Russia, China & $10,000 Gold

News

|

Posted 22/08/2019

|

9106

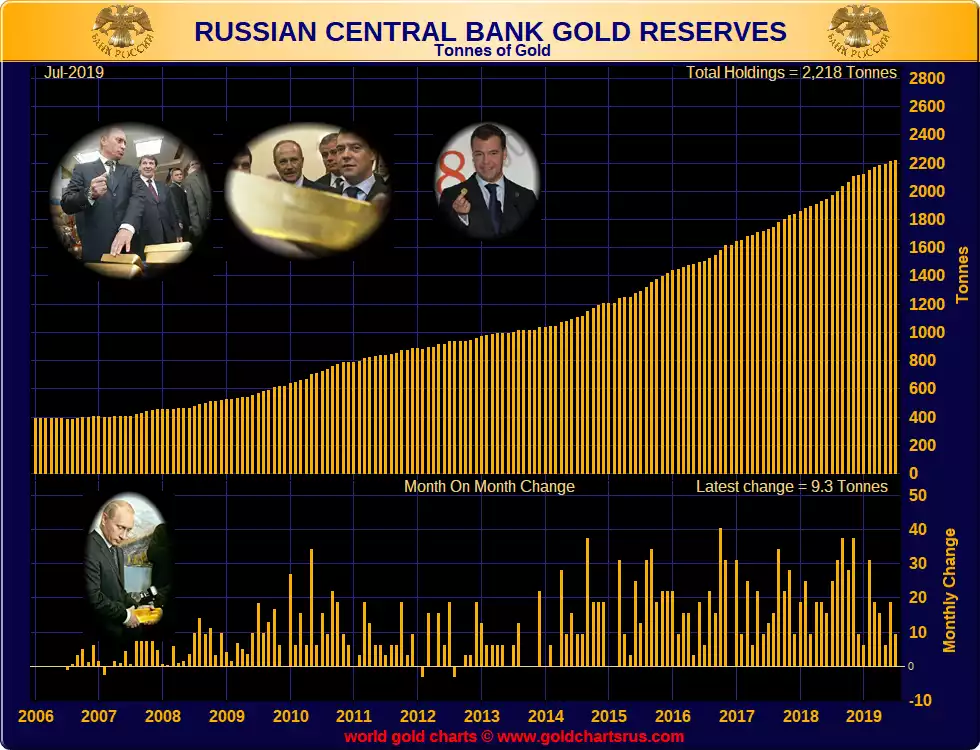

After setting an all time record of gold purchases for a central bank last year of 275 tonne, Russia continues this year unabated. This week we learned of their July purchases, up another 9 tonne and taking their total gold reserves to 2,218 tonne or $101.9 billion. For context that represents 19.35% of total gold foreign reserves and also makes Russia set to have the world’s 4th largest holding of foreign reserves whilst simultaneously swapping out their USD holdings for gold. The following chart paints a clear picture…

Whilst we have reported previously in more detail (here), this week the Australian Financial Review reported on Jim Rickard’s prediction of $10,000 gold and it is topical given the latest figures on Russia and our previous articles on China doing exactly the same thing.

“"I'm not trying to shock anybody, I'm not looking for publicity. There is a very solid methodology behind that number."

He said the base money supply in US, England, Japan, Europe and China is about $US24 trillion. Additionally, there are 33,000 metric tonnes of official gold, or gold owned by entities like central banks.

"What percentage of gold backing do you need for confidence in a gold-backed currency? It's a judgment call but I use 40 per cent."

Working backwards, that 40 per cent gold weighting leads to $US9.6 trillion of gold-backed base money, which then infers a price of roughly $US10,000 an ounce.

"It is the implied non-deflationary price of gold."

He argued Washington's move to weaponise the US dollar had encouraged its major rivals Russia and China to seek out alternatives to the greenback. Both countries have tripled their gold reserves in recent years.

"By weaponising the dollar, which has been very effective, and by throwing our weight around, which has been very effective, we have invited the blowback," he said.

"And the blowback is a non-dollar system because the US will always get its way as long as we – Russia and China – depend on the dollar.

"When you see Russia and China triple their gold reserves you have to ask a question: are they stupid or do they see something that most people don't see?"”

Russia is on the cusp of overtaking Australia as the world’s second biggest producer of gold. China is the (by far) world’s biggest producer. At 275 tonne last year, Russia accumulated more than it produced. China keeps every ounce of the 400 tonne it produces and then imports 700 tonne more. Simultaneously Western central banks are going into overdrive of stimulus creating more Fiat currency and debt. There should be no doubt about what is going on here and the implications for the gold price.