Ripple’s “On-Demand Liquidity” platform reports a 75% increase in Q3

News

|

Posted 25/10/2019

|

12221

Earlier this month, Ripple caused a stir when they removed any mention of xRapid, xVia and xCurrent from their website. The company has since clarified that the change was a part of its rebranding campaign, stating:

“Rather than purchasing xCurrent or xVia, customers connect to RippleNet via on-premises or the cloud, and instead of purchasing xRapid, customers use “On-Demand Liquidity”. These are not new products, but a rebrand of existing products. There will be little change and no impact on customers.”

Ripple said that instead of promoting a host of software solutions, they wanted to double down on the company’s aim to build a payment network and that the shift in messaging will help them achieve that.

“With a single connection, access the best blockchain technology for global payments, payout capabilities in 40+ currencies, On-Demand Liquidity as an alternative to pre-funding, and operational consistency through a common rulebook…

While all the financial institutions on our network enjoy faster, lower-cost global payments, those who use the digital asset XRP to source liquidity can do so in seconds. XRP is quicker, less costly and more scalable than any other digital asset.”

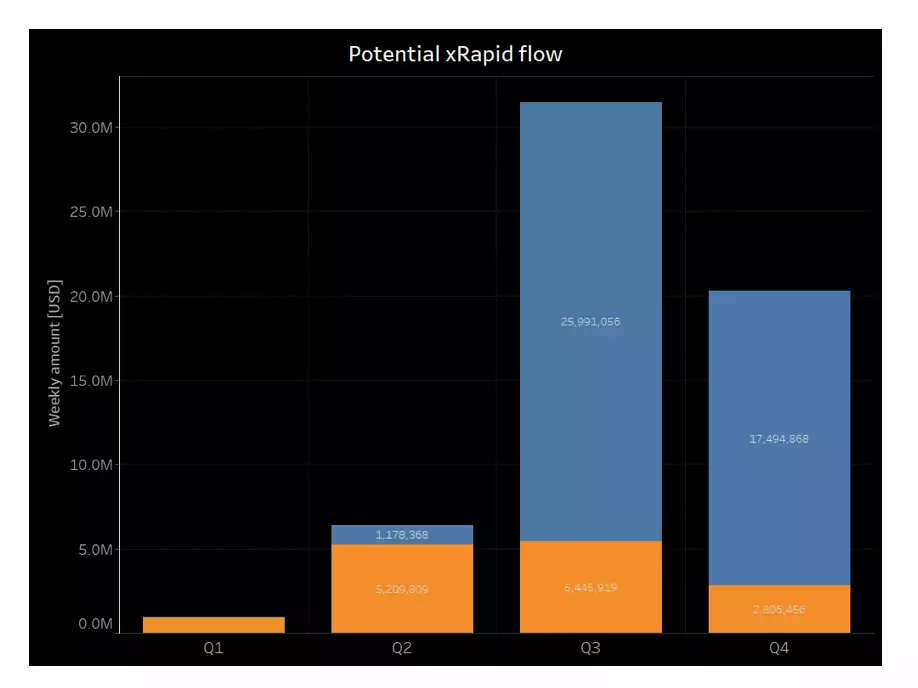

With its recent Q3 report, Ripple noted the rise in demand for its On-Demand Liquidity (ODL) leveraging XRP to source liquidity for cross-border transactions.

“Ripple customers live with ODL, including MoneyGram and others, increased by 75% last quarter and dollar volume on ODL increased more than five times from Q2 to Q3.”

This increase in active users was contributed mainly by its successive partnerships with financial bodies. Additionally, the acquisition of team Algrim supported the development of ODL and to expand its global reach, Ripple located its engineering hubs in Iceland.

The data affirmed by the Q3 report emphasised the significant increase in adoption of the ODL since Q1, where the tech was scarcely used.