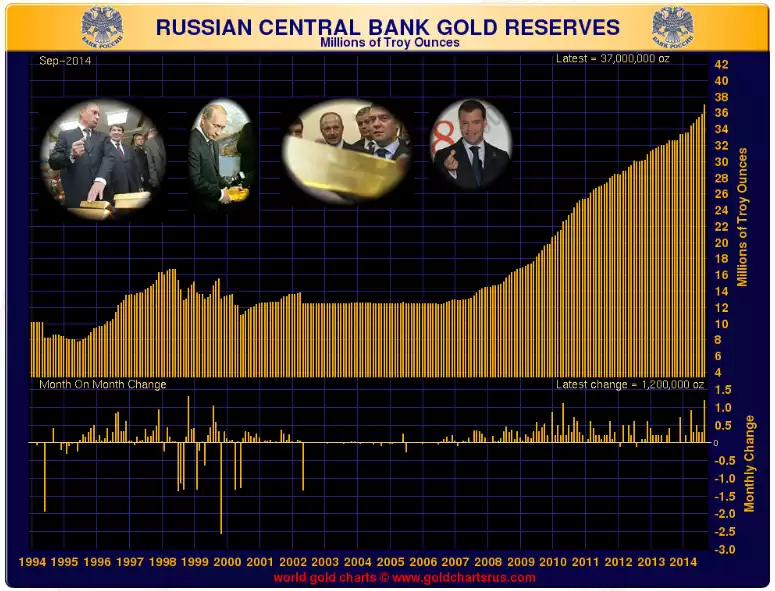

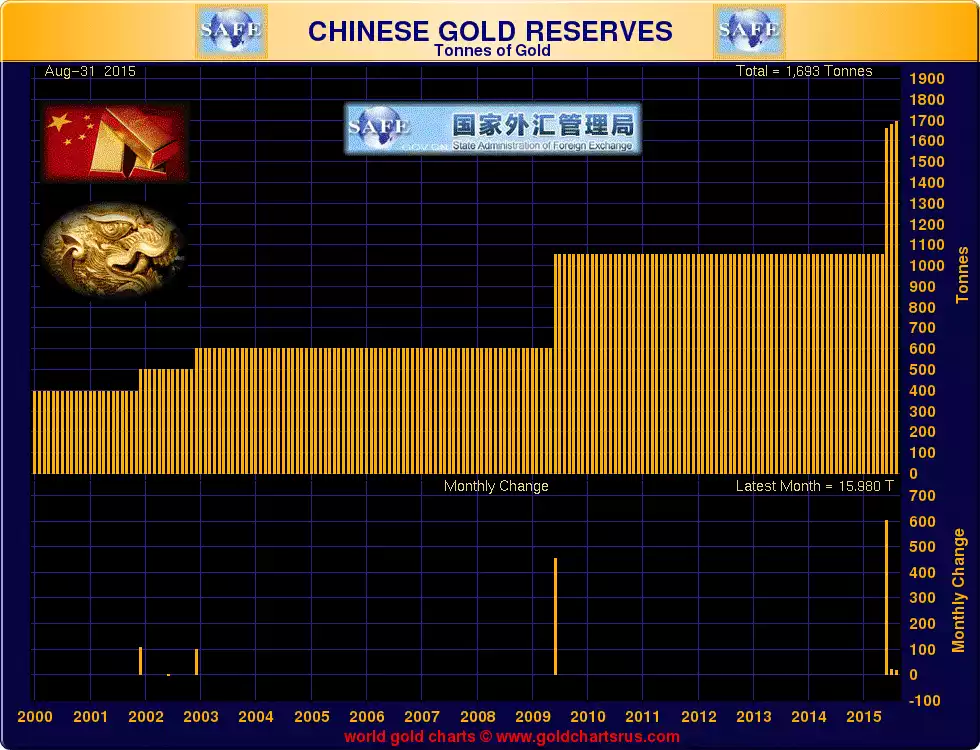

How are the big players acting amidst this backdrop of inertness however? At a time when the media is rife with discussion relating to topics such as those listed above, Russia’s central bank released the most recent data on its gold reserves; something that went largely unnoticed. The numbers showed that August saw a 31.1 metric ton increase in gold holdings amounting to one of the biggest acquisitions for 2015. Although data on China’s reserves is broadly viewed with a pinch of salt (with many commentators citing evidence of it being significantly underreported) their official August increase came in at just under 16 metric tons. See the following two plots on Russian and Chinese gold reserves respectively to illustrate.

These acquisitions are of interest in isolation, but consider the environment in which this is occurring. Both Russia and China have had need to support their currencies recently, resulting in negative foreign exchange flows. This is due to a multitude of factors including sanctions, currency devaluation and falling oil prices. What we typically expect to see in the case of foreign reserve drawdowns is a tendency to halt acquisition or even liquidate gold reserves. Deriving more than 95% of its export revenue from oil, Venezuela is a good example of the temptation to do so. Despite this, Russia and China remain strong gold buyers. Keep in mind that August saw China liquidate $94 billion of foreign reserves.

Some points to take away from this include:

- Current gold pricing is very attractive.

- There is increasing risk involved with holding foreign denominated bonds and currencies.

- Last week’s FOMC report further supports these risks.

- It is advantageous to draw down on foreign bond and currency reserves in order to bolster gold holdings.

- Such acquisitions are bullish for the gold price.

We mentioned in April that it is important to keep an eye on the big picture when attempting to evaluate real investment demand and value. The continued positioning into bullion displayed by Russia and China amidst foreign currency drawdowns and more broadly a lack of global structural reform is just such an example to heed.