Record Delivery. Supply-Demand Collision

News

|

Posted 27/07/2020

|

8811

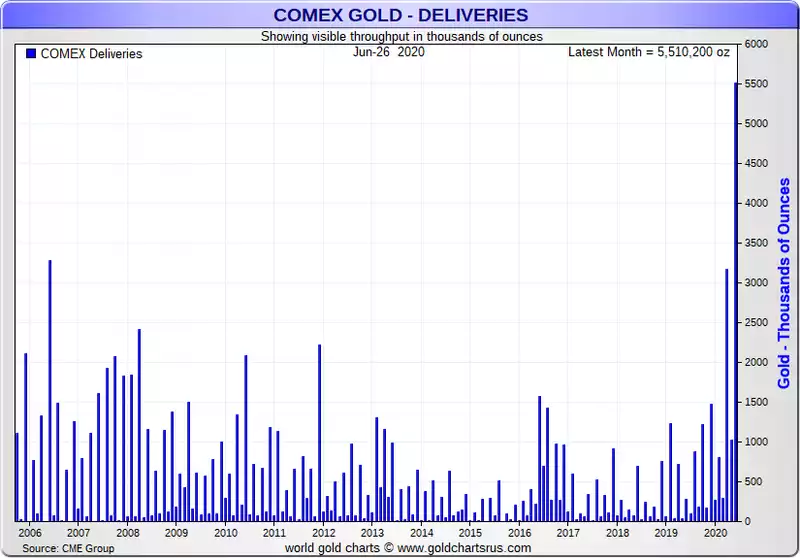

Last month COMEX, the largest gold futures exchange in the world, saw an all-time record 5.5m oz or 170 tonne of gold physically delivered when the ‘norm’ is around just 100-500oz. Silver deposited into depositories, ETFs and funds just hit another new all time weekly record. Demand is exploding at a time that COVID-19 is restricting supply.

Since 23 March amid the global panic around the onset of COVID-19 there have been extraordinary pressures on the world’s two biggest gold markets, the London Bullion Market and the COMEX in the US. We explained this here and here. That spread of price between the spot price in London and that on New York mean players have been buying gold in London, taking a long contract on COMEX and shipping it to New York for delivery to take that profit. Arbitrage at its simplest. That has of course put pressure on premiums for physical metal as we’ve seen around the world. The chart below shows the unprecedented volumes of deliveries seen.

The legendary Egon von Greyerz just wrote of his 4 key drivers of higher gold prices:

“the gold price will be fuelled by four incredibly strong factors:

- Major debasement of currencies due to money printing

- Substantial shortages of gold in LBMA and Futures markets

- Major new private and institutional gold investors entering the market

- Only smaller quantities of gold available at current prices”

Topically on the above discussion on the dynamic between the LMBA and COMEX, his 2nd dot point, he expands:

“But there are more factors that affect the gold price. There is a massive shortage of physical gold in the futures markets and LBMA system. As gold goes up and the holders of gold ask for physical delivery, there will be no gold available to settle the paper claims. There are only two potential outcomes. A default of the LBMA system which would also mean a total bank collapse. They will attempt to settle the claims in paper money but that will also lead to defaults eventually.

It is of course possible that central banks print trillions of dollars to save the banks so that they can buy the gold. The problem is that there is no gold available at current prices but only at multiples of the current price. And the more money central banks print, the less it will be worth and the more the gold will cost. So a real Sisyphean task that is guaranteed to fail.”

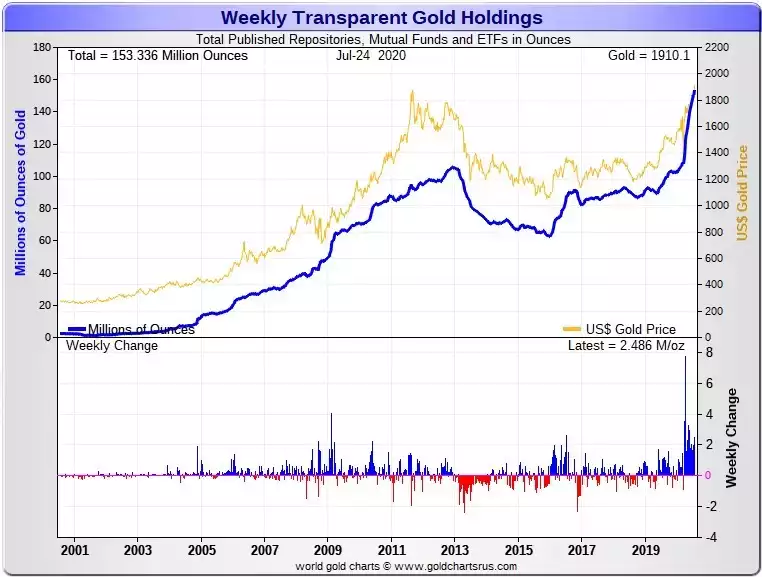

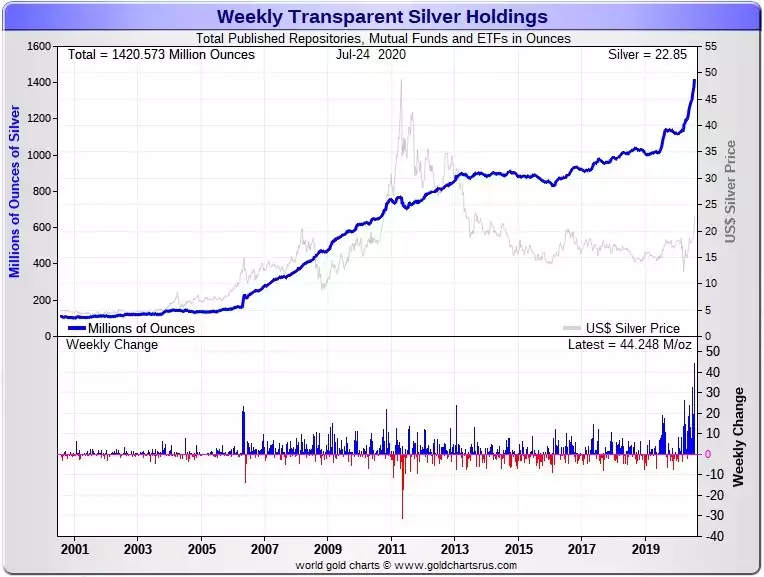

In addition to COMEX, we have just witnessed another huge week of gold into ETF’s and mutual funds as well at 2.49m oz, and not surprisingly the biggest weekly deposits on record for silver, a massive 44.28m oz of silver in just one week.

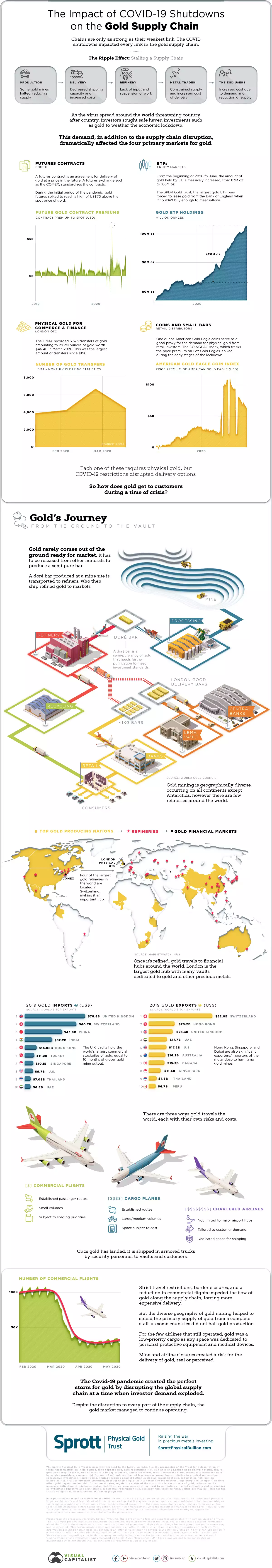

The guys at Visual Capitalist just released the following info graphic explaining how all this comes about and the broader pressures on the gold market due to COVID-19. It is worth clicking on the image for both a better quality image but also the expanded explanations in the text below it.