Record High AUD Gold v Unemployment

News

|

Posted 21/02/2020

|

19372

On the news yesterday of our worse than expected and higher unemployment figures, the Aussie dollar dropped to an 11 year low and correspondingly gold in AUD hit an all time high of $2412 and strengthened further over night to be sitting at $2450 as we write.

The AUD is now just $0.0014 from a 65c handle. In the depths of the GFC our dollar briefly kissed a 62c handle before rebounding as China came to the rescue and rebounded all the way to (and past) parity with the USD. Everyone was buying their shoes etc from the US and enjoying cheap US holidays. But it didn’t last and has been on a slippery slope since as the USD strengthened. Since that peak of the AUD in 2011 the DXY (USD index) has risen from 71 all the way to the current 99.90, again perilously close to a 100 handle. Tellingly, despite the strengthening USD, gold has rallied as well and hence the record high in AUD terms even though its only halfway retracing its USD 2011 high.

As we discussed here there is plenty of pressure and informed calls that the AUD is just getting started on its fall to 60 or even 50c. Yesterday’s news just reinforces this view as the bad unemployment figures are before any Coronavirus impact which will surely exacerbate the falls next print.

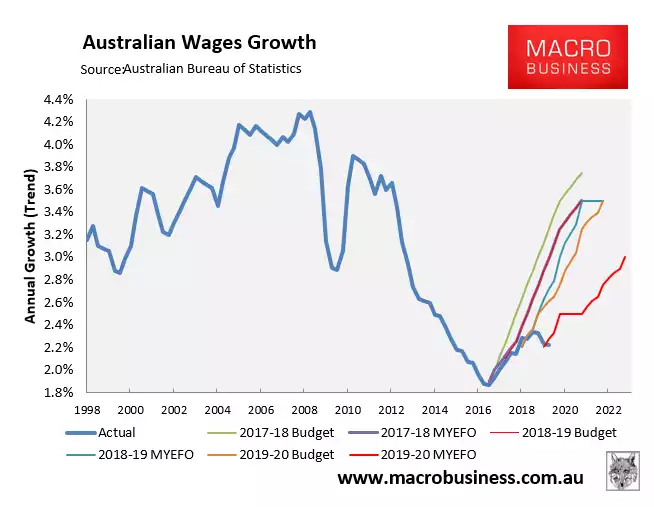

Unemployment increased by 0.2pts to 5.3% but maybe more concerning for the economy is the drop in hours worked (down 8.1m) and underemployment jumping to 8.6%. That portends more weakness in wage growth and hence more weakness in the economy and more mortgage stress. If you look at wage growth compared to what the government, bless their little optimistic hearts, is budgeting, it’s not a good picture.

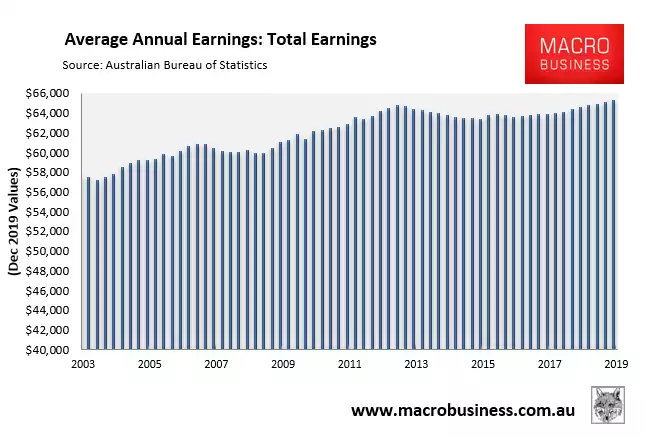

There is growing commentary too about the high levels of immigration impacting on the low wage growth. Herein lies the government’s dilemma. When you have a Ponzi scheme, which in effect the government is running, you need new people to tax and build stuff for. You will recall the recent GDP figures have actually been negative on a per population basis. Restrict immigration and the toxic mix of paying for our aging demographic and debt becomes rather problematic. Have too much immigration and competition for jobs sees higher unemployment and/or higher underemployment sees lower wage growth. If you use the ABS figures, including their Core Inflation figure (which is understating real world inflation according many analysts), real average weekly earnings rose by 1.2% over the past year and has only now surpassed May 2013 levels again after a slow grind up since 2016.

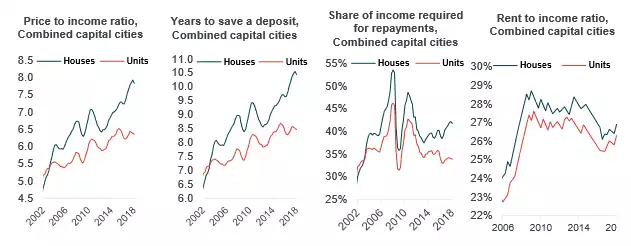

Again, this is all before the impact of Coronavirus is felt in an economy largely beholden to China. We use the word largely, because it’s not all about servicing China for the Aussie economy. We also have housing. The following charts from CoreLogic paint a clear picture and trend of how high home prices, low inflation and low income growth work for our housing sector…

The mounting pressures on the Aussie economy and our Aussie dollar are mounting. The governments prospects of hanging on to their precious surplus looking more and more unlikely both through drops in income and growing calls to start fiscal spending on infrastructure to fill the aforementioned void.

Normally something reaching an ‘all time high’ like AUD gold would have one looking to exit. That the AUD gold price comprises a USD spot price only half way to its previous highs and an AUD with more down pressure (raising the AUD spot price) than up, is a mix suggesting this is just the beginning not the end.