Robinhood “Rocketship” v Historic Precedent

News

|

Posted 15/06/2020

|

15685

Wall Street bounced off the supports of the 61.8% Fibonacci line, the Dow off the 100DMA and SP500 off the 200DMA. Finishing 1.9% and 1.3% higher respectively it was a strong rebound after the big falls Thursday night our time as we discussed Friday.

We discussed the influx of small investors in the above article and there were no shortage of articles over the weekend talking about the new wave of young day traders using the likes of Robinhood ‘free’ sharetrading platforms. The key warnings were this is a generation that has only known the sharemarket to be generally supported by the Fed, see it almost as a risk free trade, and that any dip like Friday morning is therefore a buying opportunity. There is also the very strong ‘belief’ narrative that shares have been overly corrected for a recession we will bounce out of in strong V shaped fashion, and so in essence will ‘catch up’ to the restored economy. Real Investment Advice’s Lance Roberts explains better than most that rarely does an underlying economy ‘catch up’ to sharemarkets, rather inevitably shares catch down to the economy.

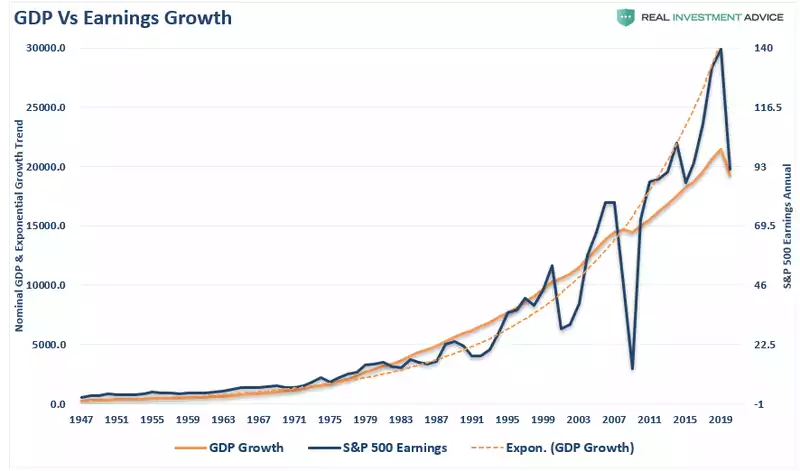

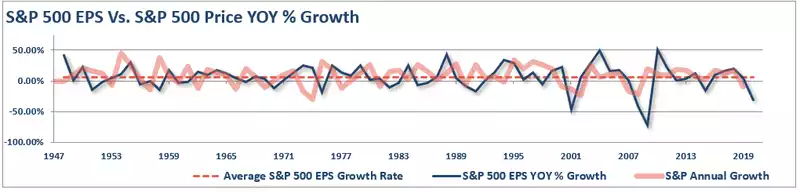

Broadly, since 1947 earnings per share have grown at an annualised rate of 6.21% compared to the economy (measured by GDP) growing 6.47%. That is pretty close and intuitively what you would expect. Of course 75 years has its ups and downs within those averages, particularly earnings.

“While over short periods, the stock market often detaches from underlying economic activity, this is due to psychology as investors latch onto the belief “this time is different.”

Unfortunately, it never is.

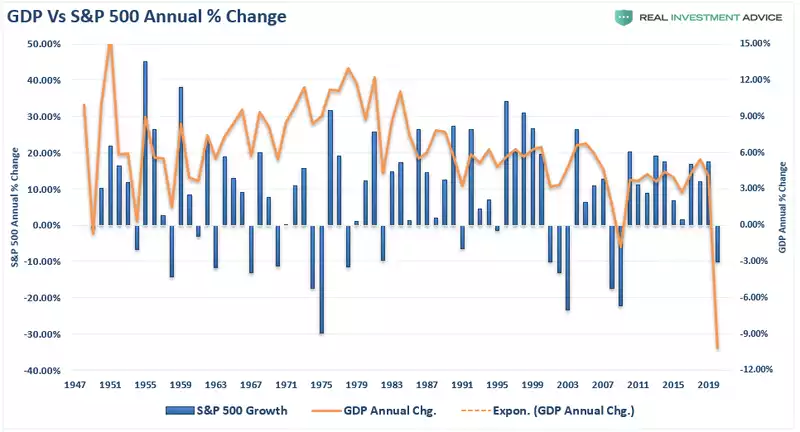

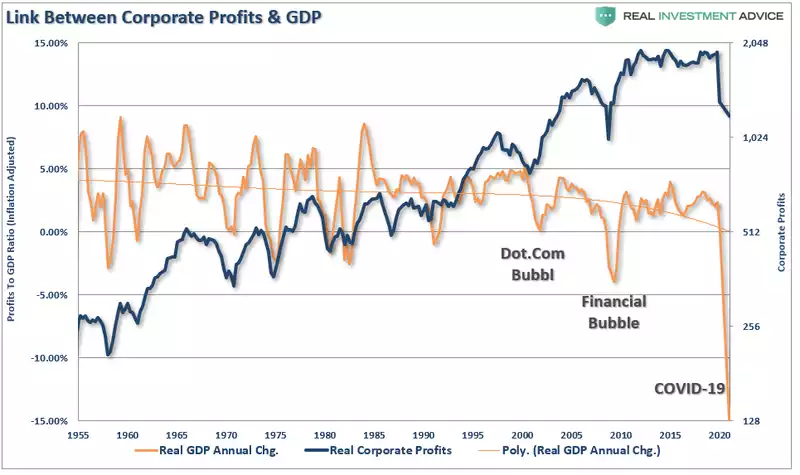

While not as precise, a correlation between economic activity and the rise and fall of equity prices does remain. In 2000, and again in 2008, as economic growth declined, corporate earnings contracted by 54% and 88%, respectively. Such was despite calls of never-ending earnings growth before both previous contractions.”

“As earnings disappointed, stock prices adjusted by nearly 50% to realign valuations with both weaker than expected current earnings and slower future earnings growth. While the stock market is once again detached from reality, looking at past earnings contractions, suggests it won’t be the case for long.”

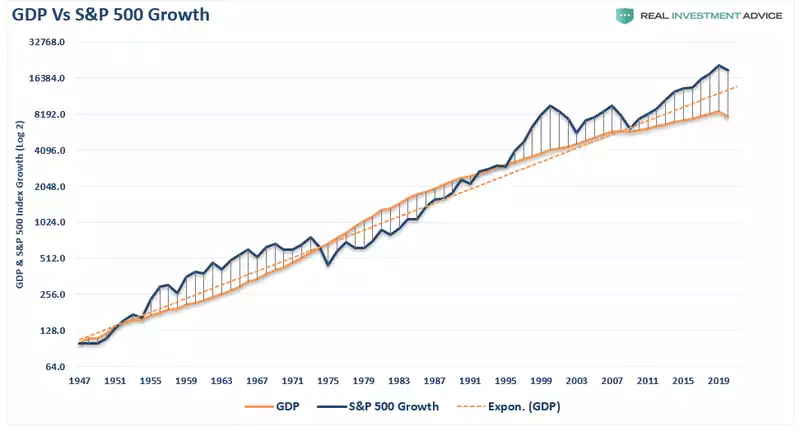

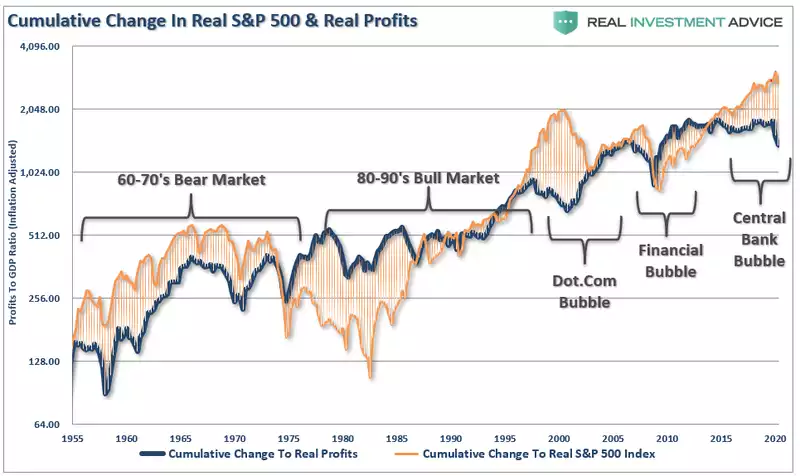

“The relationship becomes more evident when looking at the annual change in stock prices relative to the yearly GDP change.”

“Again, since stock prices are driven in part by the “psychology” of market participants, there can be periods where markets become detached from fundamentals. However, where history disagrees with [our aforementioned narrative], fundamentals never play “catch up” with stock prices.”

Roberts goes on to describe the economic reality we covered last Thursday via the OECD and he quotes more of the same from the World Bank as well.

“However, the “return to economic normality” faces immense challenges. High rates of unemployment, suppressed wages, and elevated debt levels, makes a “V-shaped” recovery unlikely.

Such is where the “math” becomes problematic. A 50% drawdown in Q2, requires a 100% recovery to return to even. In the more optimistic recovery scenario detailed above, two-quarters of record recovery rates still leave the economy running in a deep recession.

Even if the economy achieves high recovery rates, it won’t change the recession. The resulting 2.5% economic deficit will remain one of the deepest in history.”

And critically too, since the GFC we have a ‘new normal’ missed by most:

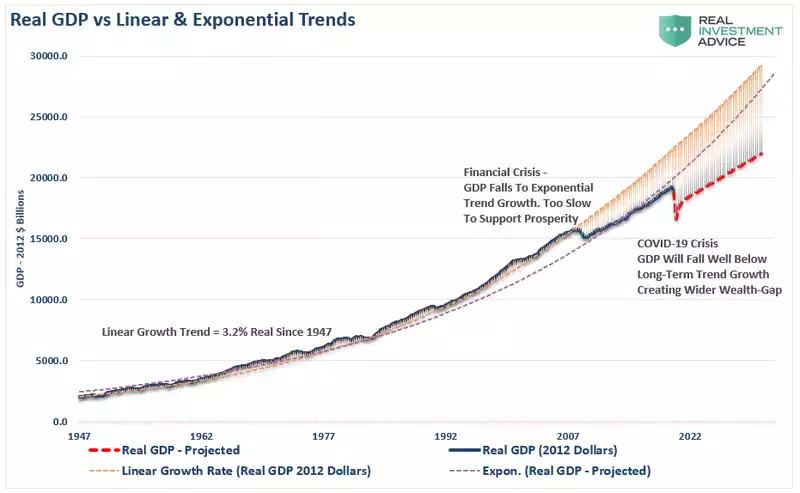

“Before the “Financial Crisis,” the economy had a linear growth trend of real GDP of 3.2%. Following the 2008 recession, the growth rate dropped to the exponential growth trend of roughly 2.2%. Instead of reducing the debt problems, unproductive debt, and leverage increased.”

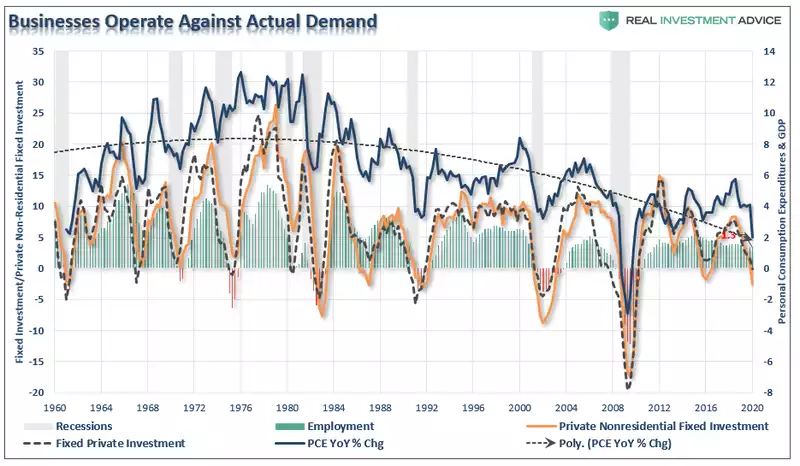

“The economic destruction playing out in real-time will eventually weigh on markets. There is a negative feedback loop between employment and consumption. As unemployment rises, consumption falls due to a lack of income. Since businesses operate based on demand for goods and services, the correlation between PCE [the Ged’s preferred inflation measure off personal consumption], fixed investment, and employment are high.”

“It isn’t just the economic data that will be horrid over the next few months, but earnings will likely be just as bad. Earnings cannot live in isolation from the economy. As shown below, corporate profits ebb and flow with economic activity.”

“The detachment of the stock market from underlying profitability guarantees poor future outcomes for investors. But, as has always been the case, the markets can certainly seem to “remain irrational longer than logic would predict.”

Roberts concludes”

“There are a tremendous number of things that can go wrong in the months ahead. Such is particularly the case of surging stocks against a depressionary economy.

While investors cling to the “hope” that the Fed has everything under control, there is more than a reasonable chance they don’t.

Regardless, there is one truth about stocks and the economy.

Stocks are NOT the economy. But the economy is a reflection of the very thing that supports higher asset prices – corporate profits.”

So yes, absolutely there could well be plenty left in this current sharemarket rally. The level of stimulus being thrown at it is without precedent and therefore historic precedent on what it will do may well be distorted too. But fundamentally you can’t divorce economic fundamentals for long and when they prevail or revert, it could be equally ‘unprecedented’ in its extent. Smart money is piling into gold at an extraordinary pace right now. Money is also piling in to shares via Robinhood and the like.

It really comes down to which ‘economist’ you want to listen to.

- “We’ve been talking about the ‘V’ — this is better than a ‘V’. This is a rocket ship.” – President Trump

or

- "Most people see a V-shaped recovery, but we think it's going to stop halfway. By the end of 2021, the loss of income exceeds that of any previous recession over the last 100 years outside wartime, with dire and long-lasting consequences for people, firms, and governments." - OECD