Record Monetisation v Growth & Inequality

News

|

Posted 02/09/2016

|

4931

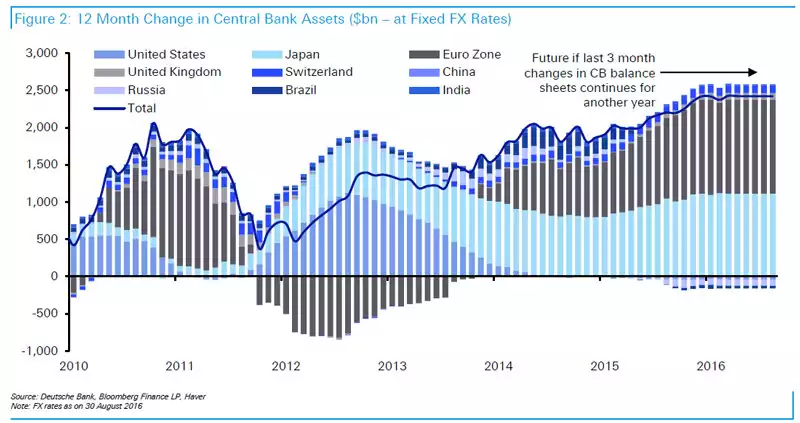

When the US was in full flight of Quantitative Easing (QE – or money printing) it was the hot topic. When they ended that a couple of years ago expectations turned to tightening monetary policy. The graph below highlights how very wrong that assumption was and the unprecedented scale of quantitative easing since its inception after the GFC undertaken to re-kick start the global economy.

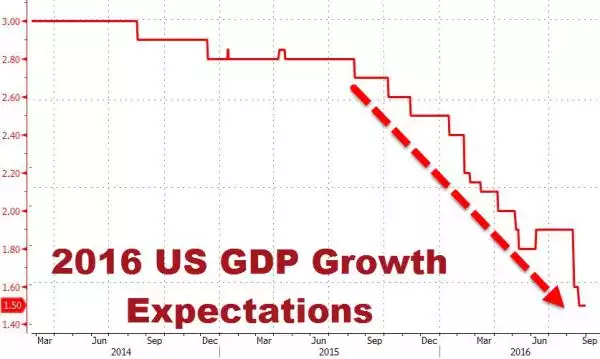

The US stopped QE because everything was fixed. As you can see below GDP has been in decline ever since. As we reported in today’s Weekly Wrap, Q2 GDP has just been finalised at just 1.1%. This may well be why the market expectations for further stimulus in the US has not been so high in many years; ironically at a time of rate rise jawboning by the Fed.

We’ve shown you before that earnings are on a similar trajectory and yet you are well aware of the chart for US shares which is the opposite of the above. Combined, it reinforces financial markets based on cheap money (to those who can get it) and central bank direct share investment inflating assets rather than real growth and prosperity for the masses… hence Trump’s popularity.

A recent survey found that the entirety of U.S. household net worth growth over the past 30 years has been concentrated in the hands of just the top 10%. This is not a socially nor economically sustainable situation, and the correction could be huge.