Risk-On Assets Heating Up

News

|

Posted 16/08/2022

|

5577

The Bitcoin and Ethereum Market continue their recent rally higher in conjunction with other risk assets in light of a deceleration of inflation prints. Bitcoin prices continue to consolidate within a range but traded up from the lows of $22,789 to a high of $24,974. Ethereum saw an increase from $1,698 to $2,012.

There is undeniable excitement in the market as the Ethereum Merge draws closer. The same is evident in ETH's price action too, with the same managing to rally back above the $2,000 price level.

ETH recorded a high flow of capital over the last few days and this triggered more upside on the chart. The FOMO and excitement around the Merge are only expected to continue increasing. The drop in Futures short liquidations suggests that investors are jumping onto the bullish bandwagon. ETH's dormancy metric was in the lower range of its 4-week performance. This means investors are opting to hold on to their coins rather than sell in anticipation of higher prices.

ETH’s dormancy metric aligns with the observations regarding long and short positions in the market. Furthermore, this confirms that there is strong demand for ETH and low selling pressure.

The BTC Price enjoyed price gains too, helped by the maturation process of BTC holdings in investor wallets. Generally, longer hold times signify improving odds of a higher conviction and cost-insensitive owner. After a 6-month aggressive sell-off period, the maturity of BTC holders paints a clear picture of supply and demand dynamics in the market at the moment.

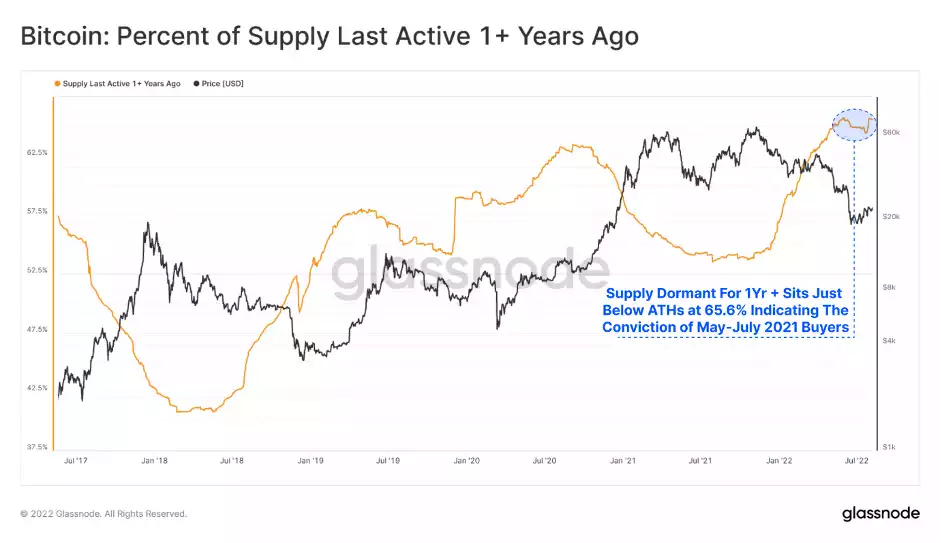

The amount of supply that has been dormant for at least 1yr can be used to provide insight into the cyclical nature of Bitcoin through distribution and accumulation cycles.

Distribution Cycles are a characteristic of a Bull Market, as the incentive to realise value increases for participants with mature coins. This leads to a reduction of 1yr+ old supply as coins are spent and sold.

Accumulation Cycles are a characteristic of Bear Markets, as the scale of potential profit decreases alongside a collapse in price. HODLing gradually becomes the primary dynamic. This leads to an increase in supply older than 1yr.

Currently, Supply Active 1+ Years sits just below the previous ATH set in May 2022 at 65%. This highlights the significant conviction of May-July 2021 buyers after the great miner migration. The equilibrium over the last three months indicates that coin maturation is in balance with spending. This is can be considered a constructive mechanic within a bear market.

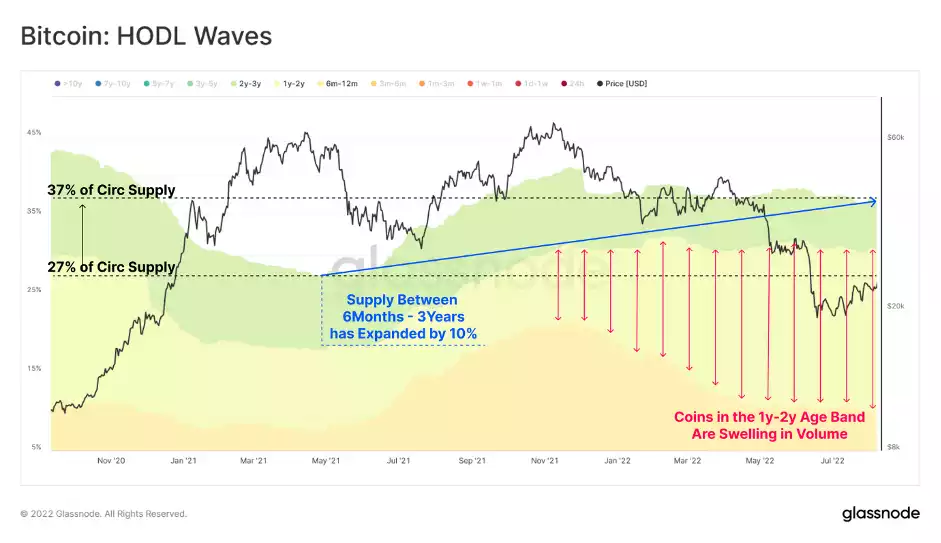

This phenomenon can be further inspected by isolating coins from the HODL Waves age bands of 6 Months to 3 Years. HODL waves provide insight into the volume of BTC held for at least a minimum duration, which provides a proxy for analysing buyers from the 2020-22 cycle, many of whom are likely experiencing their first bear market cycle.

The 6m-12m band can be seen to expand post the Great Miner Migration as HODLers refused to sell at the lows, this supply swell coincides with a bottoming in supply active 1yr+ ago. Within a HODLer dominant regime, supply was able to mature leading to a swelling of the 1y-2y age band following the Nov 2021 ATH.

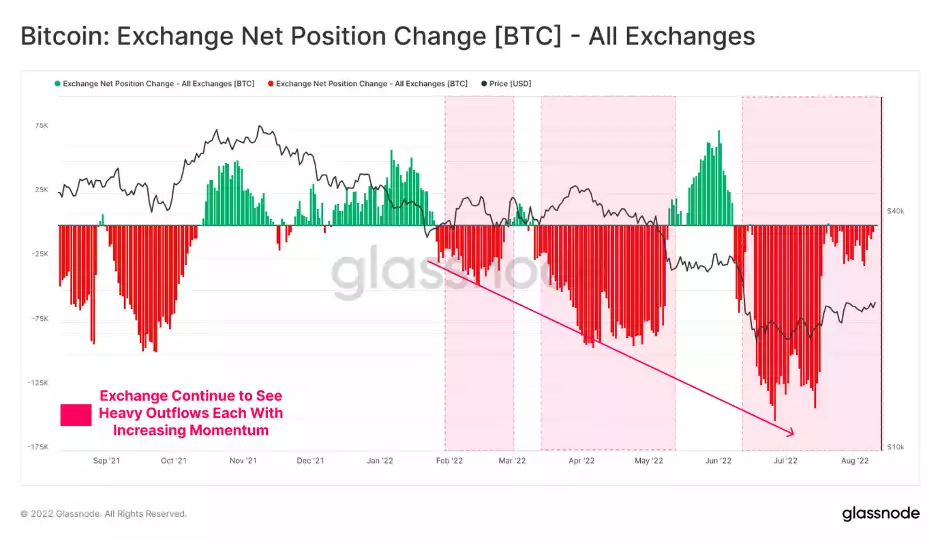

Exchanges continue to experience a macro decline in supply held, with this trend developing since the March 2020 capitulation event. Year to date, exchange outflows have continued with generally increasing intensity as prices declined. This underscores a persistent structural demand, from both small and large investors, for sovereign self-custodial assets.

On balance, Exchanges have seen a net outflow of -100K BTC following the May 2022 LUNA capitulation, which accounts for 3.2% of the total outflows since the March 2020 ATH.

To conclude, it’s apparent that Long Term Holder Supply has seen a local, modest decline as spending behaviour dominates following the LUNA collapse. However, LTH supply remains relatively range bound, which indicates more contained spending by a sub-set, rather than a loss of confidence.

In contrast, Short Term Holders are seeing a divergence between BTC and USD-denominated wealth. This is indicative of a pool of buyers who stepped in at the lows, and now hold some 300k BTC, acquired at a much lower cost basis. Now we turn to see if they have the conviction to hold on.

As for Ethereum, the price is approaching key resistance levels at $2,000. The future looks promising with "The Merge" set to launch on September 19th. Despite the slow start to 2022, things are certainly starting to heat up for the crypto market!

************************************************************************************

This afternoon, the Gold & Silver Standard Insights team will be breaking down the charts and providing technical analysis for the precious metals and crypto market's.

SUBSCRIBE to the YouTube Channel to be notified when the Gold Silver Standard Insights video is live.

**********************************************************************************