Rising US Rates and Gold

News

|

Posted 23/05/2016

|

5938

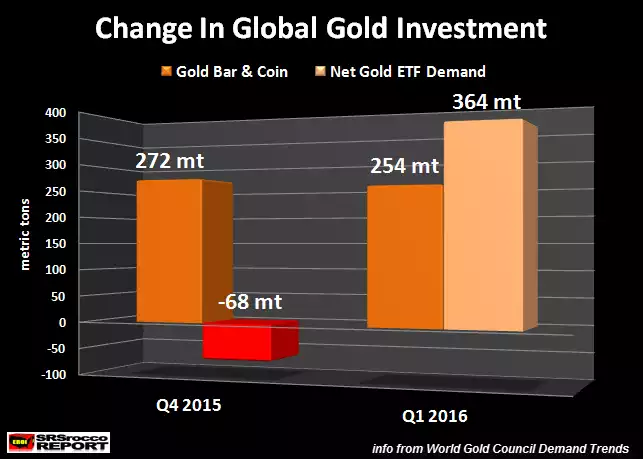

The recent World Gold Council demand trends report for the first quarter of this year (that we summarised here) shed light on the enormous inflows of gold into ETF’s this year. The chart below puts that into perspective in comparison to the last quarter.

`

`

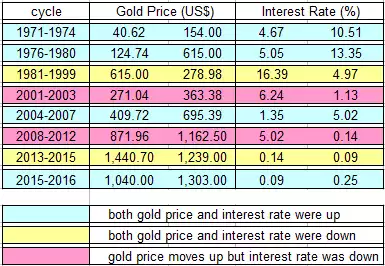

Gold had a bit of a rough week last week. Much of the pressure came courtesy of hawkish (less accommodative and more likely to put rates up) comments from the US Fed with growing expectations now of a June rate hike. This is interesting given what we’ve seen since the December rate hike. i.e. gold and silver UP around 20% after the initial dip. Wall St is going hard on gold and it’s not letting up with last week seeing the biggest weekly inflows to the gold ETF GLD this year. In the futures market too, the managed money category just hit another high in long gold positions. All this AFTER a December rate rise. The table below sheds interesting light on the misconception by some that rising rates means falling gold:

So the gold price and interest rates are positively correlated most of the time. The main exception is gold rising as interest rates fall (the second over the GFC). Indeed casting the net even further back and over 60 years we have never seen an increased interest rate resulting in lower gold prices.

We’ve reported before too, that the Fed have a shocking record of raising rates too late or when the market’s not ready. That is arguably more true now than any time before. There is a reason why Wall St is jumping so heavily into gold and silver (albeit via paper trades like ETF’s and futures). That reason may simply be history.