RBA buying A$4 billion a week in bonds

News

|

Posted 03/11/2021

|

6571

RBA buying A$4 billion a week in bonds

Yesterday the Reserve Bank of Australia (RBA) released it’s monthly statement on Monetary Policy Decisions. They are continuing to purchase bonds issued by the Australian Government at a rate of A$4 billion per week. The cash rate remains at 0.10%, a rate it has remained at now since November of 2020. They have halted their yield curve control program and quietly dropped the written assurance rates won’t rise until 2024 in the only concession to rising inflation. The RBA has also quietly tripled their holdings in the IMF’s Special Drawing Rights (SDRs).

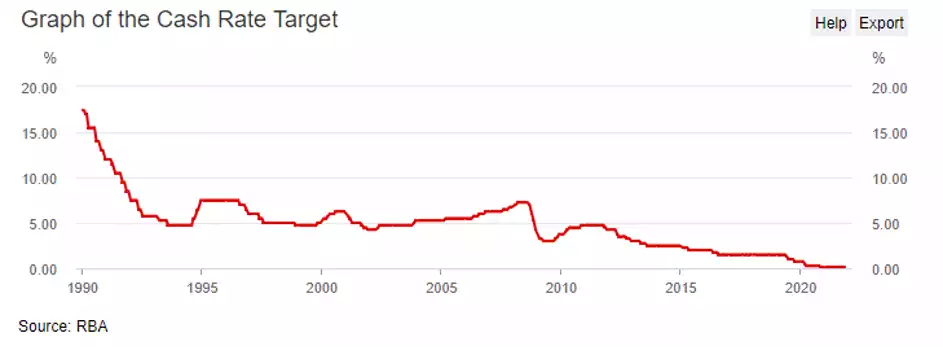

The cash rate is the interest rate on unsecured overnight loans between banks. It has a number of influences on the broader economy though, as changes to this rate are passed onto mortgage holders and other variable loans by the banks.

Interest rates have continued to drop from the elevated levels of the early 90s down very nearly into negative territory. While interest rates are significantly below the (under) reported headline CPI rate of 3%, they don’t look like moving up any time soon as the board is “committed to maintaining highly supportive monetary conditions to achieve a return to full employment in Australia and inflation consistent with the target”. One wonders whether monetary policy can have any real effect on employment rates when lockdowns and mandates have had such a massive impact on Australia’s ability to maintain gainful employment.

While not included in yesterday’s report, a look over the Table of Official Reserve Assets held by the RBA makes for interesting reading. While Foreign Exchange, Reserve Position in the IMF and Gold holdings have meandered over the last year and a half, August saw a whopping increase from A$5.5 bn in the IMF’s SDRs, to $17.7 bn. All the while, Australia’s gold holdings which are notionally kept in the Bank of England, is steady at a value of A$5.5 bn. You would be forgiven for not knowing that the RBA is holding a significant proportion of the country’s wealth in Special Drawing Rights. Not least of all because very few Australians have even heard of them. If the RBA’s purchasing is anything to go by though, perhaps Ainslie should consider selling SDRs... We explained SDR’s previously here.

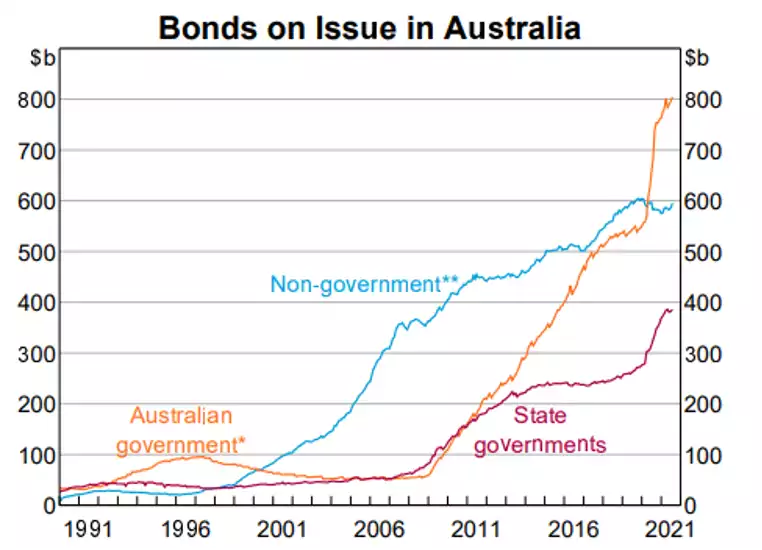

Potentially, the most surprising news from the Statement is that Australia continues to purchase A$4 billion worth of government bonds a week. The debts and deficits are blowing out. Total Government debt now stands at $1.4tr and rising rapidly. The bonds on issue have exploded for both the Australian and State governments.

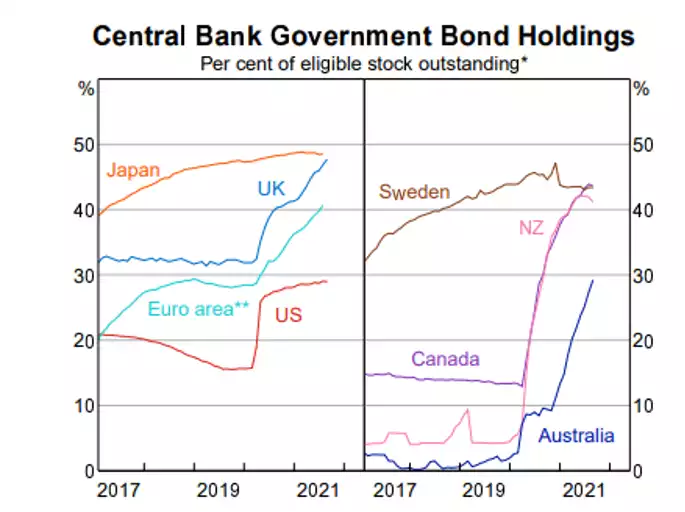

The RBA now holds almost 30% of all outstanding bonds on issue from the Federal Government. The low yields are attractive to anyone other than a central bank.

The Aussie dollar fell on the news given there were expectations of a more robust nod to rising rates earlier that did not come. And so whilst Australia currently has lower ‘official’ inflation then other nations our central bank has seemingly secured that we will catch up soon amassing more and more debt in the process. The implications are many but the headline act may be that our housing bubble will both inflate, sucking more into a Ponzi scheme, and potentially meet a very nasty end when rates inevitably rise. Remember central banks don’t always call the interest rate shots. Markets can take over.