Relative Value & Scarcity

News

|

Posted 27/10/2017

|

6774

A common complaint of investors nowadays is ‘where do I invest?’ as we find ourselves in the ‘everything bubble’ whilst cash in the bank returns next to no return and unease grows amongst a slowly enlightened world that you are little more than an unsecured creditor when you deposit funds in a bank.

Charles Hugh Smith recently wrote about this problem and points out a few salient points.

“1. Risk cannot be disappeared, it can only be masked or transferred to others. When anyone claims an investment is low-risk, they're actually claiming either A) the risk has been obscured by fancy footwork or false claims, or B) the risk has been transferred to some mark, chump or bagholder--nowadays, that usually means the taxpayer, as profits are private and losses are socialized.

2. Value flows to what's scarce. As economist Michael Spence and his colleagues have noted, conventional capital--the kind issued by central banks and private banks--is not scarce and therefore has little value. Ditto for conventional labor. This is why the returns on conventional capital and labor are so low.

Spence et al. suggest that what's scarce in today's global economy are ideas that create new business models, new productivity tools and new goods/services: Labor, Capital, and Ideas in the Power Law Economy.

This suggests an investment strategy of identifying what's scarce, or what will soon be scarce, before everyone else.”

Yesterday we wrote of the supply / demand deficit in silver. Now it would be too simplistic and wrong to say that makes silver ‘scarce’ per se. But his next point is an important one:

“4. Comparing the relative value of various assets helps identify what's relatively overvalued and undervalued. The key word here is relative: to say something is absolutely undervalued is trickier than concluding something is undervalued compared to other asset classes.”

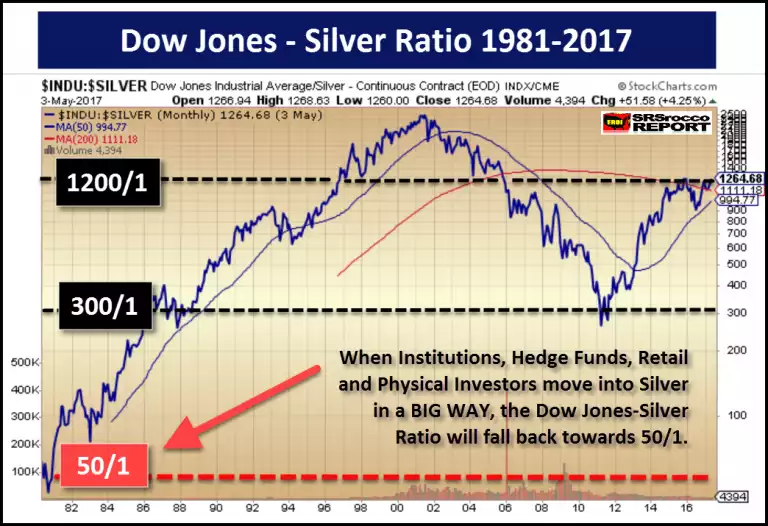

We don’t need to share any more charts on how high valuations are in financial and property markets at present, you’ve seen plenty of them recently. The chart below, however, shows the silver price relative to the Dow Jones:

This chart was done back in May and you are now looking at a ratio of 1397, well above that 1200:1 line.

A deficit in itself doesn’t make silver scarce, it just adds to it. It has been estimated that there is around 3.5b oz of investment silver in the world. That would be worth around $59 billion today. Comparing that to the approximately $300 trillion in financial assets shows just how fundamentally scarce it really is. What happens when that $300 trillion gets spooked and rushes for that tiny silver door?

On any simple observation there is a clear value differential at play. We remind you of Warren Buffet’s famous quote – “Price is what you pay, value is what you get”