Record US Corporate Debt & Buybacks

News

|

Posted 19/08/2020

|

7653

ABOVE: View todays article from the Ainslie Youtube channel.

Last night the S&P500 made a new record high, the shortest bear market in history and all whilst we are still in a recession, and a recession that may prove to be the worst ever. Whilst you woke this morning to gold and silver being still strongly up on a 24 hour basis it was a very turbulent night for all assets. After hitting that new record high, shares slumped and along with big corrections in gold, silver and Bitcoin too before all bounced back. Gold is back above US$2000.

However it is the setup in the US sharemarket that is the topic today amid one of the most bemusing markets ever. US corporate debt has repeatedly been reported and discussed as potentially one of the key issues that could see a disorderly collapse of this debt laden house of cards we call an economy. Regular readers will know we have written to both the sheer size and degrading quality of this debt for over a year. And then of course the omnipotent US Fed stepped up to the plate as a buyer of such debt in their ‘whatever it takes’ QE Infinity program announced at the depths of the COVID crash.

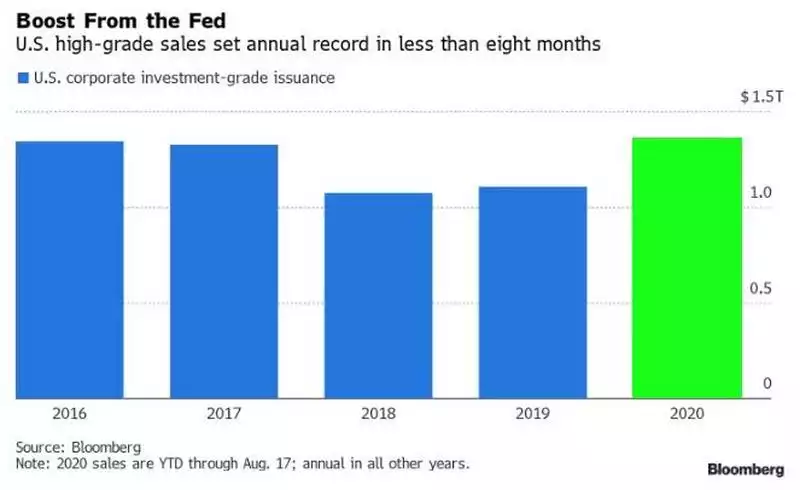

And so, amid a recession that no one knows where we will end up, US Corporate debt somehow just hit a record issuance for a year of $1.346 trillion, just 8 ½ months in to it….

But before you think this is the Fed buying it all, it’s not. Just like sharemarket rallying on the premise the Fed’s somehow ‘got this’, corporate debt is being bought at ludicrously low yields given the risk because the market believes the Fed will waltz in on any adverse event. These corporates are issuing debt to either stay alive, ala the Zombie company phenomenon, or using it to buy back their own shares to keep their share price elevated, gaming the market and collecting their bonuses. That is of course not a new trick, US companies have bought $9.2 trillion of their own shares since the GFC using the Fed’s near zero interest rate environment rather than value adding capex.

Apple, who have one of the biggest cash reserves of any entity in the world, went and raised a further $8b in what they smugly called their “general corporate purposes” bond paying just 2.5% for a 40 year term. For that lowly price they can buy back shares further fuelling their market dominance as the hoards follow them in on momentum.

Share buybacks took a little rest last year but are back with vengeance, particularly with the tech and health care companies doing well in this recession. The chart below courtesy of the Financial Times shows how companies are favouring buybacks over dividends. You will note the spike at the onset of the GFC before complete capitulation when the ‘game was up’. Since then the Fed has been sustaining a near zero rate interest rate environment and corporate debt on a tear fuelling a resurgence in buybacks amid tepid fundamentals.

This has all the traits of a market being gamed where the downside of too much debt and resulting insolvency when the V shaped recovery evaporates is not being factored in on the sole premise that the Fed will always step in and save the day. That seems like a very big punt.